Wind power is one of the dominant forms of renewable energy, and investors can tap into that burgeoning long-term theme with the First Trust Global Wind Energy ETF (FAN).

FAN seeks investment results that correspond generally to the price and yield of an equity index called the ISE Clean Edge Global Wind EnergyTM Index.

FAN components “are identified as providing goods and services exclusively to the wind energy industry are given an aggregate weight of 66.67% of the index. Those companies determined to be significant participants in the wind energy industry despite not being exclusive to such industry are given an aggregate weight of 33.33% of the index. This weighting is done to ensure that companies that are exclusive to the wind energy industry, which generally have smaller market capitalizations relative to their multi-industry counterparts, are adequately represented in the index,” according to First Trust.

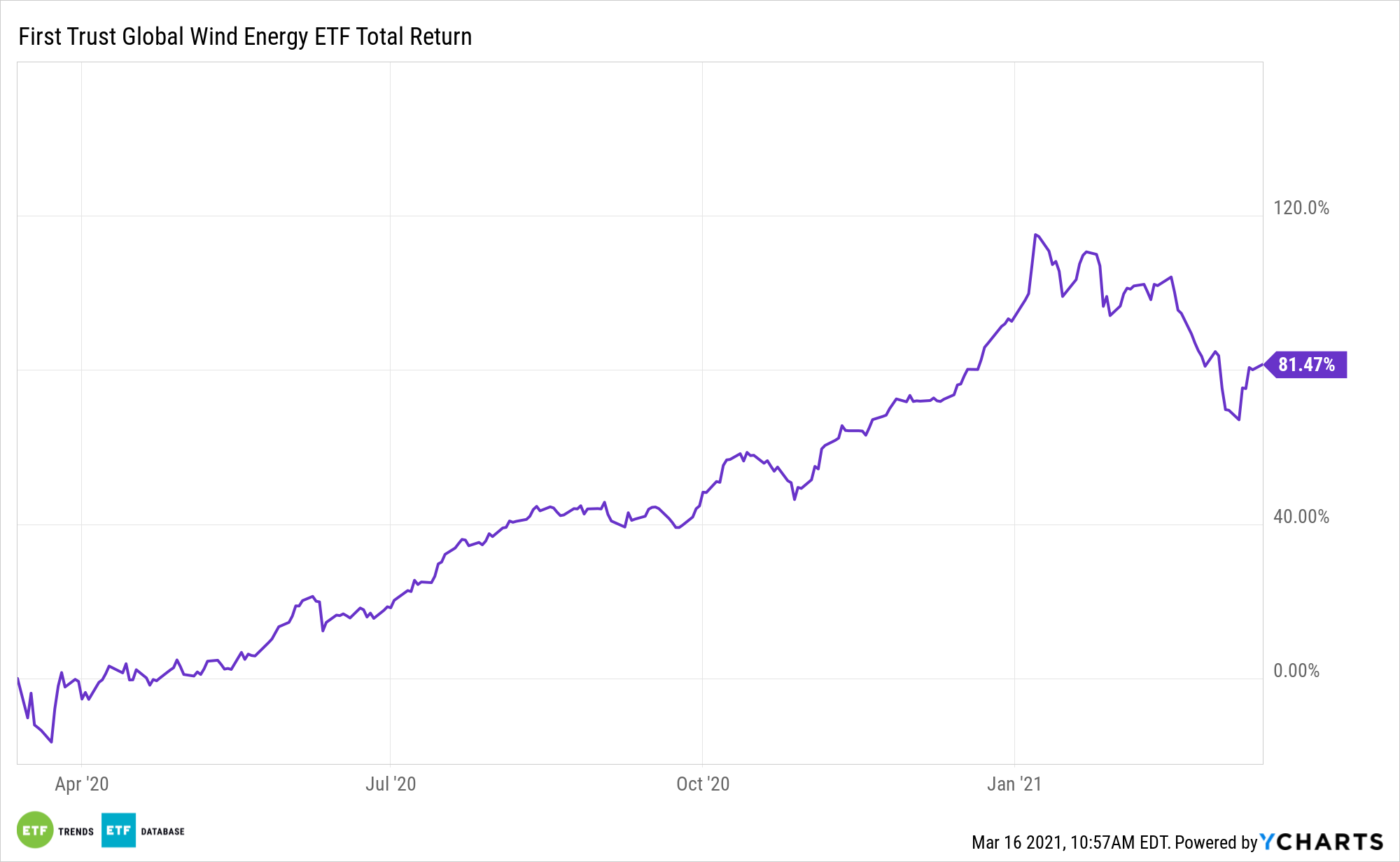

Data confirm the long-term efficacy of the FAN thesis.

“Wind is now America’s top renewable source of electricity generation. 2020 in particular was a banner year for wind power in the U.S., with more capacity installed in the final quarter of 2020 alone than in all of 2019. Now, the total capacity exceeds 120,000 MW, enough to power about 38 million homes,” reports Katie Bigham for CNBC.

A FANtastic Opportunity

Environmental, social, and governance (ESG) is becoming an integral part of the investment space and as more investors clamor for funds that hone in on these initiatives, ETF providers are scrambling to give the people what they want. One of these areas is alternative energy, which will allow ETFs that center on wind and solar power to come into focus.

FAN’s index provides a benchmark for investors interested in tracking public companies throughout the world that are active in the wind energy industry. In order to be eligible for inclusion in the index, a security must be issued by a company that is actively engaged in some aspect of the wind energy industry.

“Essentially all of that growth was in the onshore wind sector. Developers are planning more offshore projects for the coming years, too. And they’re pioneering advances in the field along the way, like the development of increasingly huge turbines, with individual blades larger than football fields,” according to CNBC. “But for all the promise of wind power, there are some concerns that have persisted over the years, impeding the expansion of both onshore and offshore turbines. Regulatory and permitting hurdles, concerns over turbine-caused bird deaths and other environmental impacts, and of course the intermittent nature of renewables all pose a challenge.”

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.