Beyond the large macroeconomic trends and short-term safe haven bets, Alistair Hewitt, Director at the World Gold Council, pointed to sustained demand that has helped support gold prices. Specifically, he looked toward jewellery, bar and coin investment and industrial uses, with a robust 70% of global demand coming out of the emerging markets.

“I care about consumer demand for gold, in contrast to a lot of commentary around the internet,” Hewitt said. “Of course financial market factors are really important for the gold price, especially in the short term, but they are not the only drivers. The interplay between supply and consumer demand are also really important too.”

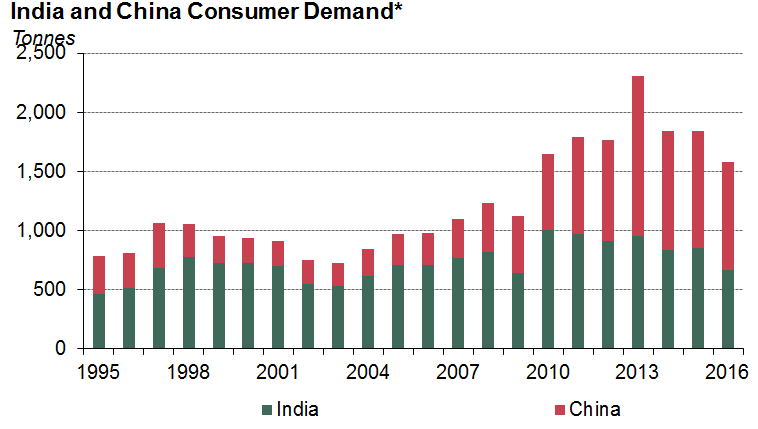

For instance, India and China have been key to the performance of gold over the past decade as they are the two largest contributors of emerging market consumer demand. Meanwhile, European and U.S. consumer demand has dipped over the past decade.

However, Hewitt pointed out that European investors have exhibited an uptick in investment demand, particularly for gold-backed ETFs as Europe has led gold-backed ETF flows this year.

“People who want to move quickly into and out of gold were taking advantage of the superior liquidity behind GLD to build up substantial positions very rapidly, and then unwind them just as quickly. Safe haven flows come and go, that is a simple fact of life,” Milling–Stanley said..

Investors who are interested in gaining exposure to the gold markets have a number of options available to them. For instance, the SPDR Gold Shares (NYSEArca: GLD) is the largest and most liquid gold-related ETF on the market.

Furthermore, those who are still interested in gold but are wary of the negative relationship with a stronger greenback may consider the SPDR Long Dollar Gold Trust (NYSEArca: GLDW), which debuted earlier this year. The new gold ETF may help investors gain exposure to gold bullion price movements to hedge against potential market volatility, without worrying about the negative effects of an appreciating U.S. dollar.

Financial advisors who are interested in learning more about gold can watch the webcast here on demand.