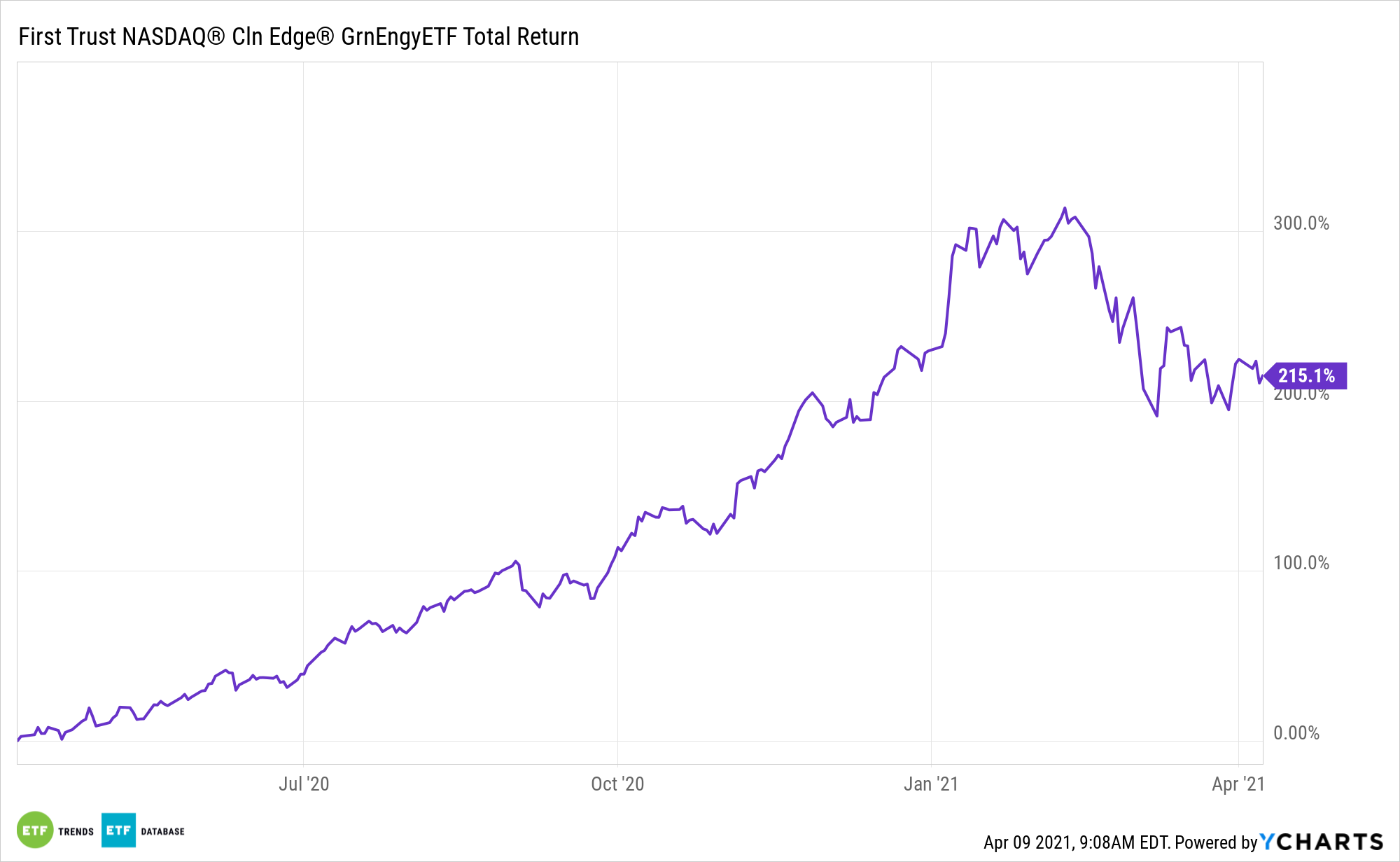

If there’s one corner of financial markets the Biden Administration is stoking enthusiasm for, it’s clean energy. That’s to the benefit of exchange traded funds like the First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN).

QCLN seeks investment results that correspond generally to an equity index called the NASDAQ® Clean Edge® Green Energy Index. The index is designed to track the performance of small-, mid-, and large-capitalization clean energy companies that are publicly traded in the United States.

In fact, QCLN’s underlying index is a secret to the fund’s success and its methodology is highly relevant to investors seeking clean energy exposure today.

“Investors’ interests for clean-energy stocks are clearly firing up. Is there any way to invest in the clean-energy economy as a whole? Nasdaq offers a solution — the Nasdaq Clean Edge Green Energy Index (CELS),” according to Nasdaq research. “The Nasdaq Clean Edge Green Energy Index (CELS) is designed to track the performance of companies that are manufacturers, developers, distributors, and/or installers of clean-energy technologies. It returned an exceptional 185% in 2020, which easily beats any of the 35 years in the Nasdaq-100’s illustrious history.”

The Right Benchmark at the Right Time

QCLN’s is backstopped by impressive top and bottom line growth thanks to its benchmark.

“The CELS Index’s total sales are expected to grow from $90 billion at the end of January 2021 to $174 billion in 2023, an average of 25% growth per year. CELS Index’s earning growth is more extraordinary: it is projected to grow from $1.7 billion in Jan. 2021 to $17 billion in 2023, an average of 117% growth per year,” according to Nasdaq.

Adding to the near-term case for QCLN is that the Biden Administration may be starting to feel the heat when it comes to living up to renewable energy promises. That could be supportive of a stellar profitability outlook for CELS components.

“Profitability, as measured by Net Income divided by Revenue, will also improve over time to more than 10% in 2023. This will make clean energy, as a sector, more attractive than the S&P 500, which has a current trailing 12 months net profit margin of 7.2%,” continues Nasdaq.

The index is looking potent either way.

“Based on the FactSet analysts’ estimate consensus, the overall CELS index aggregated earnings will not only grow exponentially, the majority of companies in the clean-energy industry, as represented by the CELS index universe, are expected to be profitable in three years,” concludes Nasdaq.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.