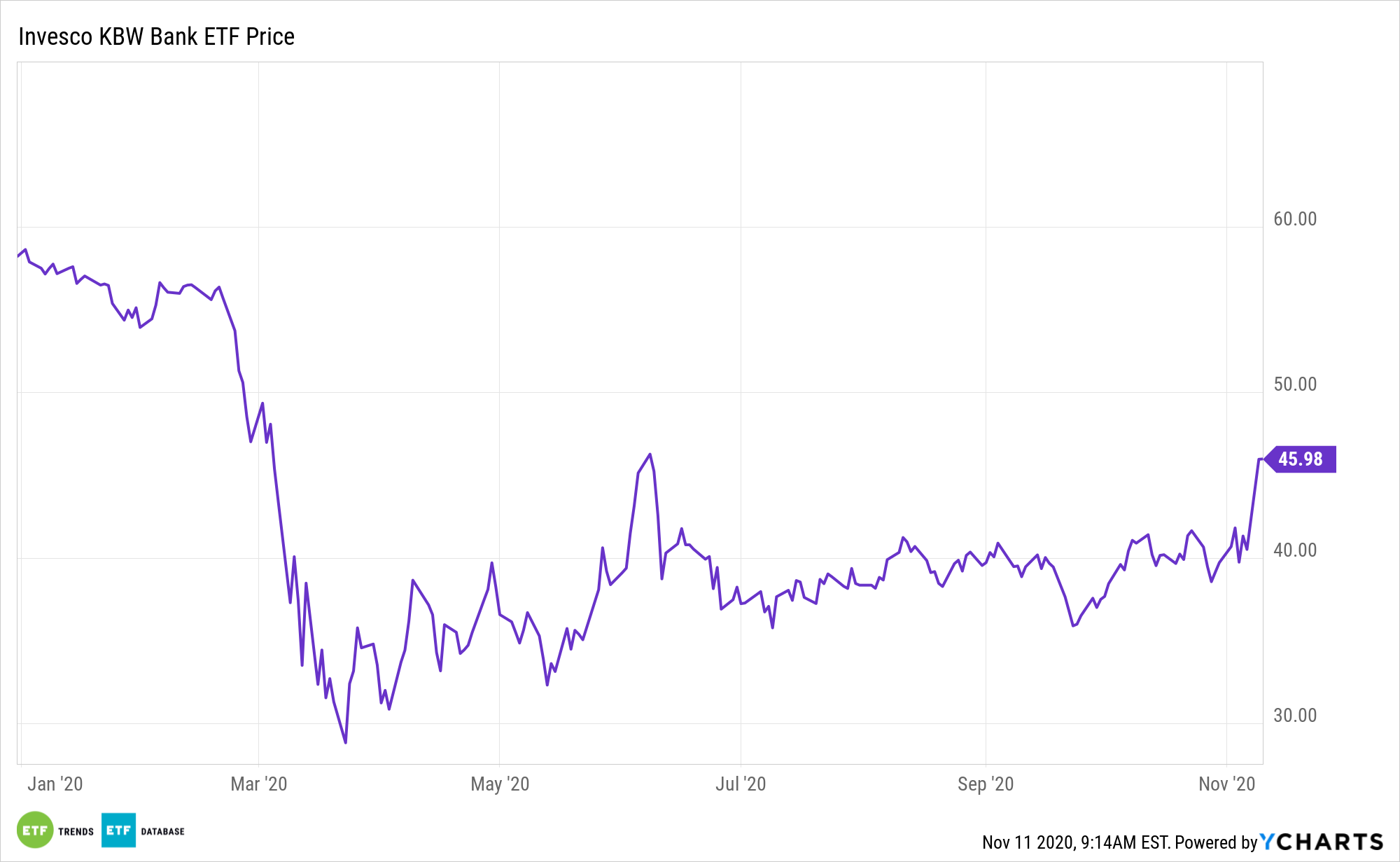

The Invesco KBW Bank ETF (NASDAQ: KBWB) and other financial services exchange traded funds endured their share of misery earlier this year thanks in large part to lower interest rates. But with cyclical stocks back in style, it could be time to give KBWB another look.

KBWB tracks the widely followed KBW Nasdaq Bank Index.

“The Index is a modified-market capitalization-weighted index of companies primarily engaged in US banking activities. The Index is compiled, maintained and calculated by Keefe, Bruyette & Woods, Inc. and Nasdaq, Inc. and is composed of large national US money centers, regional banks and thrift institutions that are publicly traded in the US,” according to Invesco.

Bank stocks are performing well in the wake of clarity of Joe Biden becoming the 46th president of the United States.

“Bank stocks may have had a significant run-up in recent days, but the sector may still represent compelling opportunities for investors,” reports Carleton English for Barron’s. “The sector had double-digit gains in Monday’s trading on the heels of positive Covid-19 vaccine data as investors hoped that the rollout of an effective vaccine would speed up the economic recovery and provide support to struggling bank stocks. Rising bond yields on Monday’s news also helped lift bank stocks.”

Can You Bank on Banking ETFs?

Rock-bottom interest rates and rising loan loss reserves are among the factor hampering KBWB and other bank ETFs, but the latter scenario could turn for the better if the U.S. economy bounces back.

The problem with banks setting aside large chunks of cash to cover bad loans is that the strategy weighs on earnings. Those reserves come directly out of profits, but if the economy improves, KBWB holdings may not need to cover as many bad loans as expected, meaning those reserves could eventually be turned into profits.

“While bond yields rose, providing a benefit to banks’ net interest margins, long-term yields still remain historically low, meaning that banks will continue to feel some pressure. That said, a rise of 2 basis points in net interest margins would improve bank earnings per share by 1.9% in 2022, according to Vivek Juneja, analyst at J.P. Morgan Chase,” reports Barron’s.

Some analysts believe bank stock performance is about to take a turn for the better after falling behind amid pandemic-induced revenue concerns due to low interest rates and weak loan growth, along with credit concerns. Plus, there are some near-term catalysts for KBWB and friends, including solid credit quality.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.