Semiconductor stocks are spending considerable time in the limelight this year, thanks in part to global supply shortages.

Nevertheless, assets like the First Trust Nasdaq Semiconductor ETF (FTXL) can still be a pivotal part of technology-oriented portfolios, particularly as the global economy emerges from the coronavirus pandemic.

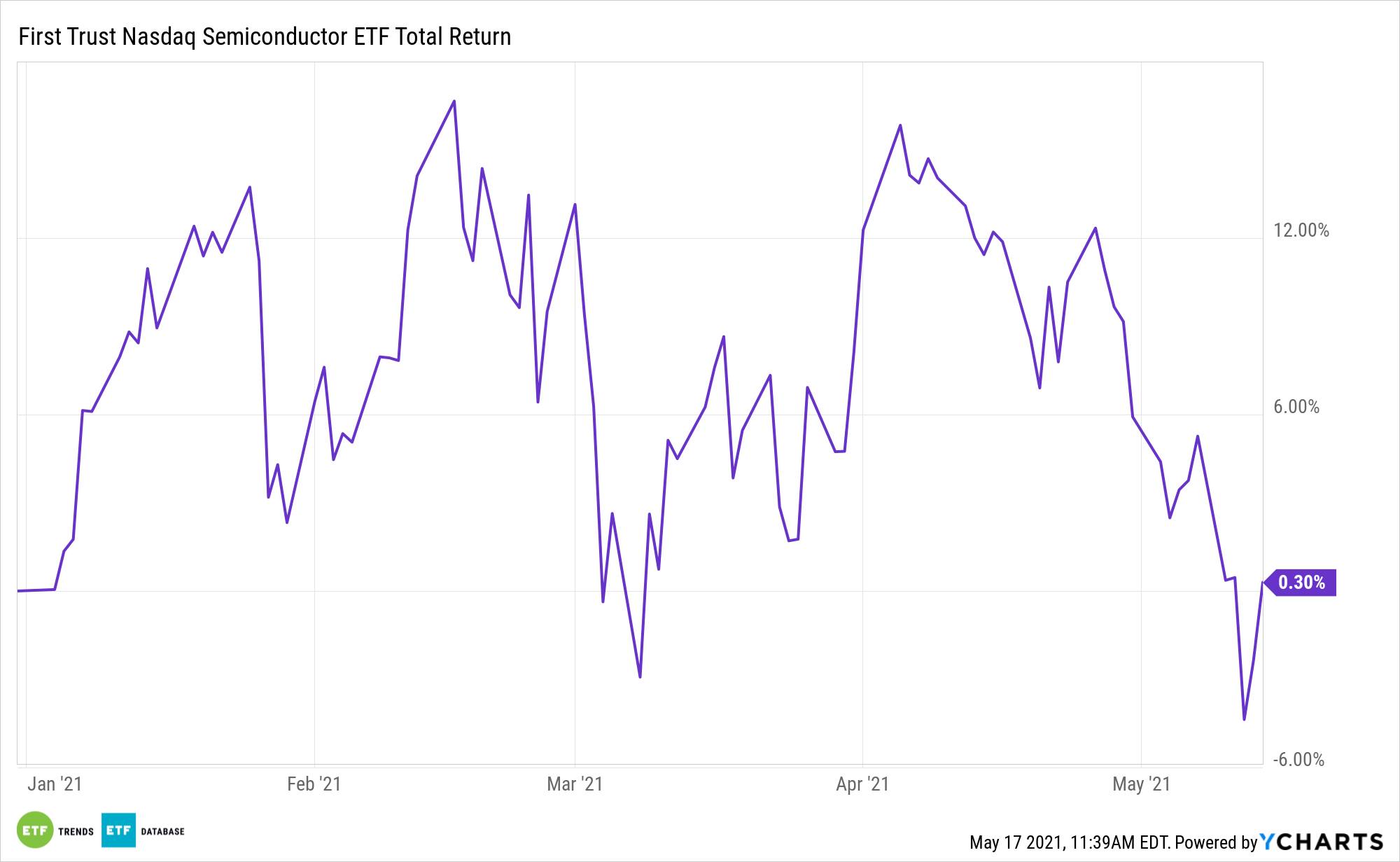

FTXL hovers around 2.37% year-to-date, but the First Trust ETF could be a rebound candidate due to long-ranging factors that were in place prior to the pandemic – essentially all of which will remain after the virus is vanquished.

“Semiconductor firms have been riding a wave of increasing demand for their products, which power an ever wider array of devices thanks to the rise of Cloud Computing and the Internet of Things (IoT),” notes Mark Marex, Nasdaq senior product development specialist. “As more devices connect to the cloud, there will continue to be a need for ever smaller and more powerful computer chips and processors. Continuous advances in mobile phones, gaming and media entertainment, cryptocurrency, and new machinery such as drones, robots, and autonomous vehicles will drive further innovation in this competitive field.”

Not Any Old Thematic Play

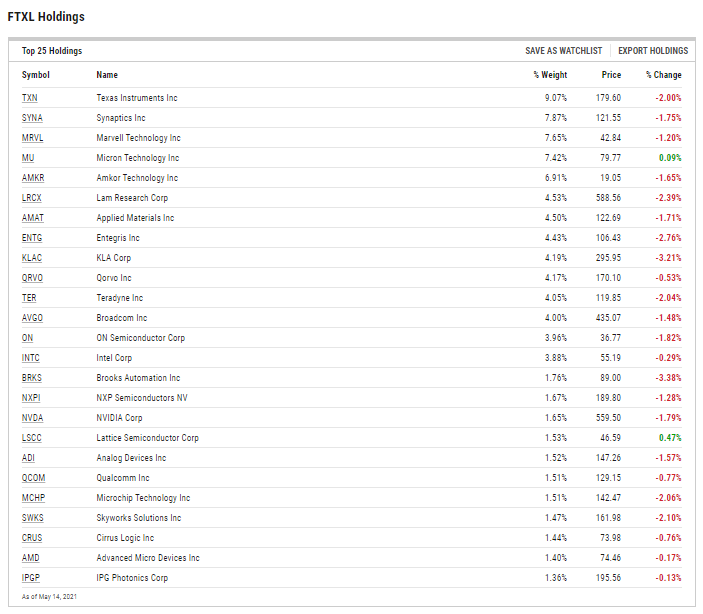

FTXL turns five years old in September and holds 30 stocks. The ETF isn’t a traditional cap-weighted fund, helping it stand out in a crowded field of chip funds that use that methodology.

Rather, FTXL, which tracks the Nasdaq US Smart Semiconductor Index, takes growth, value, and volatility principles into account. Components are weighted based on combined scores of those three investment factors. That unique methodology could better-position FTXL to capitalize on expected revenue growth in the semiconductor industry. That growth is slated to come from several different sources.

“The supportive trends in place prior to Covid-19 have only accelerated with the pandemic spurring widespread work-from-home, learn-at-home, and play-at-home,” adds Marex. “Per Gartner, worldwide PC shipments reached 275 million units in 2020 and saw the highest growth in ten years. Tablet sales grew nearly 20% year-over-year, with more than 52 million shipments in the fourth quarter alone – a new record.2 Sales of gaming consoles are on track to hit fresh records in 2021 after exceeding 50 million shipments for the first time in 2020.”

For investors wanting thematic exposure, FTXL stands as a backdoor play on the concept.

“With the rise in popularity of various thematic tech indexes and tracking products, it is worth considering just how central semiconductors are to the many products and services that comprise the modern landscape of thematic technology,” concludes Marex.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.