Advisors can use NightShares ETFs in client portfolios for non-correlated exposure across asset classes.

Alternative assets are used to reduce the overall risk and diversify client portfolios, as alternatives should have minimal correlation to stocks or bonds. These non-correlated assets can minimize the volatility of the portfolio and often lead to higher overall portfolio returns.

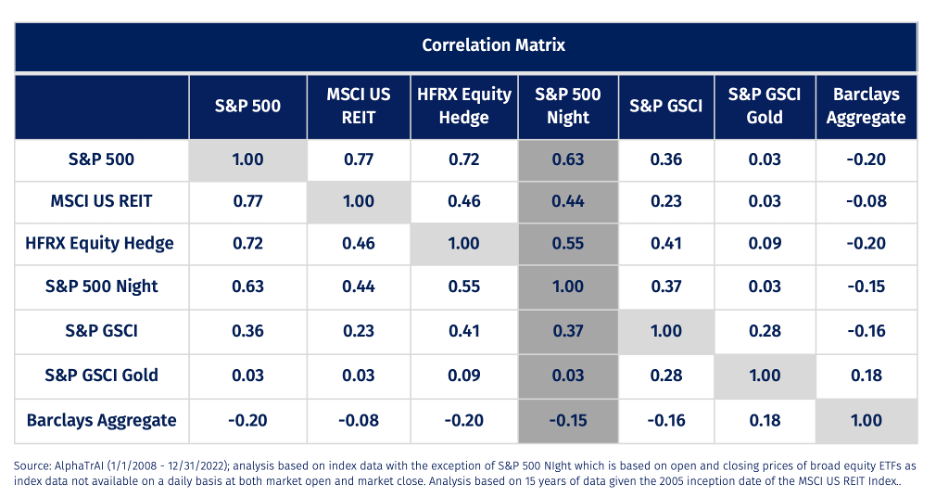

Notably, investing in the night can provide the same effect as other alternatives. The night session of the market has lower correlation to the full market session than commonly used alternatives including real estate and equity hedge funds, making it a useful tool for diversifying client portfolios.

The night effect is a persistent phenomenon whereby overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis.

The night session of the U.S. large cap equity market — accessible through the NightShares 500 ETF (NSPY) — is less correlated to the full market cycle than real estate and equity hedge funds based on an analysis of the past 15 years. The night session also has low correlation to the returns of other alternatives, including commodities and precious metals.

NightShares launched three ETFs in 2022, offering investors the ability to efficiently capture the night effect for the first time, something previously only accessible on an institutional trading floor or at a hedge fund.NSPY offers focused exposure to the night performance of 500 large-cap U.S. companies.

For investors looking to maintain day exposure but overweight the night, the NightShares 500 1x/1.5x ETF (NSPL) tilts toward the night, providing investment results, before fees and expenses, that correspond to 100% of the performance of a portfolio of 500 large-cap U.S. companies during the day and 150% of the portfolio performance at night.

The NightShares 2000 ETF (NIWM) provides exposure to the night performance of 2000 small-cap U.S. companies.

For more news, information, and analysis, visit the Night Effect Channel.