The Nasdaq-100 Index (NDX) is known for being a growth benchmark, one that boasts a lengthy track record of topping the S&P 500.

Yet i’s not known for being a premier income destination. Today, NDX yields just 0.52%, and that’s despite years of the technology sector being a prime spot for dividend growth. There are, however, income-based strategies linked to NDX, but those products, usually exchange traded funds, typically force investors to take income with little in the way of price appreciation.

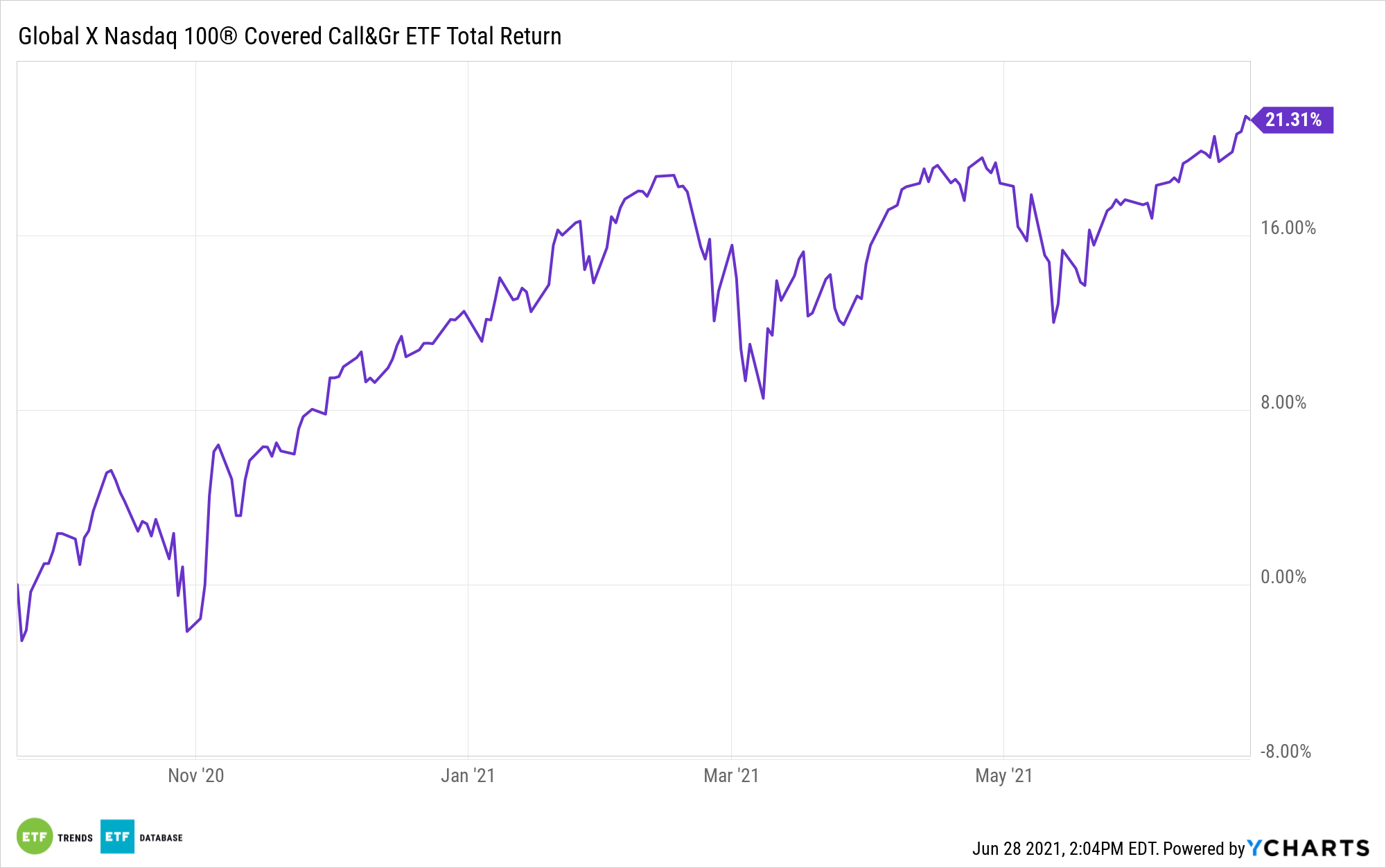

The Global X Nasdaq 100 Covered Call & Growth ETF (QYLG) splits the difference. QYLG, which debuted last September, tracks the CBOE Nasdaq-100 Half BuyWrite V2 Index. That may sound like a complex name for an index, but QYLG’s strategy is straightforward. The fund splits its investments between the Nasdaq 100 and covered calls.

“The Nasdaq 100 experienced strong returns over the past decade, largely due to its high-tech growth-oriented exposure,” said Global X analyst Rohan Reddy in a recent note. “Covered call strategies on the Nasdaq 100 are a powerful solution for investors to potentially generate income and monetize volatility amid choppy markets.”

A Practical Idea for Today’s Markets?

QYLG isn’t a fixed income product and its 0.14% 30-day SEC yield is modest, but the fund is actually a credible alternative to government bonds and pure equity exposure to NDX when interest rates rise. That’s an important point alone because as recent history proves, NDX is sensitive to rising rates.

“The 10-year treasury yield moved from 0.91% at the end of last year to 1.74% by the end of Q1,” adds Reddy. “The NDX exhibited an aversion to rising bond yields this year, with the NDX displaying a -0.28 correlation to 10-year Treasury yields in Q1. And no sector had a more negative correlation to the 10-year Treasury yield than Information Technology in Q1.”

Of course, it’s fair for investors to ponder QYLG’s upside prospects, particularly with its low yield. The fund is higher by almost 8% this year.

QYLG is beneficial in another way. NDX is historically more volatile than the S&P 500 and the Russell 1000. Options premiums inherent in the ETF can help mitigate potential volatility.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.