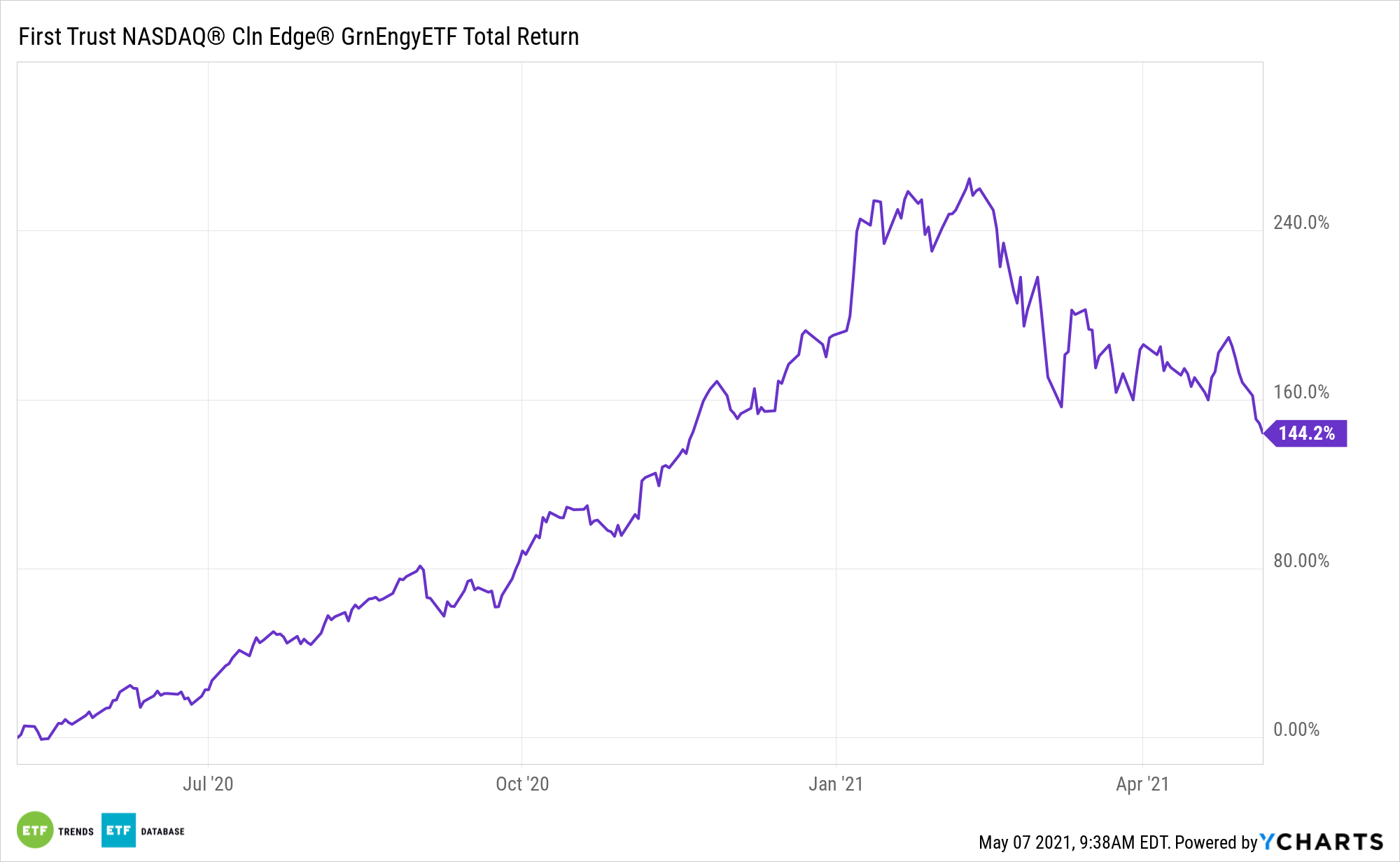

In application and as an investment theme, renewable energy is an international concept. However, some markets are more attractive than others. The U.S. is one of the best clean energy investment environment, making a strong case for asset like the First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN).

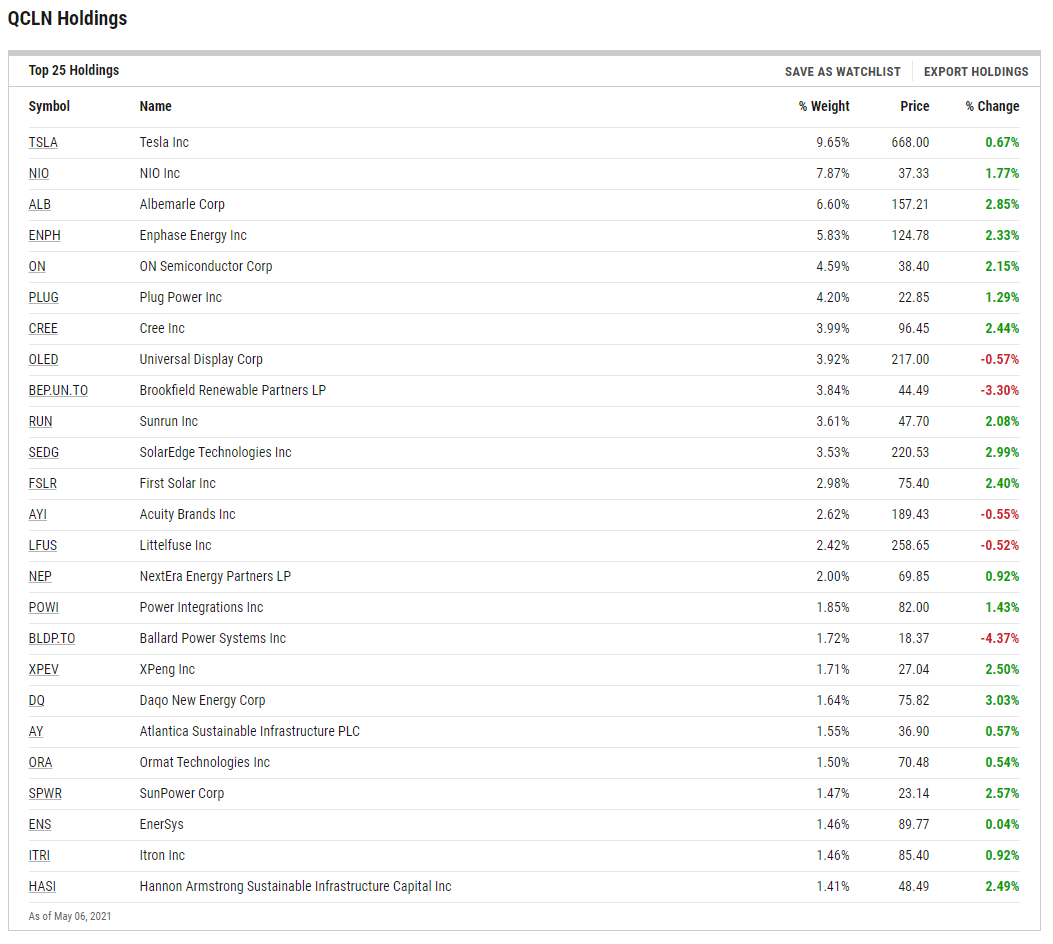

The $2.47 billion QCLN, like many rival exchange traded funds, features ample international equity exposure, but it’s also more than adequately levered to opportunities in the booming domestic green energy market.

“Sound fundamentals and the availability of an attractive yet phasing down subsidy positioned the United States as the most attractive market for renewables investment,” according to IHS Markit. “In contrast, Mainland China, which accounted for over half of the world’s total non-hydro renewables additions last year, ranked third on the attractiveness ranking—just behind number two Germany—as difficulties in accessing the market weighed down its overall score.”

Tech Talk with ‘QCLN’

QCLN allocates about 20% of its weight to pure play technology companies and another 23.63% to renewables equipment manufacturers with tech-esque traits. That’s important to investors because technology is at the epicenter of renewable development.

“In individual technology rankings, the United States also retained the top ranking in investment attractiveness for onshore wind and solar PV. The United Kingdom—which failed to crack the top ten in the combined rankings due to its relative lack of support for developing onshore wind and solar PV—ranked as the most attractive market for offshore wind investment,” notes Markit.

Boding well for QCLN over the long haul is that many countries will need to make significant investments to ensure they aren’t left behind in the renewables transition.

“A growing number of markets are facing infrastructure preparedness issues on their quest to decarbonize. These include India (Rank 6) where onshore wind build has suffered from lack of grid and land access, Australia (Rank 7) where disconnect between federal and state ambitions have increased investor uncertainty, and Vietnam (Rank 12) where mushrooming wind and solar additions have started to expose fault lines in the national grid,” adds Markit.

QCLN’s grid exposure is another potential catalyst for the fund.

“The ongoing transition to competitive procurement and a growing need for grid-parity renewable energy has forced investors to look beyond financial incentives, and focus on factors including economic stability, market liberalization, and investor friendliness,” concludes Markit. “With renewables increasingly forced to compete on cost with other generating technologies, investors are on the lookout for established yet fast growing markets to minimize risk.”

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.