By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Investors have a right to be nervous given the age of the current business cycle and bull market, along with the daily headlines highlighting various geopolitical risks. It should be no surprise that investors have frayed nerves, but Financial Advisors have tools that can help soothe those nerves and provide some important perspective on risk and volatility.

Richard Thaler recently won the Nobel Memorial Prize in Economics for his work on Behavioral Economics. Behavioral Economics suggests that falling markets affect investors at least twice as much as gains. Down markets create significant emotional stress and when people are stressed, they often want to take action to relieve the situation. Making emotional decisions in a down market often leads to mistakes, such as locking in losses when markets are down and missing out on potential gains as the markets recover.

From a Behavioral Economics perspective, utilizing an asset allocation strategy that has a tactical element to managing risk in real time, as well as a process to raise cash in case of an emergency, can be an important tool in navigating volatile markets. Strategies that are managed in this style can help investors sleep better at night knowing that their investments are not locked into the market at all times. These types of strategies, when properly implemented to reduce volatility, can act as behavioral relief valves by letting off pressure and helping investors to stay the course. Staying on a well-charted course is the key to realizing investment success.

Volatility management is another tool that Financial Advisors can use to help their clients achieve more success during stressful times. Mathematically, the level of volatility correlates with increased uncertainty, which makes sense as volatility measures the deviation around the mean. Therefore, an investor will likely be less confident in the outcome of their forecast when using higher volatility strategies. Conversely, lower volatility strategies should allow for greater confidence in the outcome.

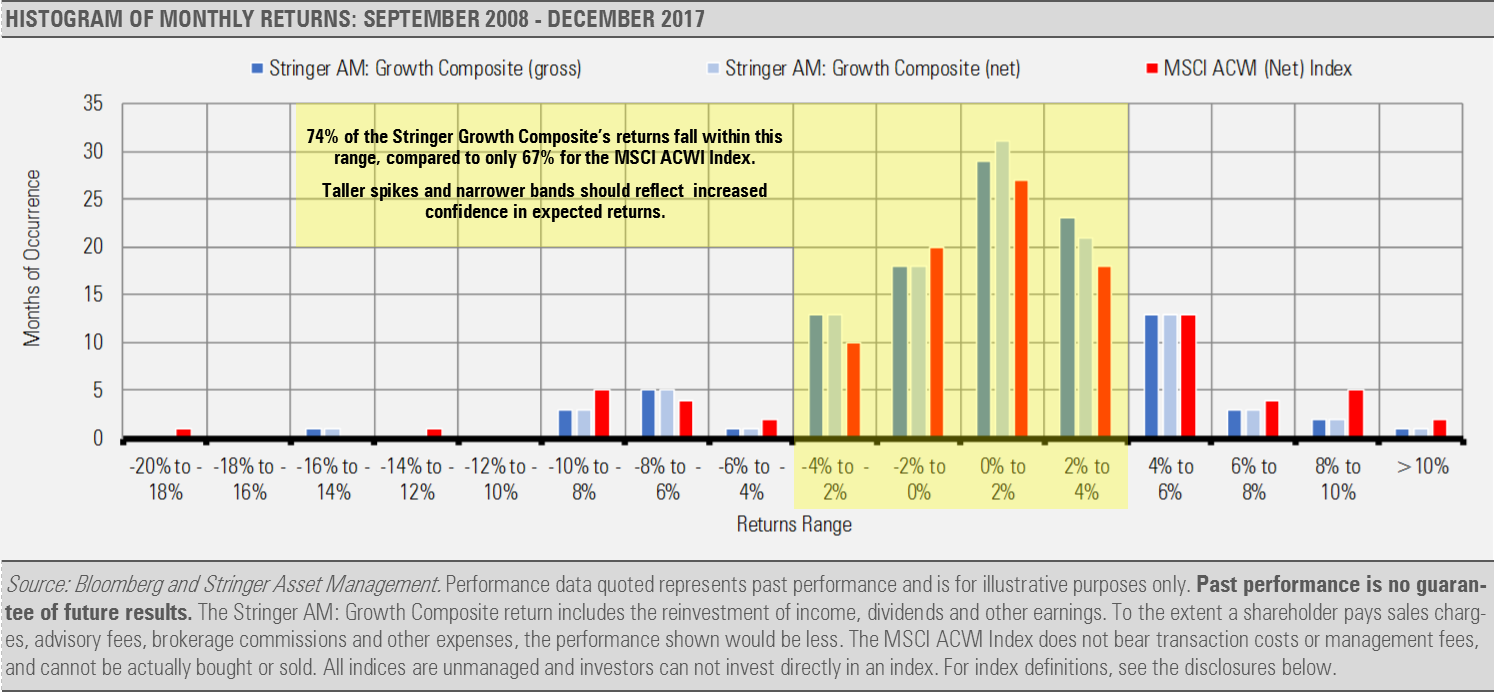

The following histogram of the Stringer Growth Portfolio compared to its benchmark, the MSCI ACWI, highlights this nicely. Ideally, you would want to see a nice, tall stack of returns in the middle and fewer outliers.

![]()

Consistency counts and the Stringer Growth Portfolio has a much tighter distribution of monthly returns than the MSCI ACWI Index. For example, the Stringer Growth Portfolio has 83 months that returned within the –4% to +4% range, compared to only 75 months for the MSCI ACWI Index. This tighter range of returns should offer more confidence in the expected results.

Pulling the tools and concepts of Behavioral Economics and volatility together, it is clear that reducing downside risk and volatility, in general, increases investor confidence. Greater confidence should help investors stay the course and increase the potential for achieving their financial goals.