The Nasdaq-100 Index (NDX) has long been one of the best-performing, most widely observed gauges of domestic equities. One of the primary reasons behind that enviable track record is technology sector exposure, and lots of it.

Currently, NDX has a nearly 48% weight to tech stocks, well ahead of the 26.34% the S&P 500 devotes to the sector. In this vein, to many investors, the Nasdaq-100 is synonymous with tech investing.

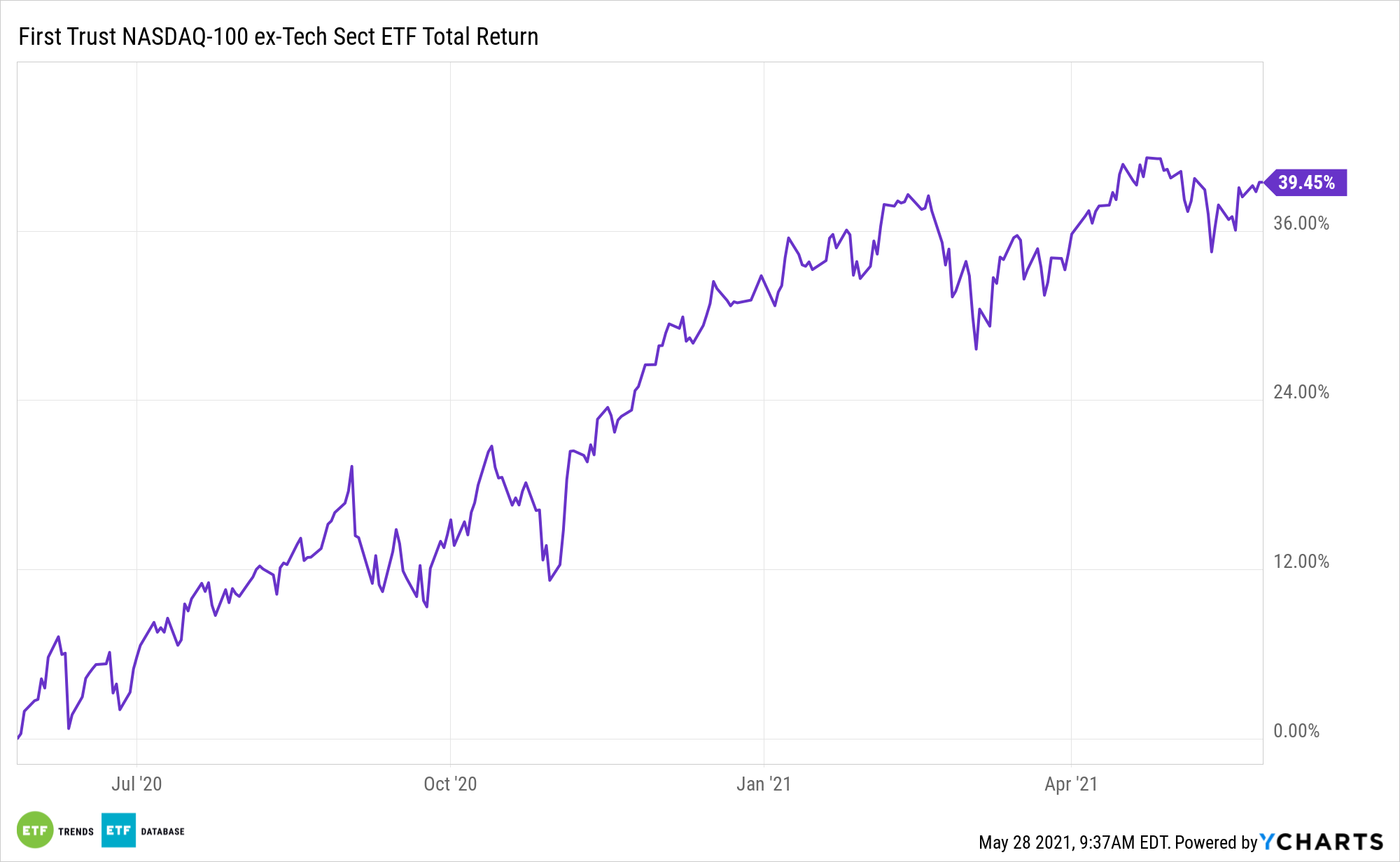

Yet a tech-less Nasdaq-100 is not heresy. The First Trust NASDAQ-100 Ex-Technology Sector Index Fund (NasdaqGM: QQXT) proves it’s a viable methodology for investors that already have tech exposure, but are seeking access to some of the other innovative companies.

The Method behind the Madness

The $141.62 million QQXT holds 61 stocks and tracks the NASDAQ-100 Ex-Tech Sector Index. That benchmark’s methodology is straightforward. It’s home to the largest non-tech stocks in NDX. Since NDX already excludes financial services names, that sector isn’t part of QQXT either.

Not only does QQXT help investors diversify away from tech while still accessing growth fare, it excludes some communication services names, such as Google parent Alphabet (NASDAQ: GOOG, GOOGL), because some of those stocks were previously part of the tech sector.

Another point in favor of the First Trust ETF is limited single-stock risk, as the asset is an equal-weight fund. In the cap-weighted version of NDX, three stocks – Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN) – combine for roughly 30% of the benchmark’s weight. Conversely, no QQXT holding even has a weight of 2%.

Obviously, QQXT has significant holdings-level overlap with NDX at 61, but the overlap by weight between the fund and NDX is tame at 35%, according to ETF Research Center data.

Additionally, the exclusion of tech and communication services names from QQXT doesn’t diminish the fund’s growth profile, potentially making it a compelling choice for growth investors that sourcing tech exposure elsewhere.

Additionally, QQXT’s consumer cyclical exposure is derived mostly from e-commerce platforms and consumer-facing retailers and restaurants, giving the fund some credibility as a re-opening trade.

While the exclusion of tech may be a tough pill for some investors to swallow, QQXT rewards that faith. Over the past three years, the fund has beaten the S&P 500 by nearly 900 basis points while sporting slightly less annualized volatility.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.