Due to the likes of Amazon (NASDAQ: AMZN), Etsy (NASDAQ: ETSY), Shopify (NYSE: SHOP), and many, many more, investors tend to be familiar with domestic e-commerce equities.

The acceleration in online shopping caused by the coronavirus pandemic only enhanced that familiarity and interest, but investors shouldn’t sleep on the emerging markets e-commerce opportunity set, which is accessible via several exchange traded funds, including the Global X Emerging Markets Internet & E-Commerce ETF (NASDAQ: EWEB).

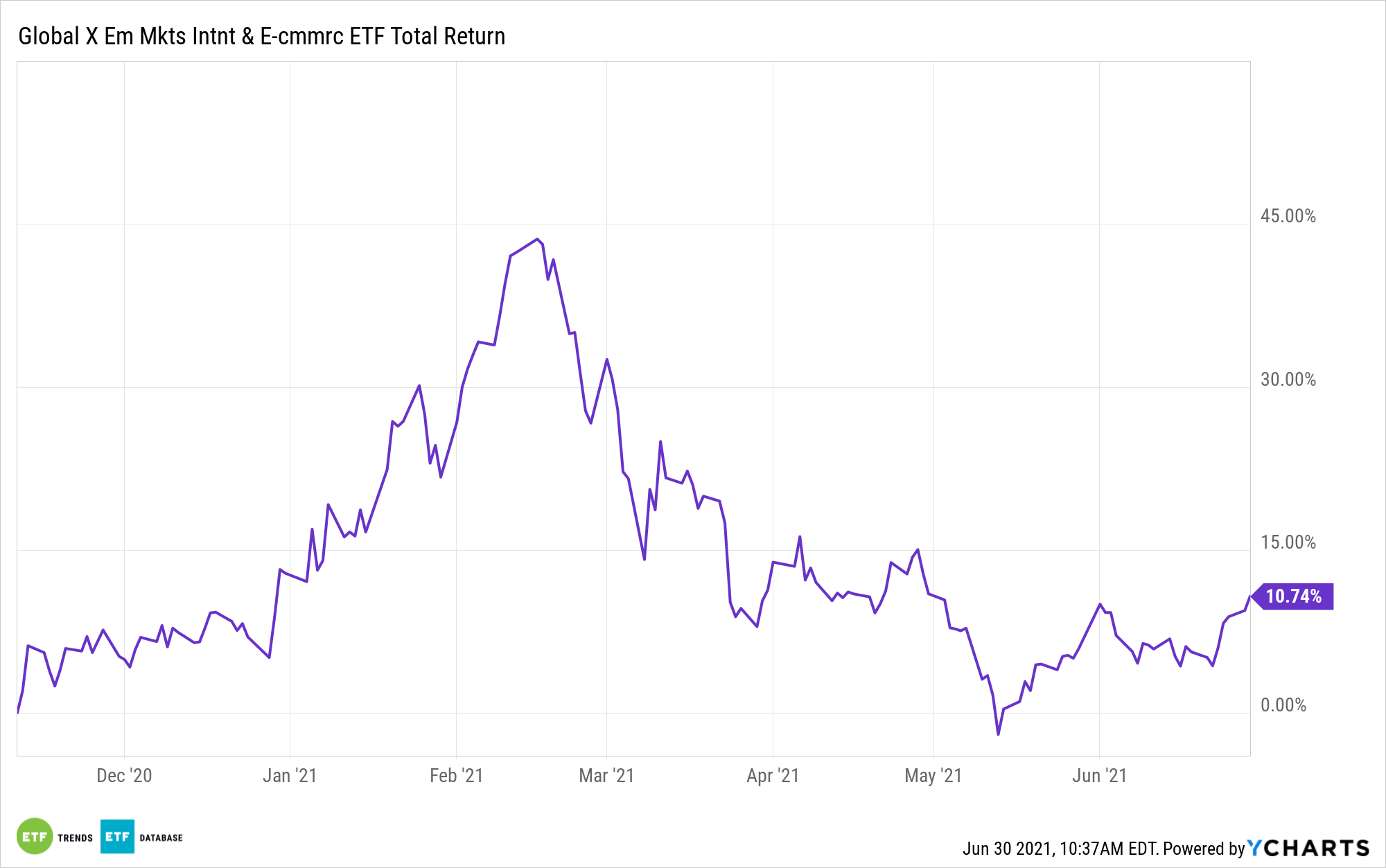

EWEB, which debuted in November 2020, follows the Nasdaq CTA Emerging Markets Internet & E-commerce Net Total Return Index. The Global X fund is a compelling idea for investors for a variety of reasons, including its sensitivity to changes in consumer tastes driven by the pandemic, as has been seen in more mature markets.

“The COVID-19 pandemic has significantly swelled the ranks of online shoppers worldwide. But this is only the start. The latent demand for e-commerce in emerging markets remains large. Cross-country data suggests that online markets can take off rapidly, as incomes rise,” according to Brookings.

Evaluating EWEB’s Long-Term Prospects

Among the other factors that bode well for EWEB from a long-term perspective are emerging markets’ favorable demographics and rising middle classes. Additionally, developing economies, broadly speaking, have lower rates of internet penetration than markets like the U.S. and the U.K.

However, emerging markets also lack traditional Western style brick-and-mortar retail stores. There aren’t many Costo- or Target-esque stores in countries like Brazil and Indonesia. That’s one indication that emerging markets consumers make for natural fans of online retail, and as internet penetration in these regions rises, so does the opportunity to gain market share for EWEB components.

“In the emerging markets e-commerce revolution, governments, homegrown entrepreneurs, and international e-commerce giants all need to play their part,” adds Brookings. “If done right, online markets stand to create new jobs and benefit customers. By unleashing innovation and strengthening market competition, e-commerce may be just what is needed to unlock the emerging world’s next growth phase.”

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.