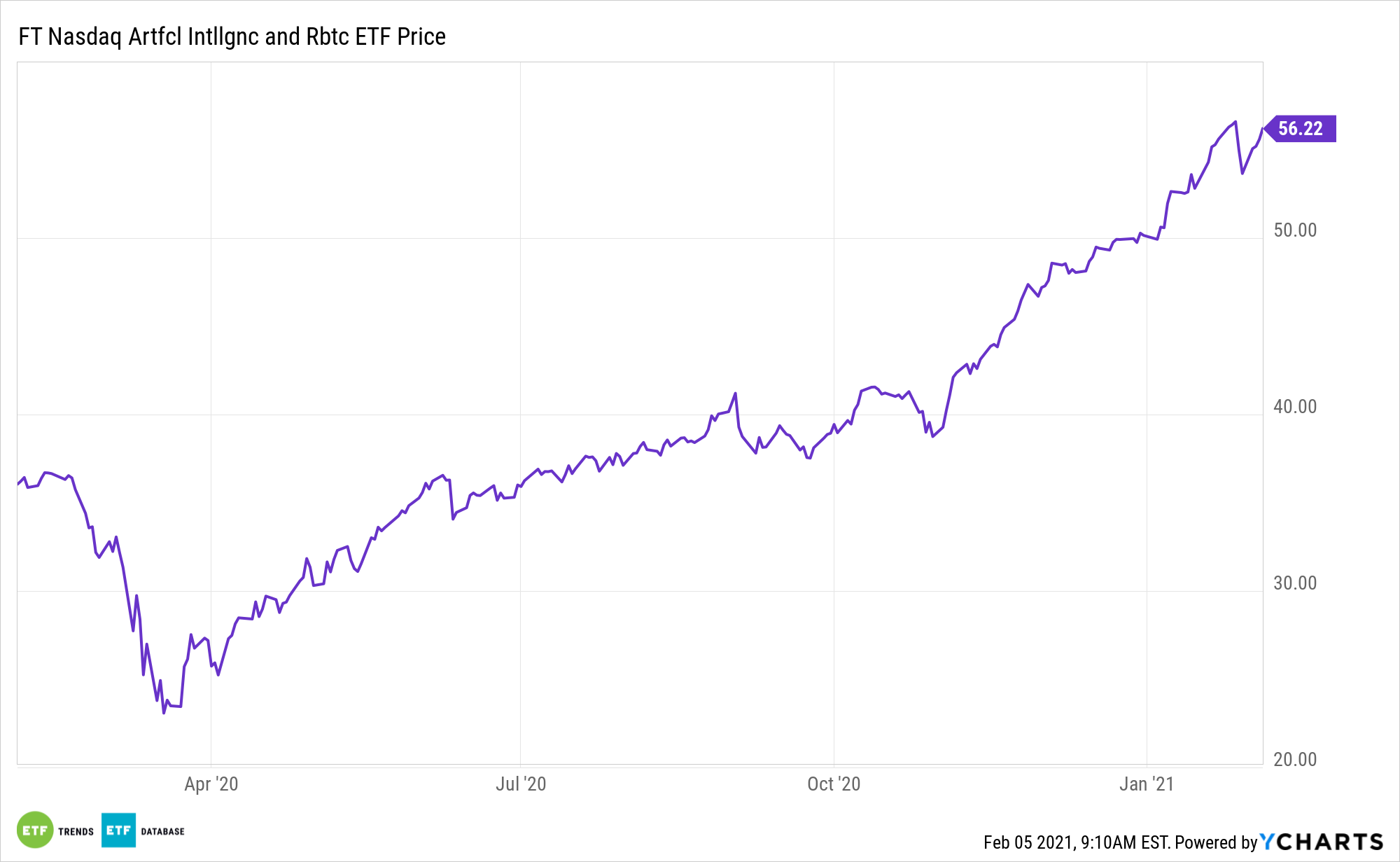

Robotics is an increasingly compelling investment niche, but one that’s often tricky to stock pick in. Enter exchange traded funds like the First Trust Nasdaq Artificial Intelligence and Robotics ETF (NasdaqGM: ROBT).

ROBT follows the Nasdaq CTA Artificial Intelligence and Robotics Index. ROBT provides exposure to target companies engaged in the artificial intelligence and robotics segments of the technology, industrial, and other economic sectors. Components are classified as AI or robotics engagers, enablers, or enhancers, as determined by the Consumer Technology Association.

Home to nearly $222 million in assets under management, ROBT turns three years old later this month. It has the leverage to clear growth trends.

The annual global installed base of industrial robots is expected to rise to 3.55 million by 2021, compared to 1.83 million back in 2016. Meanwhile, artificial intelligence will find support from drivers like inference systems including facial recognition, robotics, factory automation, autonomous driving, and surveillance. Automotive systems like including infotainment, ADAS, safety, autonomous driving and financial services like identity authentication and smart portfolio management will also play their part.

Get it Right with ROBT

One of the advantages of ROBT is that there’s an element of robotics purity with the ETF.

To earn admission into the fund’s underlying index, companies must classified as A.I. or robotics engagers, enablers, or enhancers, as determined by the Consumer Technology Association. Specifically, enablers refers to companies that develop the building block components for robotics or A.I., such as advanced machinery, autonomous systems/self-driving vehicles, semiconductors, and databases used for machine learning. Engagers are comprised of companies that design, create, integrate, or deliver robotics and/or AI in the form of products, software, or systems. Lastly, enhancers cover a group of companies that provide their own value-added services within the AI and robotics ecosystem, but which are not core to their product or service offering.

Robotics refers to a branch of technology that deals with the design, construction, operation, and application of robots. Artificial Intelligence refers to the theory and development of computer systems that perform task normally requiring human intelligence.

A Seeking Alpha article by Michael Fitzsimmons referenced a MarketsandMarkets research report that said:

“The global artificial intelligence market size was valued at the US $39.9 billion in 2019 and is expected to grow at a compound annual growth rate (‘CAGR’) of 42.2% from 2020 to 2027. The continuous research and innovation directed by the tech giants are driving the adoption of advanced technologies in industry verticals, such as automotive, healthcare, retail, finance, and manufacturing.”

The Googles and Amazons of the world are already locked in a battle of who can utilize disruptive tech like A.I. to the fullest extent of their business models, which can only boost the space even further.

Integral to the long-term ROBT thesis is that demand for robotics aside from industrial robots, such as those working in warehouses, is booming.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.