In this week’s TETFindex update, we focus on ETFs that employ the equal weighting (EW) methodology.

Equal weight is a type of weighting that gives the same weight, or importance, to each stock in a portfolio or index fund, and the smallest companies are given equal weight to the largest companies in an equal weight index fund or portfolio.

This may be the simplest form of alternative weighting or smart beta indexing, and also a quite successful one in terms of asset growth.

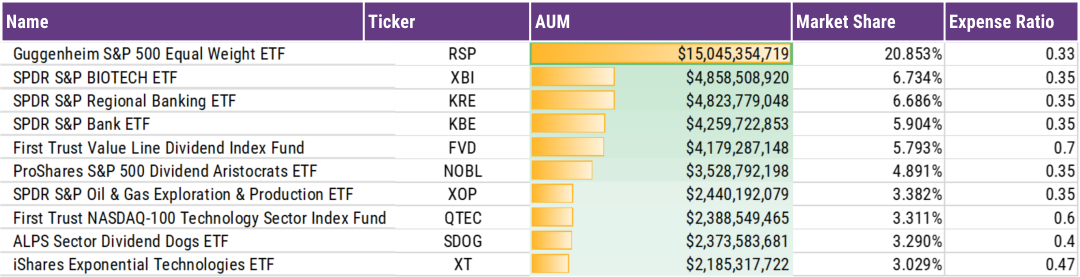

Today, there are 162 EW ETFs with $72B in assets. The biggest is RSP with $15Bn in assets representing 21% of EW assets. Considering the natural simplicity of EW, some investors may find it surprising that this has been a driver of ETF growth.

Top Ten EW ETFs

![]()

EW ETF CLIENT ALIGNMENT GROWTH FACTORS

Financial academics have cited for many years that traditional market cap weighting unintentionally promotes momentum, growth and large-cap factors. Meanwhile, EW is a straightforward, transparent way of mitigating those factors while systematically promoting the value and size factors.

Out of the 162 EW ETFs, 63 are alternative versions of traditional indexes representing 73% of EW assets. The average weighted expense ratio for these EW ETFs is 0.41% vs 0.22% for the overall ETF ecosystem. This simple weighting system has supported ETF growth and innovation for many years.

EW ETF INNOVATION GROWTH FACTORS

The other 99 EW ETFs focus on innovations like dividends, themes, and business characteristics. These ETFs have an average expense ration of 0.50%. We believe this will be the future driver of ETF growth. There are 24 EW ETFs focused on dividends, and more specifically, EW often enhances dividend yield. Even more interesting, thematic ETFs have been a huge growth driver of ETFs and many have embraced an EW methodology.

NUMBER OF EW ETFs BY OBJECTIVE

![]()