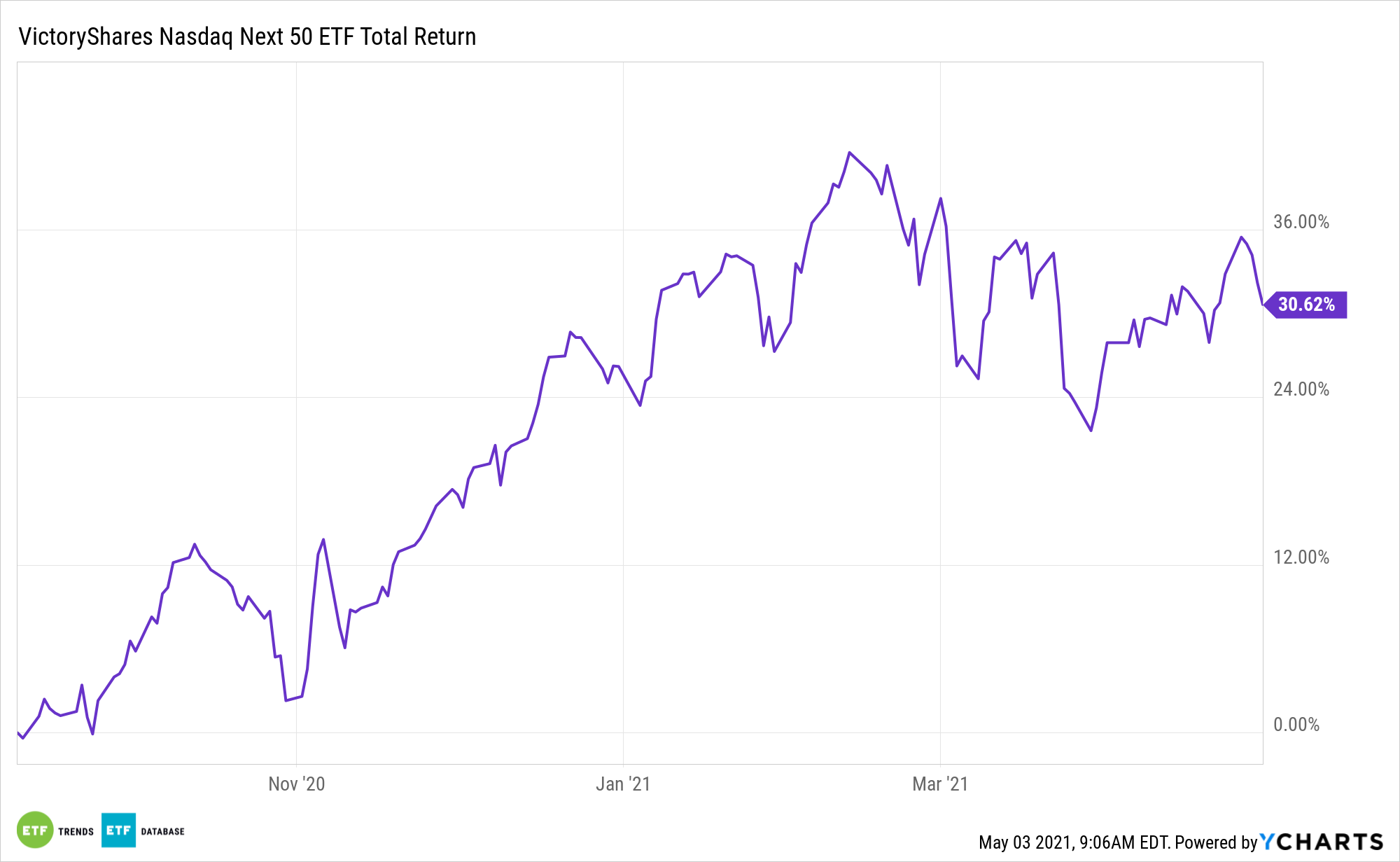

Owing to the longer duration cash flows of many growth companies, growth stocks are often viewed as vulnerable rising interest rates. Nevertheless, the VictoryShares Nasdaq Next 50 ETF (QQQN) is higher year-to-date.

That could be a sign that growth’s inverse relationship with Treasury yields is overstated. It could also be a sign that investors shouldn’t sleep on QQQN, one of 2020’s most successful new exchange traded funds.

“Good news: history suggests that small-cap growth investors need not be so anxious in the face of rising rates. In fact, it appears that smaller, fast-moving companies may actually be able to press their advantages, further improving the likelihood of outperformance should we enter a prolonged rising-rate environment,” notes Victory Capital’s Brian Jacobs.

The mention of small cap growth is relevant as it pertains to QQQN because that asset class can be an entryway to QQQN’s index, which is chock full of mid cap growth and smaller large cap growth fare.

A Promising Newcomer

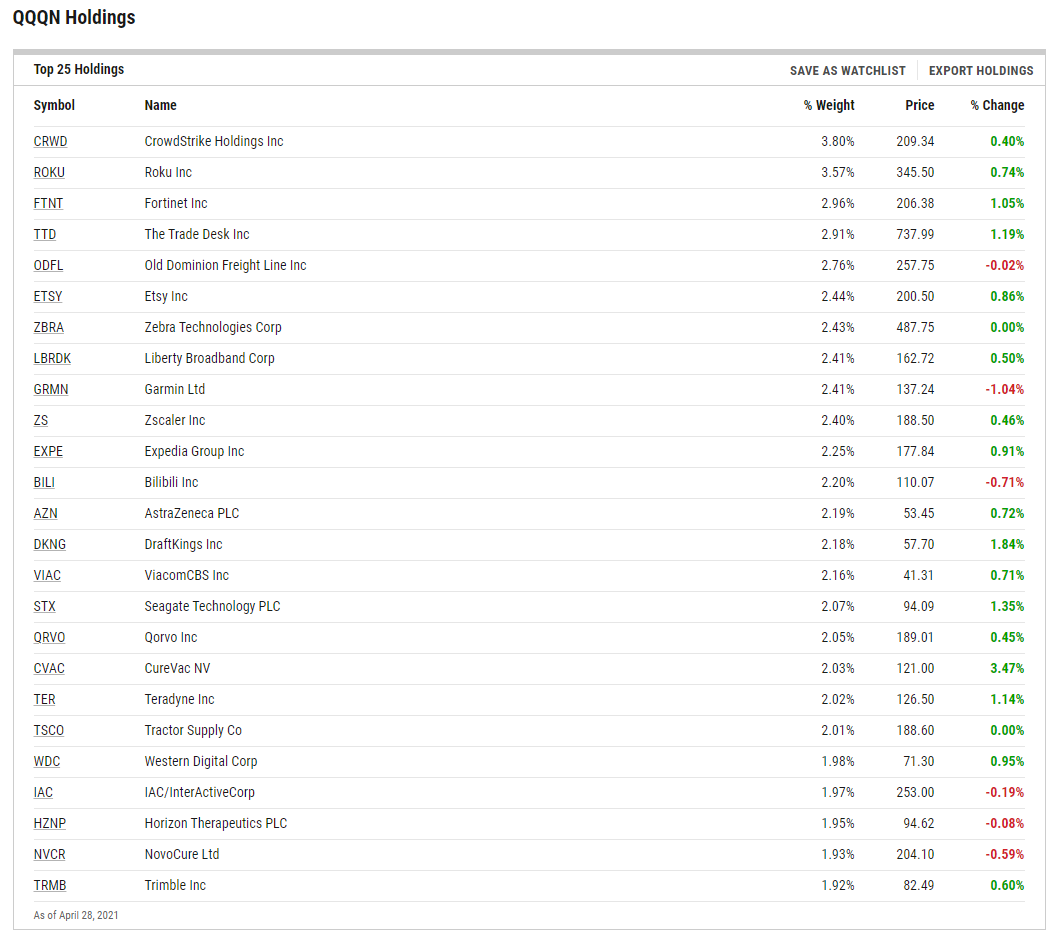

The VictoryShares ETF seeks to provide investment results that track the performance of the Nasdaq Q-50 Index before fees and expenses. The fund aims to achieve its investment objective by investing at least 80% of its assets in securities in the index. The index comprises the 50 largest non-financial domestic and international companies listed on the Nasdaq Stock Market based on market capitalization after excluding the companies included in the Nasdaq-100 Index.

Translation: QQQN’s roughly 50 components are the names most likely to be the next additions to the widely followed Nasdaq-100 Index.

Adding to the case for more QQQN upside is a favorable historical precedent for growth experienced in tandem with rising rates.

“After looking back at various periods of rising interest rates over the past 25 years, our thesis was confirmed by the strong absolute performance for the growth stock asset class, and the especially strong relative performance of smaller growth-oriented stocks versus their value-oriented counterparts,” adds Jacobs. “Although we acknowledge that a rising rate environment—thanks mostly to improving economic conditions—can provide a tailwind to all types equities, the outperformance of growth and small growth investing styles during these periods is evidenced.”

QQQN turned a year old last week and has $143.65 million in assets under management.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.