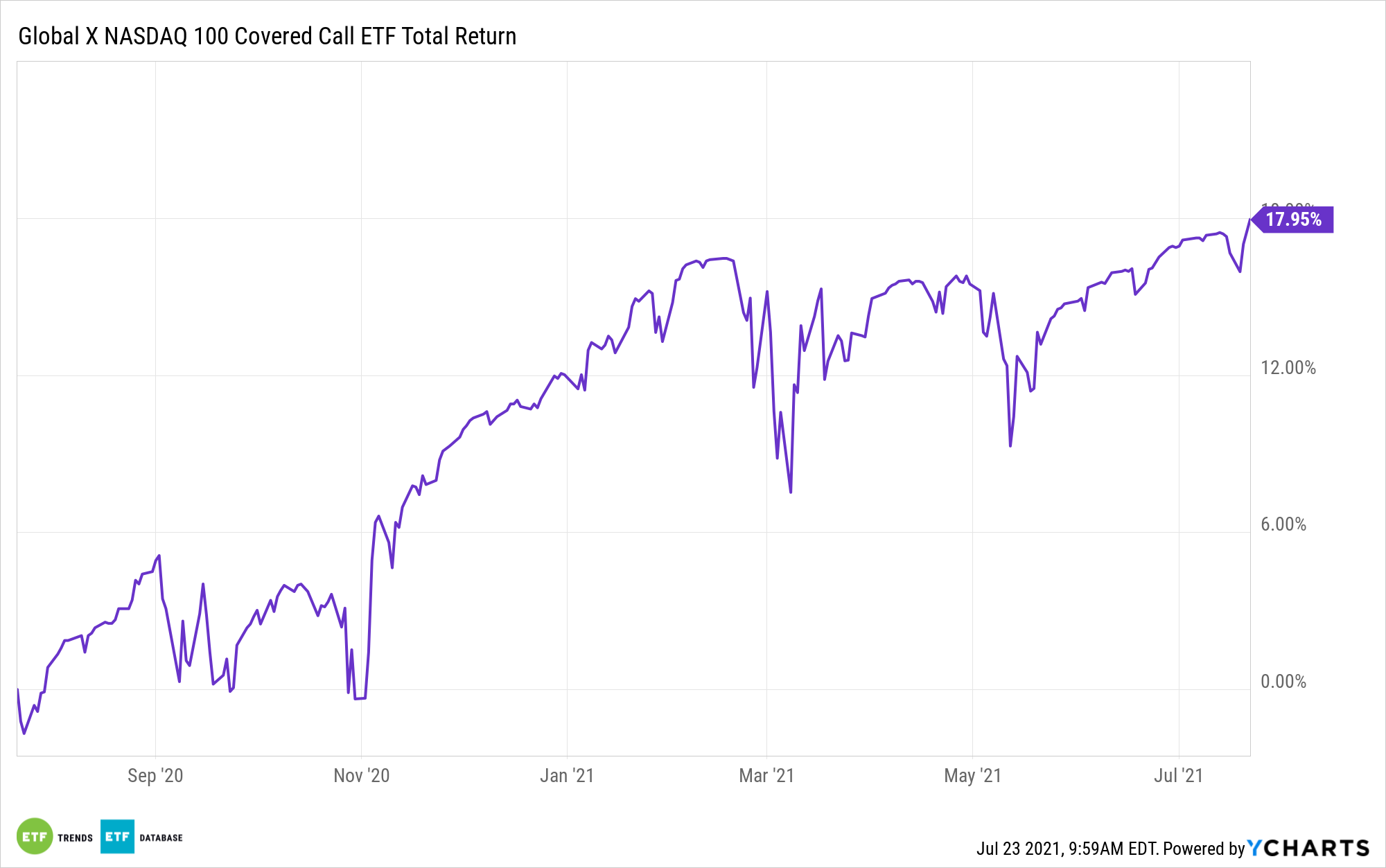

With market volatility showing signs of upside potential, options premiums will follow suit, potentially increasing the allure of strategies like the Global X Nasdaq 100 Covered Call ETF (QYLD) for income-starved investors.

QLYD follows the CBOE Nasdaq-100 BuyWrite V2 Index. The ETF is an exchange traded fund that offers covered call exposure to the popular Nasdaq-100 Index (NDX). With a yield of 12.06%, QYLD is an ideal income elixir in today’s low-yield climate. The fund also brings income to an asset investors don’t often associated with income as NDX currently yields 0.53%.

Covered call writing “is best suited for names the call seller has a neutral short-term view on, as a call sells the right to upside participation beyond the call strike for a fee,” said Bank of America analysts in a recent note.

The bank recently screened the Russell 1000 Index for favorable covered call ideas using the Aug. 20 expiration as the target data. Three of the ideas that came back, including Tesla (NASDAQ: TSLA), are NDX components.

QYLD: A Good Near- and Long-Term Idea

While Bank of America is recommending near-term covered call ideas and individual options strategies that come with expiration dates, investors don’t have to worry about that extra work with QYLD.

One of five covered call ETFs offered by Global X, QYLD is passively managed and delivers monthly income – something many basic dividend funds don’t do. That makes it an appealing alternative income idea for long-term investors.

As noted above, if market volatility creeps higher, options premiums are likely to follow suit, meaning QYLD could deliver an even higher level income until that situation corrects. However, even if that situation proves fleeting, the fund is still a credible idea, particularly if some summertime market lethargy sets in.

“While covered call strategies will underperform stocks in fast bull markets, they will still realize significant profits,” notes Bank of America. “Covered call strategies tend to outperform outright stock ownership in flat, down and slightly up markets.”

The $3.47 billion QYLD has been roughly over the past month. The fund charges 0.60% per year, or $60 on a $10,000 investment.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.