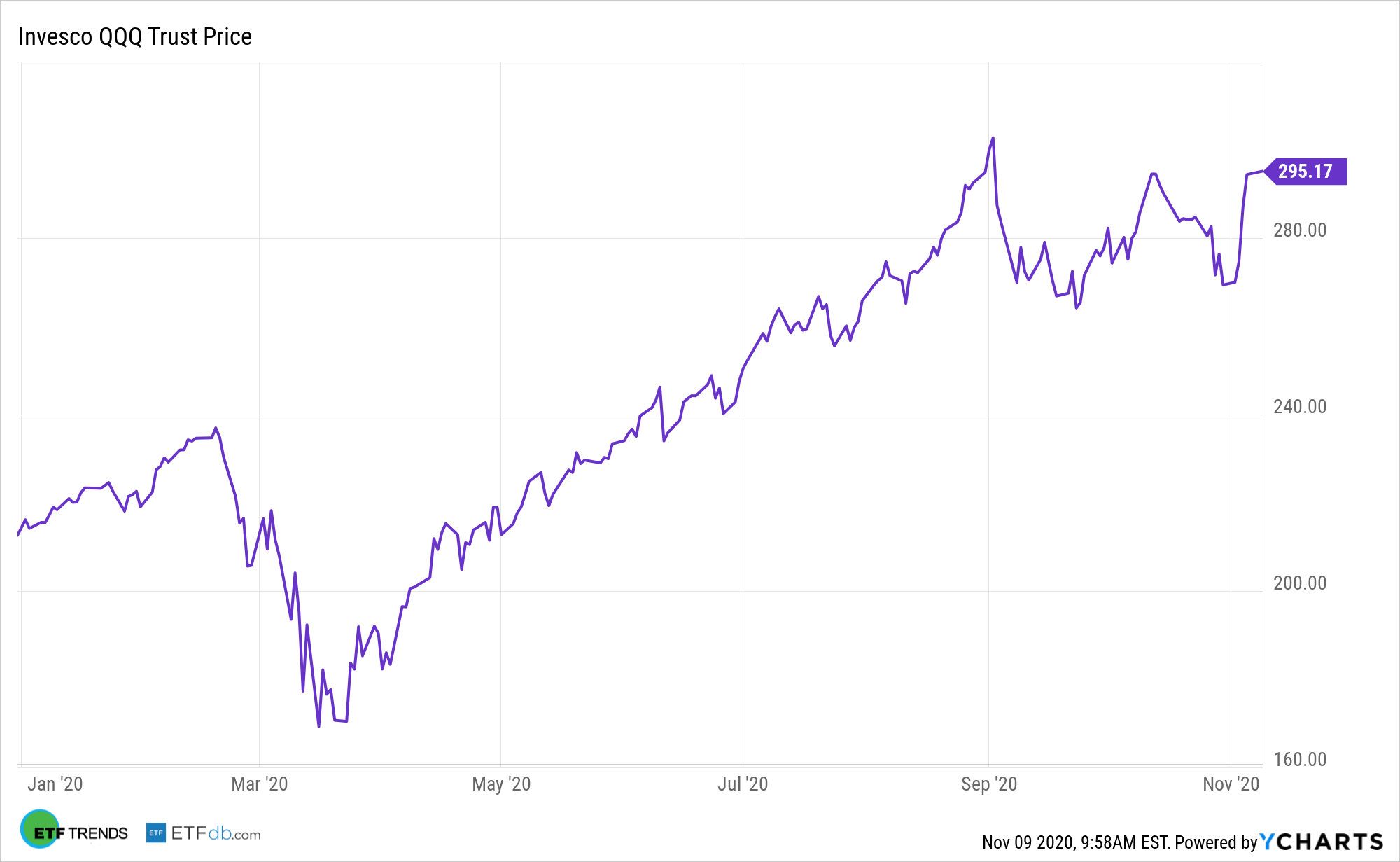

The Invesco QQQ Trust (NASDAQ: QQQ), which tracks the Nasdaq-100 Index, is one of the largest, most widely followed exchange traded funds.

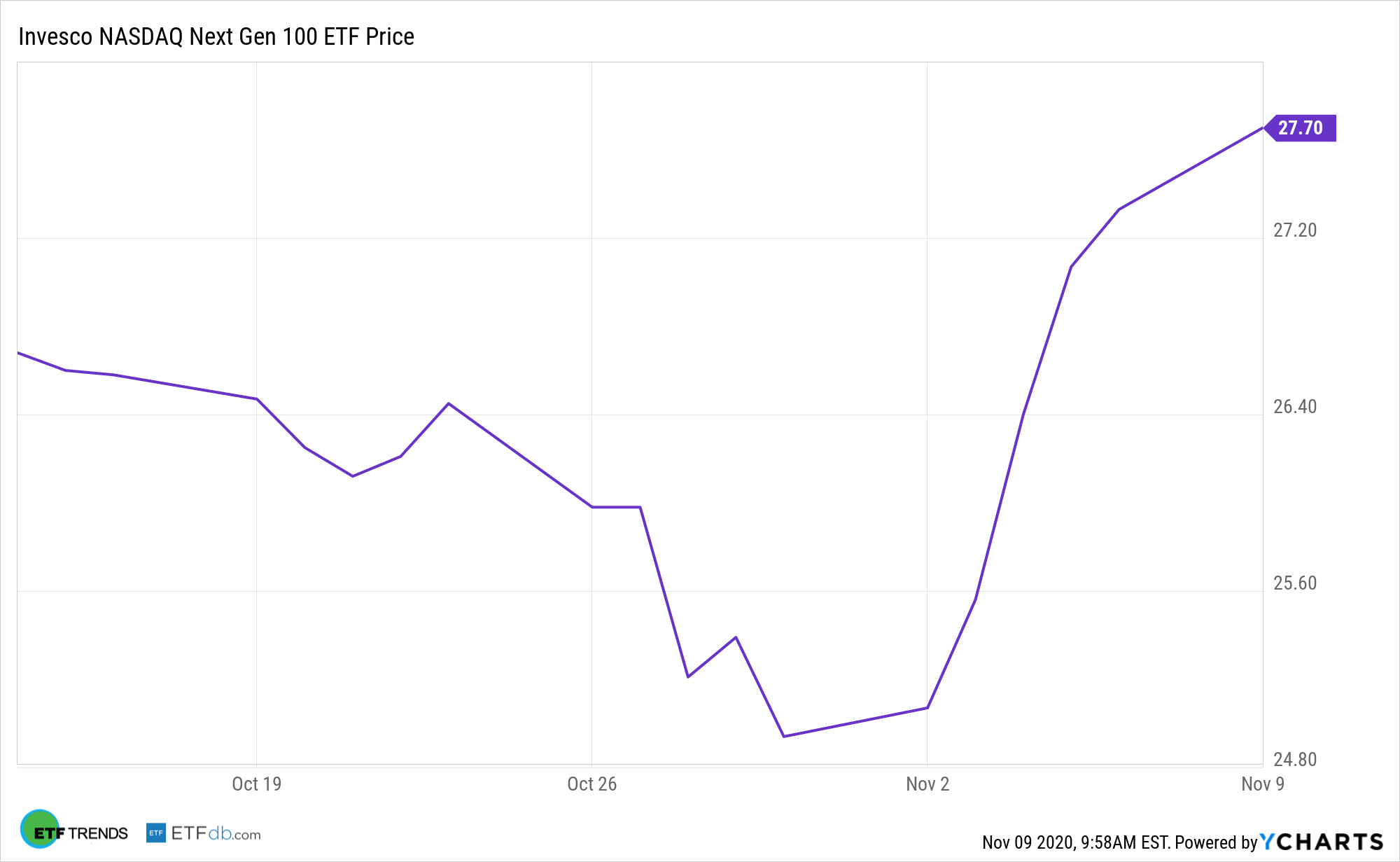

With traits like that, it’s reasonable to expect sequels to QQQ will appear and some recently have, including the Invesco NASDAQ Next Gen 100 ETF (QQQJ). QQQJ, which is almost a month old, extends this concept further by offering access to the “next 100” non-financial companies listed on the Nasdaq, outside of the NASDAQ-100 Index, offering a mid-cap alternative to the NASDAQ-100.

In other words, QQQJ is where stocks go to grow up and get ready for possible entry into the large/mega-cap QQQ.

“For its part, QQQJ is finding swift success. At less than a month old, it has nearly $136 million in assets under management, making it one of the stars of this year’s crop of new equity-based ETFs while confirming the cache of being related to QQQ,” according to Nasdaq.

The QQQJ: A Mid-Cap Alternative

Investing mid-caps has plenty of advantages and QQQJ, which is in the mid-cap spectrum, highlights some of those perks.

“The NASDAQ Next Generation 100 Index, QQQJ’s underlying benchmark, is a new index, having debuted in August and while backtesting isn’t always flawless, it does turn up some positives in the case of index,” notes Nasdaq. “Backtesting QQQJ’s index to Dec. 17, 2010 through Sept. 30, 2020 indicates returns of 271 percent compared to 209 percent for the Russell Mid Cap Growth Index and 106 percent for the S&P MidCap 400 Index, respectively.”

Mid-cap companies are slightly more diversified than their small-cap peers, which allows many mid-sized companies to generate more consistent revenue and cash flow, along with providing more stable stock prices. Additionally, they are not so big that their size would slow down growth. Increased mergers and acquisitions activity could be just what mid-caps need to catch up to large- and small-cap stocks.

QQQJ components exhibit robust innovation and growth fueled by consistent and substantial investment in R&D. Additionally, the Invesco NASDAQ Next Gen 100 ETF tracks profitable growing companies with strong fundamentals, with revenue and dividend growth rates that surpass that of the S&P 400 and Russell Mid-Cap Growth indices.

“Patent exposure metrics better than midcap benchmarks as well, with 38% of index constituents registering patent activity in one or more Disruptive Tech sub-themes over a recent 12-month period,” according to Nasdaq Research. “Not only are NGX constituents more likely to file patents than midcap benchmark peers, they also tend to file them in more areas of innovation, on average 3.7 sub-themes per active company.”

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.