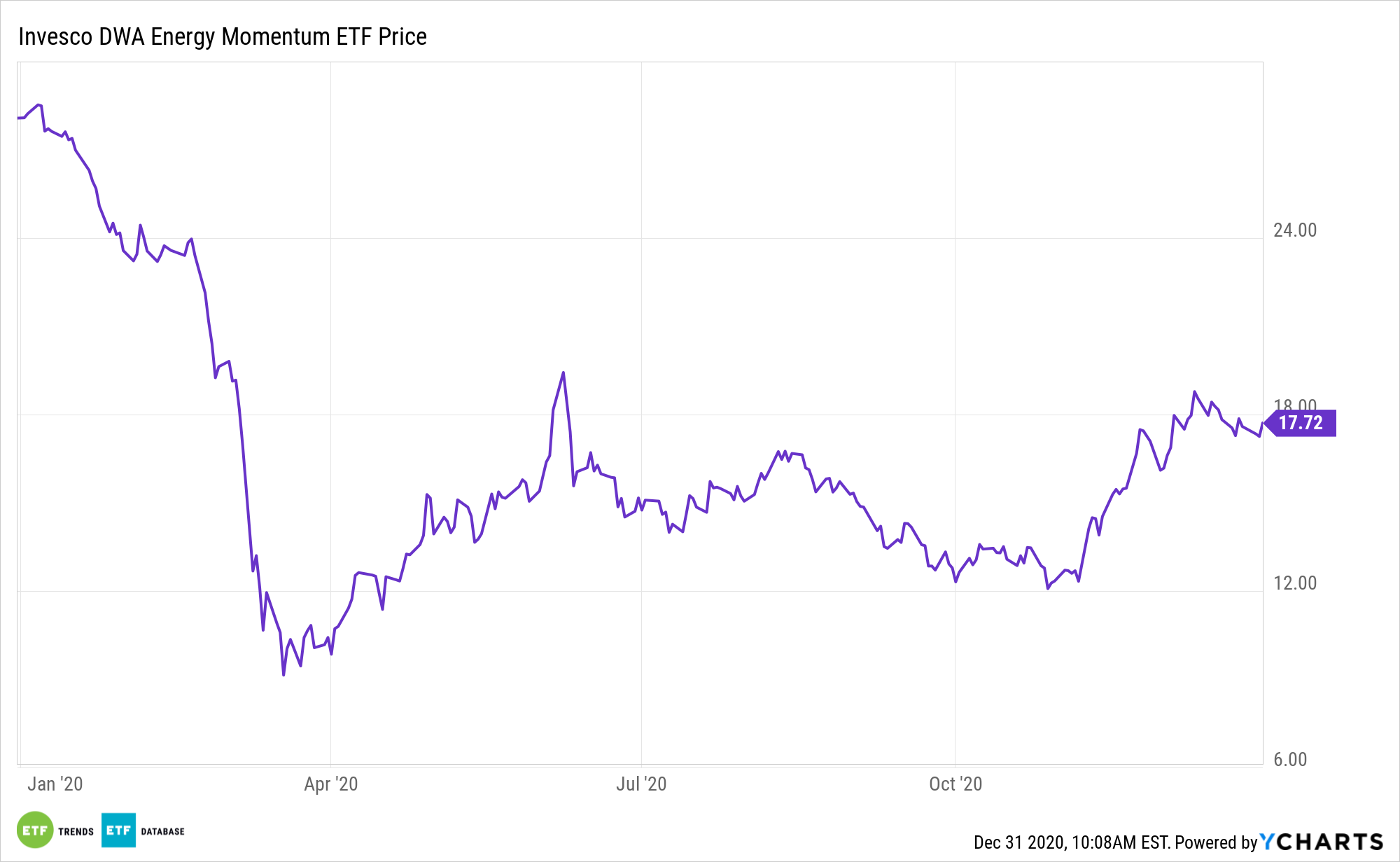

The energy sector was the worst-performing group in the S&P 500 in 2020, but it did end the year on a a decent note. For example, the S&P 500 Energy Index is higher by almost 4% this month.

Impressive to be sure, but that’s a far cry from the 10% returned by the Invesco DWA Energy Momentum Portfolio ETF (PXI) in December.

PXI follows the Dorsey Wright Energy Technical Leaders Index, a benchmark rooted in Dorsey Wright’s famed relative strength methodology.

“The Index is designed to identify companies that are showing relative strength (momentum) and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe,” according to Invesco.

PXI’s momentum-based strategy could serve investors well as energy stocks perk up entering the new year.

Energy, PXI Pertinent in 2021

“A bullish technical signal was being given by the S&P 500 energy sector on Wednesday, when the 50-day moving average for the industry index rose above the 200-day moving average, forming what chartists label a golden cross,” reports Reuters.

Oil bulls appear ready to charge following the latest price weakness in the commodity. This all bodes well for oil investors—long-term holders and short-term traders alike. Interestingly, energy recovery is perhaps more impressive than it’s being given credit for.

Buoyed by factors such as coronavirus vaccine progress, rebounding oil prices, and a rotation into value stocks, PXI is on a scintillating pace, surging 35% in the fourth quarter.

Energy’s fourth-quarter resurgence is widely attributable to success on the coronavirus vaccine front. The faster a vaccine comes to market, the more rapidly demand will increase as industry ramps up and Americans unleash pent-up travel demand.

Adding to the case for PXI in 2021, the incoming Biden Administration is expected to take a softer approach to dealing with China, which is viewed as a plus for natural resources stocks because China could up imports of US-produced commodities as relations between the world’s two largest economies improve.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.