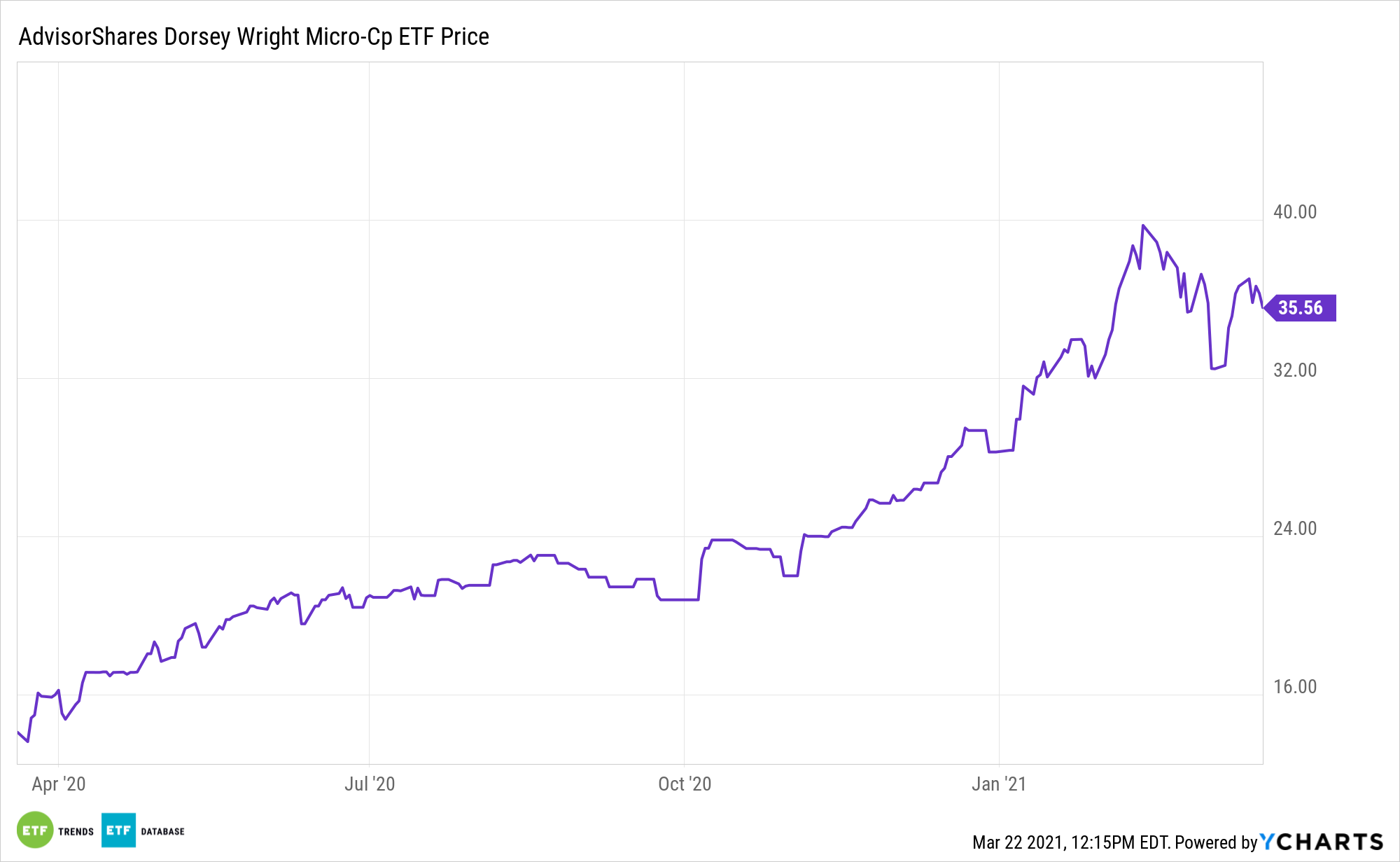

While small cap stocks get plenty of attention, micro caps often go overlooked. Still, the asset class offers significant potential for risk-tolerant investors. One powerful option is the AdvisorShares Dorsey Wright Micro Cap ETF (NASDAQ: DWMC).

DWMC hopes to capitalize on companies with a market capitalization of less than $1 billion. DWMC invests in micro cap equities with favorable relative strength characteristics that meet or exceed Dorsey Wright’s proprietary methodology for selection. The micro cap portfolio will consist of 150 holdings that takes advantage of strong performers and avoids underperformers.

The ETF is actively managed by Nasdaq Dorsey Wright–best known for their core philosophy of relative strength investing. This investment strategy involves purchasing securities that have appreciated in price more than other securities and then holding those securities until they exhibit sell signals. Furthermore, the fund uses technical, systematically-driven investment approaches that avoid fundamental company data and remove human emotions from day-to-day management.

Reasons to Consider ‘DWMC’

Micro cap companies have a market capitalization of $50 million to $300 million, less than small cap stocks. Typically, investors will notice that larger capitalization stocks are less risky, generating smaller but more steady returns. In comparison, smaller company stock sees greater swings, but the added risk comes with potentially greater returns.

Micro caps offer “low correlations with the upper reaches of the market-cap ladder. It might also serve as a more liquid, less costly, and more readily accessible proxy for a private equity allocation,” said Morningstar in a recent note. “However, this asset class is not without its drawbacks. Chief among these are greater volatility and limited liquidity and capacity. Also, for fund investors, there are few options for exposure to this sliver of the market. It is a market segment where indexing is challenged. Fortunately, there are some better alternatives.”

Small caps are focused on the domestic economy and have less direct exposure to global geopolitical uncertainty and currency risks, as opposed to large cap companies that have an international footprint, which may be affected by overseas risks and a strengthening U.S. dollar.

“Micro-cap stocks tend to be riskier than small-, mid-, and large-cap stocks. Smaller companies tend to be riskier. They often have weaker balance sheets, more limited product, and service offerings, limited geographic diversification, and less experienced managements than larger companies,” adds Morningstar.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.