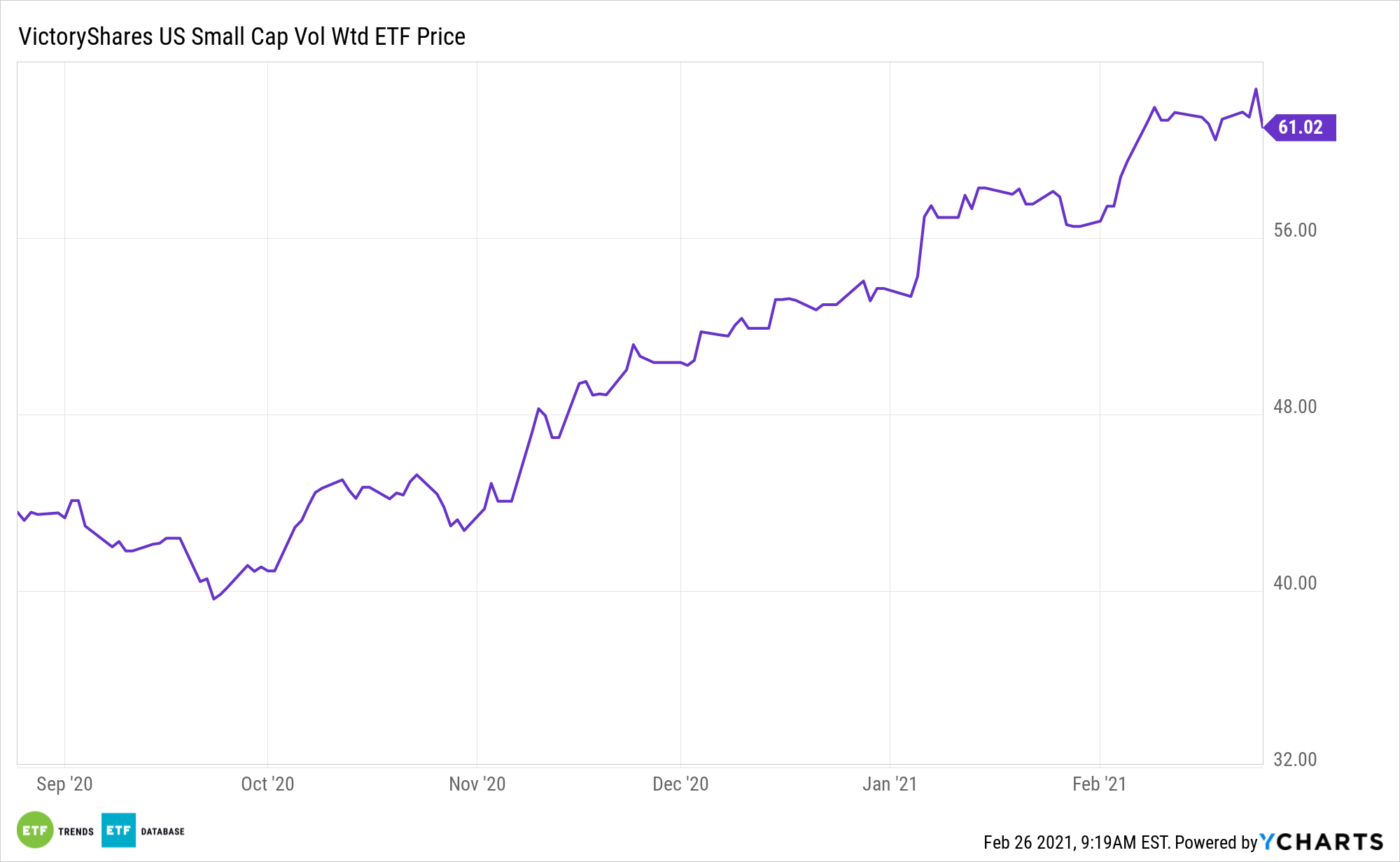

Plenty of investors love the growth opportunities associated with small cap stocks. Conversely, most dislike the volatility historically associated with the size factor. The VictoryShares US Small Cap Volatility Weighted ETF (Nasdaq GM: CSA) offers a best of both worlds approach.

CSA seeks to provide investment results that track the performance of the Nasdaq Victory US Small Cap 500 Volatility Weighted Index, which is an unmanaged, volatility weighted index. The index identifies the 500 largest, profitable U.S. companies with market capitalizations of less than $3 billion measured at the time the index’s constituent securities are determined.

The ETF offers a better approach than many of the most widely followed small cap benchmarks. In fact, the VictoryShares fund can be seen as a higher quality alternative to Russell 2000 Index funds.

One of the highlights of small cap equity investing is the ability to capitalize on value-added growth companies that can provide room for more future gains. On the opposite end of the spectrum, large cap equities like big tech stocks may have already reached their peaks.

Small Caps vs. Large Caps

CSA is worth a look as the economy rebounds from the ill effects of the COVID-19 pandemic. While investors may flock to the relative safety of large cap equities during a recession to lessen the blow of market volatility and provide a cushion during market downturn, small cap performance is worth watching as the economy exits a recession. As such, investors may want to give small cap equity funds a look now to make a factor-oriented play.

Small cap stocks have been gaining momentum, outperforming their large cap counterparts in recent months, as investors look for opportunities outside of high-flying large cap growth names. They may still be a good ‘value play’, with a price-to-book ratio well below their large cap peers.

Small caps, including some CSA components, sport recent relative strength compared to large caps, attractive valuations, strong fund flows, and diversity in sector exposure as compared to the large cap segment.

The size factor is one of the most durable themes in the factor space, but many investors often overlook the benefits of focusing on higher-quality, small cap equities. While growth prospects remain compelling with smaller stocks, evidence suggests there’s waning quality in the group, potentially exposing investors to undue risk.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.