Today’s low-yield world requires income investors to get creative, as many fixed income strategies simply aren’t delivering the goods. Fortunately, the world of exchange traded funds offers plenty of credible solutions, including the Strategy Shares Nasdaq 7 Handl Index ETF (HNDL).

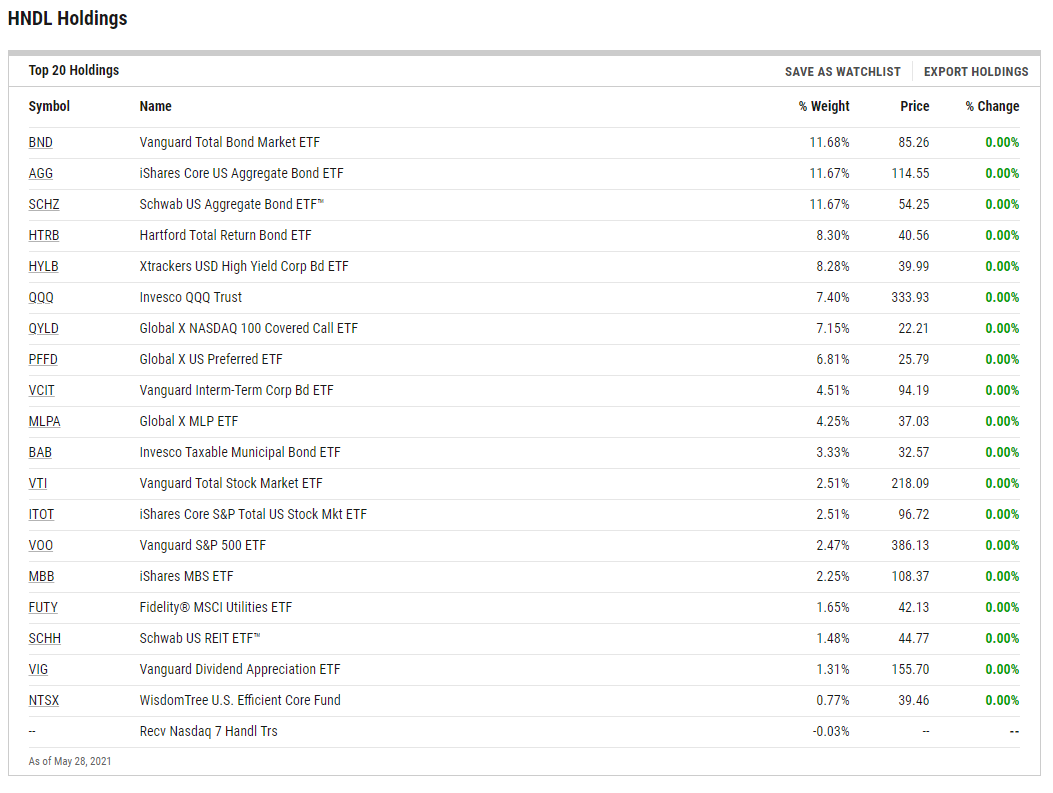

The $563.21 million HNDL follows the NASDAQ 7 HANDL™ Index, which is something of a refreshed spin on the old 60/40 portfolio split. That benchmark is half allocated to a “core portfolio,” which is comprised of equity and fixed income assets, while the other 50% is dedicated to the “Dorsey Wright Explore Portfolio.” That sleeve contains stocks, bonds, and alternative assets.

The fund is building a reputation as an effective one-stop shop for income seekers. That efficacy comes by way of HNDL being an ETF of ETFs.

Data confirm yield hunters are warming the HNDL story. In mid-December 2020, the ETF crossed the $100 million in assets under management mark. In other words, HNDL’s assets tally has surged more than five-fold in less than six months.

HNDL’s Secret Sauce

“The Nasdaq 7HANDL ETF has adopted a policy to pay monthly distributions on Fund shares at a target rate that represents an annualized payout of approximately 7.0% on the Fund’s per-share net asset value on the date of a distribution’s declaration,” according to Strategy Shares.

In any environment, let alone today’s climate, a 7% yield is impressive. What drives the ETF’s attractive income stream?

HNDL’s top 10 holdings, which combine for over 41% of the fund’s weight, are a diversified mix of bonds, equities, and alternative income-generating strategies, including covered calls, master limited partnerships (MLPs), and preferred stocks.

See also: MLP Momentum Is Building, Sparking a Turnaround for ‘AMLP’

Fixed income exposure in the top 10 roster includes broad market bond funds, taxable munis, and high-yield corporate debt. The fund’s top 10 equity exposure spans the gamut of boring (a utilities ETF) to exciting growth prospects via the Invesco QQQ Trust (QQQ).

HNDL devotes 12% of its weight to a covered call fund and a preferred stock ETF. That’s compelling in this environment because preferred stocks are in style when interest rates are low. Meanwhile, covered calls carry little to no rate risk.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.