Technology stocks are out, but not down. The Nasdaq-100 Index (NDX) is up about 6% year-to-date, a decent if tepid performance.

The tech-heavy Nasdaq-100 is simply lagging this year. It’s not in the red. Furthermore, some market observers believe now is a good time for long-term investors to consider tech. That could drive renewed interest in exchange traded funds like the Invesco DWA Technology Momentum ETF (PTF).

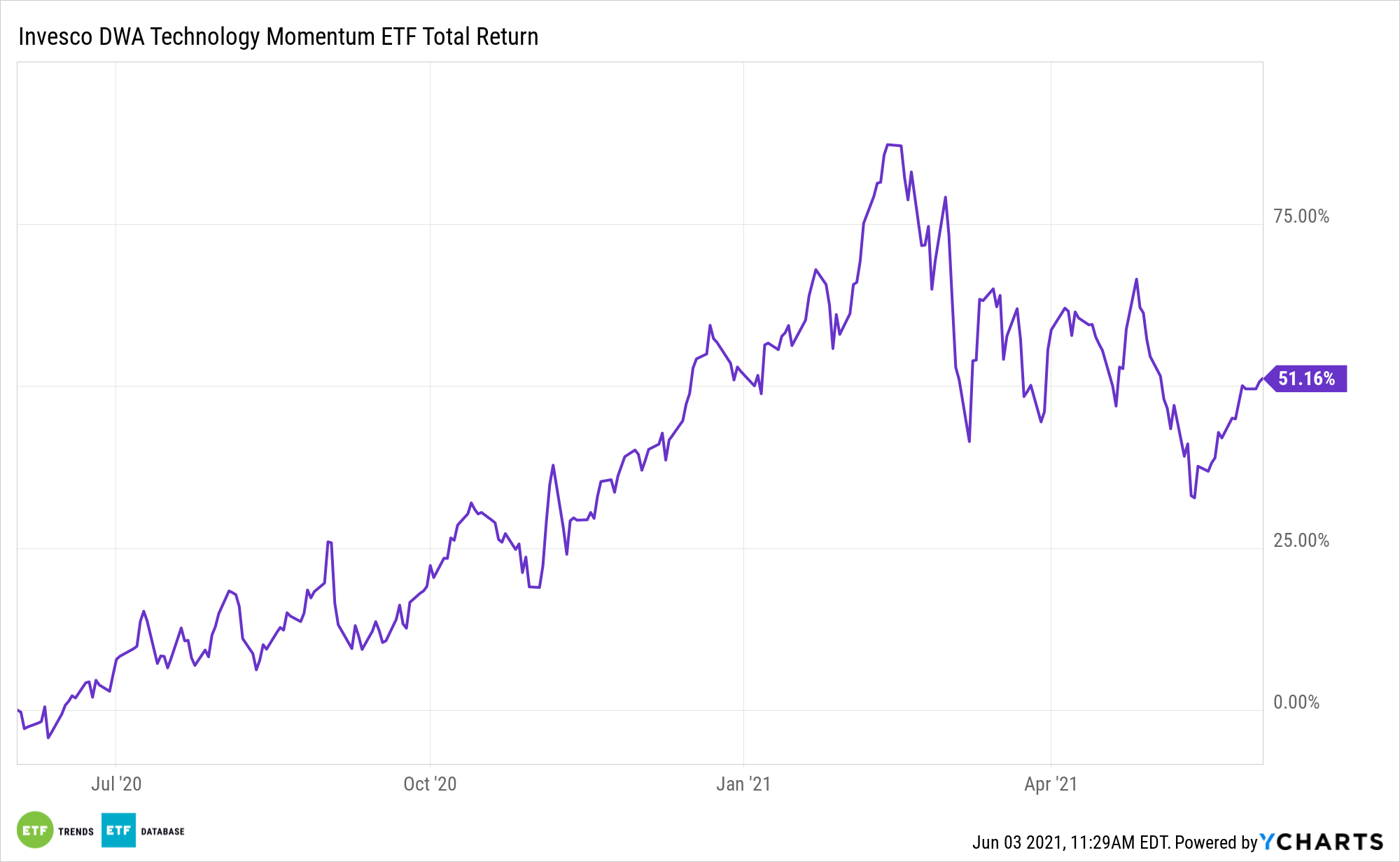

As its name implies, PTF is a momentum-based strategy. That factor is out of favor this year, but it’s higher by almost 4% over the past week. Strong fundamentals support the case for tech upside as 2021 moves along. Consider the sector’s showing during the first-quarter earnings season.

“Tech was one of two sectors that had the highest percentage of companies that reported earnings above estimates — a whopping 94%,” writes Invesco Chief Global Market Strategist Kristina Hooper. “And it’s not just earnings — tech had the highest percentage of companies reporting revenue above estimates as well at 94%.”

PTF Potential

The $277.3 million PTF follows the Dorsey Wright® Technology Technical Leaders Index – a benchmark comprised of a minimum of 30 members of the NASDAQ US Benchmark Index displaying favorable relative strength traits.

PTF is industry agnostic, but it’s currently top-heavy, with over 64% of its weight split between software and semiconductor stocks. This year, that results in a splitting the difference scenario as software stocks are lagging amid concerns about frothy valuations. On the other hand, chip stocks are rallying due in part to a global semiconductor shortage.

Another element of the tech equation to consider is the sector’s international exposure, making it an ideal play on a recovering global economy.

“Another important point to make is that the tech sector has the greatest non-US revenue exposure of any sector in the S&P 500 Index — 57% of tech companies’ revenues are derived from outside the US,” adds Hooper. “Given that we expect economies outside the US to follow the US into a stronger recovery as economies re-open, the tech sector’s strong revenue and earnings may have longer legs.”

Though PTF isn’t explicitly mentioned in Hooper’s note, the fund has credibility as a global recovery play. As just one example, many of the ETF’s chip holdings (31.81% of the portfolio) sell their wares in an array of ex-U.S. markets.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.