Low interest rates and jittery equity markets combine to highlight the allure of high dividend and low volatility exchange trade funds. Some ETFs, including the VictoryShares US Large Cap High Div Volatility Wtd ETF (NasdaqGM: CDL), marry those concepts.

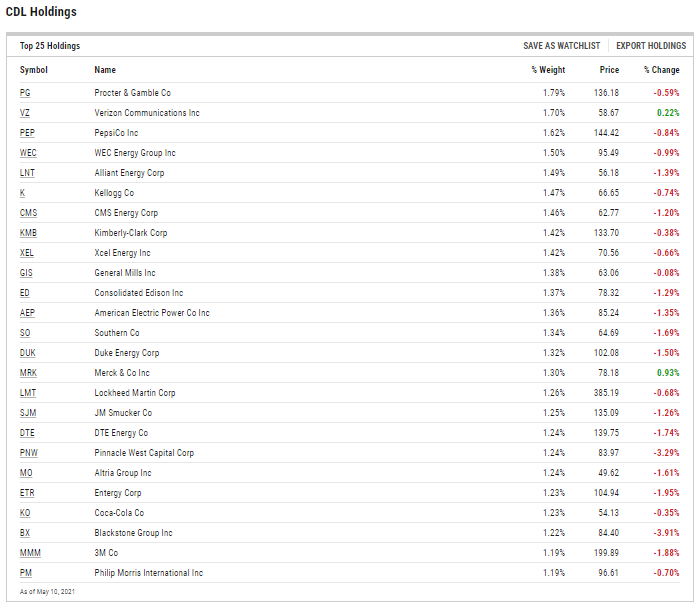

CDL tracks the highest 100 dividend-yielding stocks of the CEMP U.S. Large Cap 500 Volatility Weighted Index with four quarters of positive earnings weighted based on their daily standard deviation, or volatility.

However, CDL isn’t the standard low volatility fund. Nor is it a traditional high dividend strategy. For example, components in its underlying index must have four straight quarters of positive earnings, indicating the fund adds elements of quality and dividend growth potential. CDL’s payout growth prospects are something for investors to mull over in this environment.

“Michael Fredericks, Head of Income Investing for BlackRock’s Multi-Asset Strategies and Solutions team, shares his equity counterpart’s affinity for dividend stocks, and sees a particular opportunity after the valuations of high-dividend stocks were beaten down last year,” according to BlackRock. “He cites the potential for company dividends to grow across time as a benefit versus bond coupons, which are very low and fixed to maturity.”

‘CDL’ as a Bond Alternative

With a dividend yield of 2.81% and reduced volatility, CDL makes for a credible fixed income alternative, particular for younger investors that don’t need large bond weights in their portfolios.

“Fredericks cites the acceleration in economic growth as another reason to question the role of traditional bonds in a portfolio, as rising bond yields mean falling bond prices. He is cautious on investment grade bonds, mortgages and the quality parts of fixed income that make up the Bloomberg-Barclays Aggregate Bond Index,” notes BlackRock.

CDL is also positioned as a rising rates play because it allocates 22% of its roster to financial services stocks – its second-largest sector weight.

That exposure is meaningful because it offsets the fund’s more than 44% combined weight to defensive utilities and consumer staples names – two of the weaker S&P 500 sectors this year.

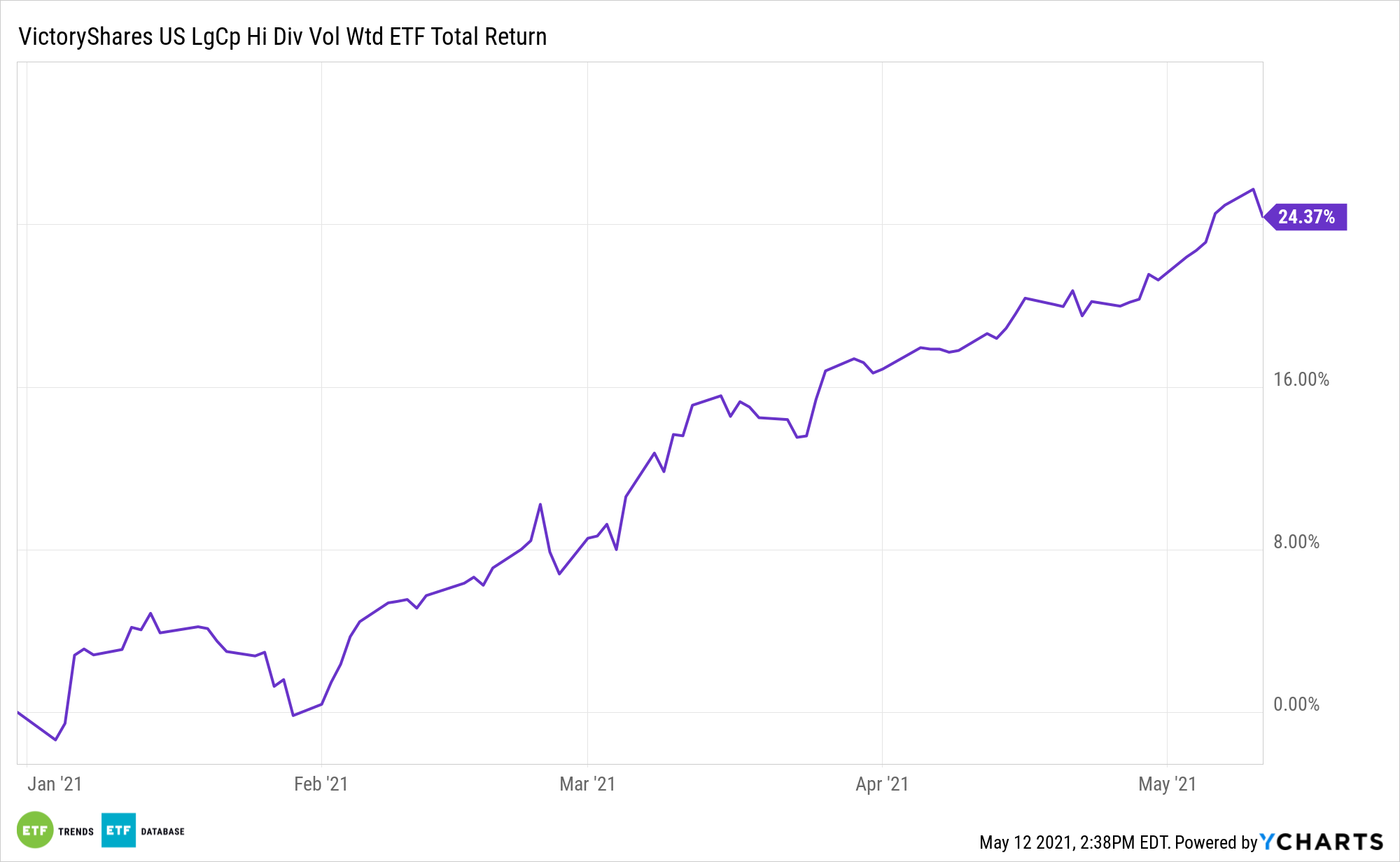

Even with that, CDL is up 24.54% year-to-date, easily topping the S&P 500 Low Volatility Index, while beating some high dividend benchmarks as well.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.