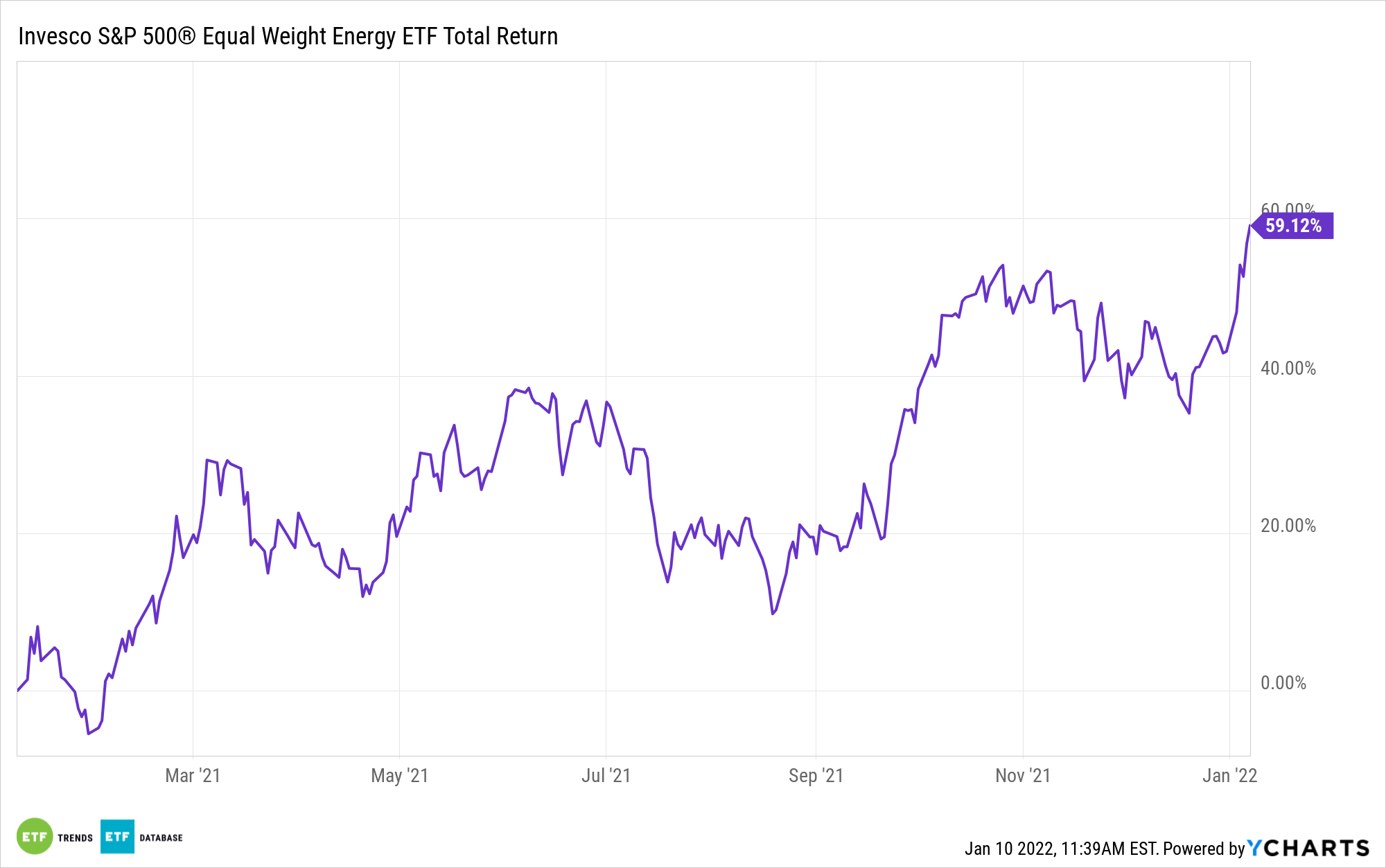

Like so many energy exchange traded funds, the Invesco S&P 500 Equal Weight Energy ETF (RYE) posted stellar returns in 2021.

That doesn’t mean that a bit of an alteration won’t help the equal-weight energy ETF. Currently, RYE follows the S&P 500 Equal Weight Energy Index, the equal-weight counterpart to the cap-weighted S&P 500 Energy Index. However, RYE is moving to another index.

In a recent filing with the Securities and Exchange Commission (SEC), Invesco details plans to shift RYE to the S&P 500 Equal Weight Energy Plus Index. That change goes into effect at the close of U.S. markets on March 18.

Currently, RYE holds 22 companies, and there’s a plan in place in case the new index cannot provide the ETF with at least that number.

“In the event there are fewer than 22 companies eligible for inclusion in the New Underlying Index at a quarterly rebalance, the New Underlying Index will be supplemented with the largest energy companies in the S&P MidCap 400 Index based on float-adjusted market capitalization until the 22 company minimum is reached,” according to the SEC filing.

RYE’s new benchmark launched last November and is rebalanced in March, June, September, and December. As of December 31, the index’s 22 components had a median market capitalization of $30.26 billion, and the largest component commanded a weight of 4.9%.

Due to RYE’s stellar start to 2022 — it surged 11.2% last week — the average market capitalization of its components is $50.1 billion. Its largest holding, refining giant Valero Energy (NYSE:VLO), has a 5% weight in the fund.

It’s not uncommon for equal-weight sector funds to assign what appear to be large weights to small numbers of stocks. Still, RYE is far more diverse than the S&P 500 Energy Index, where Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) combine for nearly 44%. The two largest U.S. companies combine for just 9.45% of RYE.

RYE’s holdings range in weight from 4.35% to 5.03%, and 76% are classified as mid-cap stocks. The $301 million ETF debuted in November 2006 and carries an annual fee of 0.40%, or $40 on a $10,000 investment.

For more news, information, and strategy, visit our Portfolio Strategies Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.