When it comes to investment choices, investors can play offense, defense and even neutral market strategies.

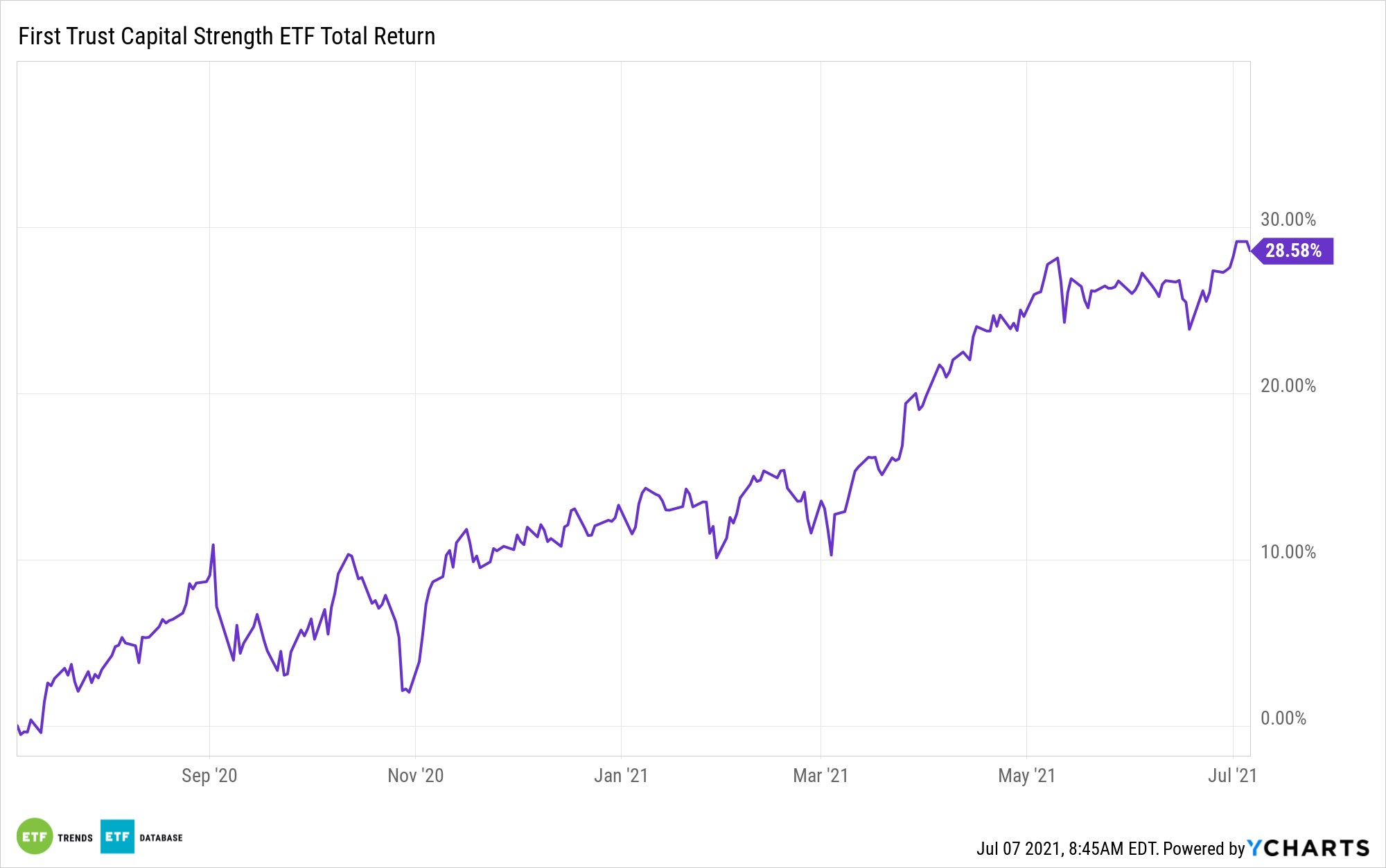

Rare are the strategies that allow investors to establish offensive and defensive postures under a single, efficient umbrella. The First Trust Capital Strength ETF (FTCS) affords investors that luxury, owing to its links to the Capital Strength Index (NQCAPST). Interestingly, FTCS and its underlying index may provide a superior alternative to both offense and conservative positioning relative to traditional multi-factor strategies.

“The index methodology that NQCAPST employs is not limited to any single style, such as value or growth, so it has the capacity to allocate to growth, a traditional offensive style, so long as the components meet the selection criteria, which is based on profitability, leverage, and cash reserves,” writes Ben Jones, Nasdaq senior index strategist.

The Method behind the Fund

The $8.17 billion FTCS holds 50 stocks, none of which exceed weights of 2.28% (as of June 2), confirming single stock risk is minimal in the fund. That’s one benefit. So is the fund’s ability to marry defense and growth – an alluring combination, but one that’s more easily discussed than realized.

“The high-quality and low-volatility screening process has achieved better risk-adjusted returns than the broader market, experienced less participation to the downside during significant market corrections, and ultimately served as a defensive-growth complement to more traditional equity strategies,” adds Nasdaq’s Jones.

At the sector level, FTCS has a defensive feel as healthcare and consumer staples names combine for 36% of the fund’s weight. However, that’s augmented by a deeply cyclical feel with industrial, consumer discretionary, and financial services stocks combining for approximately 60% of the portfolio. That’s the lineup for now, as the Capital Strength Index is designed to be style- and sector-agnostic.

“The index methodology that NQCAPST employs is not limited to any single style, such as value or growth, so it has the capacity to allocate to growth, a traditional offensive style, so long as the components meet the selection criteria, which is based on profitability, leverage, and cash reserves,” continues Jones.

Adding to the ETF’s dual threat capabilities is the fact that the fund in both the short- and long-terms. Remembering that companies with weak balance sheets are usually the first to be punished in market downturns and that quality equities are currently inexpensive, the fund’s cash requirement (at least $1 billion) and debt-to-equity and return on equity of less than 30% and above 15% are appealing traits today and over the long haul.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.