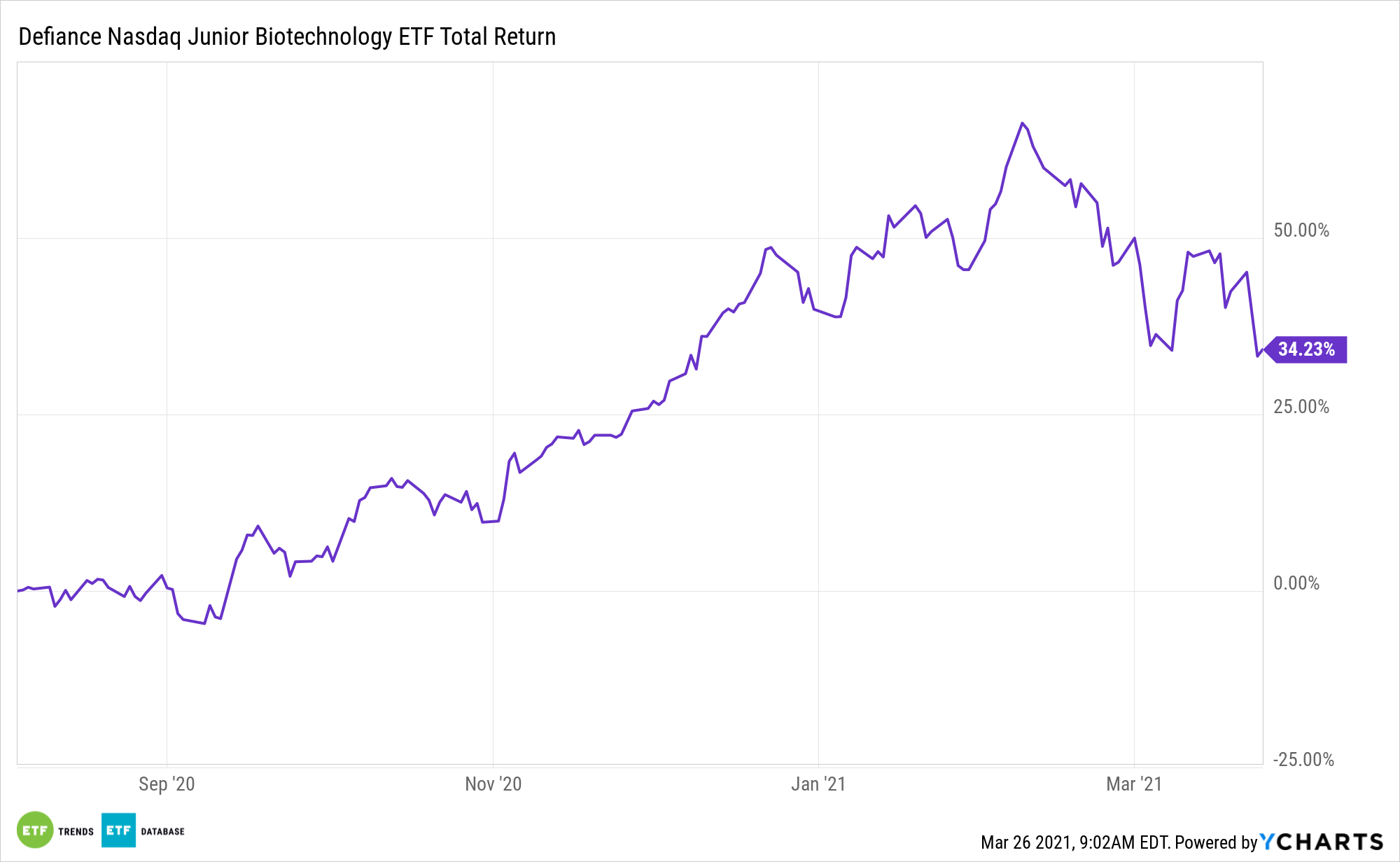

Small cap stocks are retreating. So are biotechnology names. Yet this combo could be an attractive invitation to examine with the Defiance Nasdaq Junior Biotechnology ETF (IBBJ).

IBBJ, which debuted last year, tracks the Nasdaq Junior Biotechnology Index (NBIJR), which is home to nearly 180 stocks. The benchmark caps components’ market value at $5 billion at the time of inclusion.

IBBJ’s member firms “are “engaged in biotech research and development, the sale or licensing of biological substances for the purposes of drug discovery and diagnostic development; and pharmaceutical manufacturers of prescription or over-the-counter drugs, including vaccines and development and manufacturing companies,” according to Defiance.

IBBJ’s benchmark methodology underpins a strong thesis for the still newish fund.

“NBIJR’s annual reconstitution went effective on December 21, 2020. Reflecting the generally strong trends across the industry in the past year, there were 99 additions made to the index, and only 26 deletions,” writes Mark Marex, Nasdaq product development specialist. “Put another way, the index’s constituent pool grew by more than 40% (from 169 to 242), a result of the historic growth in the pool of smaller-cap biotech companies that now meet the minimum $200MM market cap threshold. More than half of the new additions conducted an IPO in the past three years, with 26 going public in 2020, 17 in 2019, and 10 in 2018. And of the 26 deletions, roughly half (12) graduated into the senior ranks of NBI with market capitalizations exceeding $5Bn.”

Inside ‘IBBJ’

A primary benefit of IBBJ is that the growth fund is chock-full of companies that emphasize research and development, which is critical to success in the biotechnology arena. In fact, IBBJ components are more R&D intensive than the large cap names found in the Nasdaq Biotechnology Index (NBI).

IBBJ’s index “approach to investing in future returns from today’s most important healthcare R&D investments,” adds Marex. “We observed that in 2019, fully 63% of the index constituents’ aggregate revenue was spent on research & development. Looking at the most recent four quarters of data (with a few companies still left to report full-year 2020 results), that ratio has increased to 68% — double the rate of NBI.”

After a lull in mergers and acquisitions activity, Big Pharma could begin to use its cash stores to buy out smaller targets, potentially fueling the momentum in biotechnology-related exchange traded funds that target the small- and mid-cap segments. Observers attributed the slowdown in M&A activity to the onset of the coronavirus pandemic, along with election-related uncertainty over future regulatory outlook.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.