Investable Market Real Estate 25/50 Index sports a dividend yield of 3.50%, almost 110 basis points above the yield on the S&P 500.

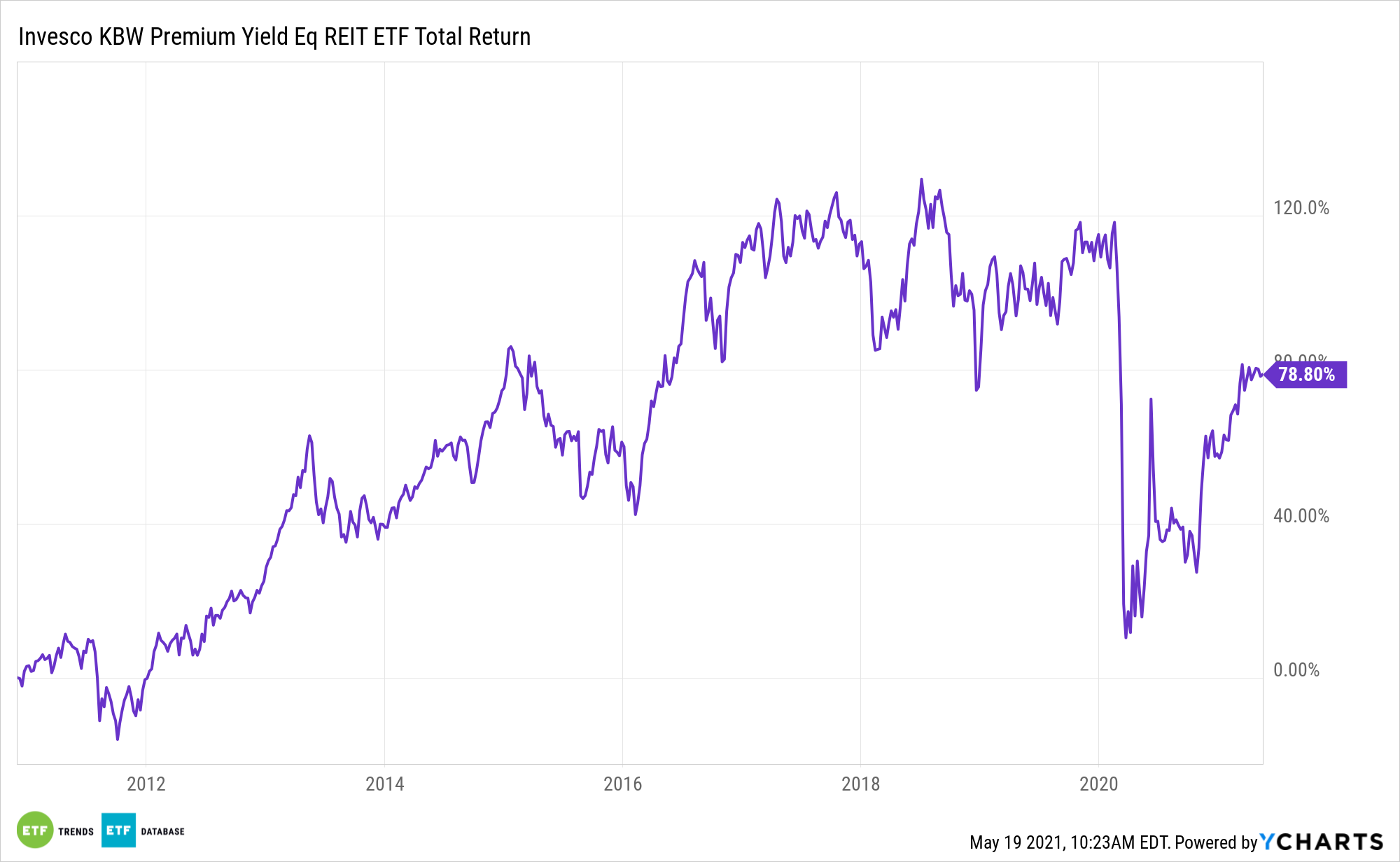

Real estate investors looking to jumpstart their yield profiles can turn to the PowerShares KBW Premium Yield Equity REIT Portfolio (NYSEArca: KBWY), which tracks the yield-weighted KBW Nasdaq Premium Yield Equity REIT Index.

The $337.6 million KBWY sports a jaw-dropping 12-month distribution rate of 8.18%, according to Invesco data.

Speaking of KBWY’s assets under management tally, roughly a third of that sum has flowed into the Invesco product just this year, reports Ari Weinberg for Pensions & Investments.

“In aggregate, U.S.-listed real estate ETFs had $80.4 billion in assets under management through May 3, according to CFRA,” reports Pensions & Investments.

KBWY: More Than an Income Idea

Home to 31 holdings, KBWY obviously has an eye-catching yield, and for some investors that’s enough. However, the fund offers other benefits.

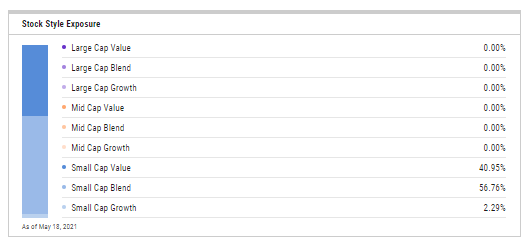

Those holdings have an average market capitalization of $1.79 billion, positioning KBWY to benefit from a rebound in small cap equities. Furthermore, nearly 41% of KBWY member firms are classified as value stocks – a meaningful characteristic because small cap value is one of the more potent factor combinations over long holding periods.

Another longer-ranging catalyst for KBWY could be professional money managers altering real estate allocations to more public real estate. Those asset allocators often lean on private real estate.

“According to Green Street data through 2018, pension fund real estate allocations in aggregate allocated roughly 5% to private real estate and less than 1% to public REITs. In Green Street’s analysis of institutional ownership of public REITs, 41% is held by passive strategies, 55% by active strategies, and 4% by pensions directly,” reports Pensions & Investments.

Another overlooked perk with KBWY is that it delivers distributions monthly, not quarterly. Many funds in this category are on the quarterly dividend schedule, but KBWY can help investors attain a steadier stream of income with its monthly payout schedule.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.