Experienced investors know the real estate sector is broad, encompassing a wide variety of different property types. They also know that real estate investment trusts (REITs) in one industry don’t necessarily perform in lockstep with counterparts the other groups.

While broad index and exchange traded funds often do the trick when it comes to diversified real estate exposure, investors may find more alluring opportunities by getting tactical. On that front, a prominent ETF idea to consider is the Pacer Benchmark Industrial Real Estate SCTR ETF (NYSEArca: INDS).

As its name implies, INDS is an ETF that focuses on industrial REITs, or warehouse landlords. That might sound like a boring corner of the REIT universe to allocate to. Yet warehouse REITs, thanks to strong demand from online retailers, are almost as hot as the residential real estate market.

“The competition is driving up industrial rents as retailers and logistics providers race to move goods closer to population centers, with some engaging in bidding wars for the most coveted sites. Businesses are pushing to deliver online orders faster to the homes of digital shoppers and responding to growing consumer spending that is helping drive an economic rebound,” reports Jennifer Smith for the Wall Street Journal.

Proof in the INDS Pudding

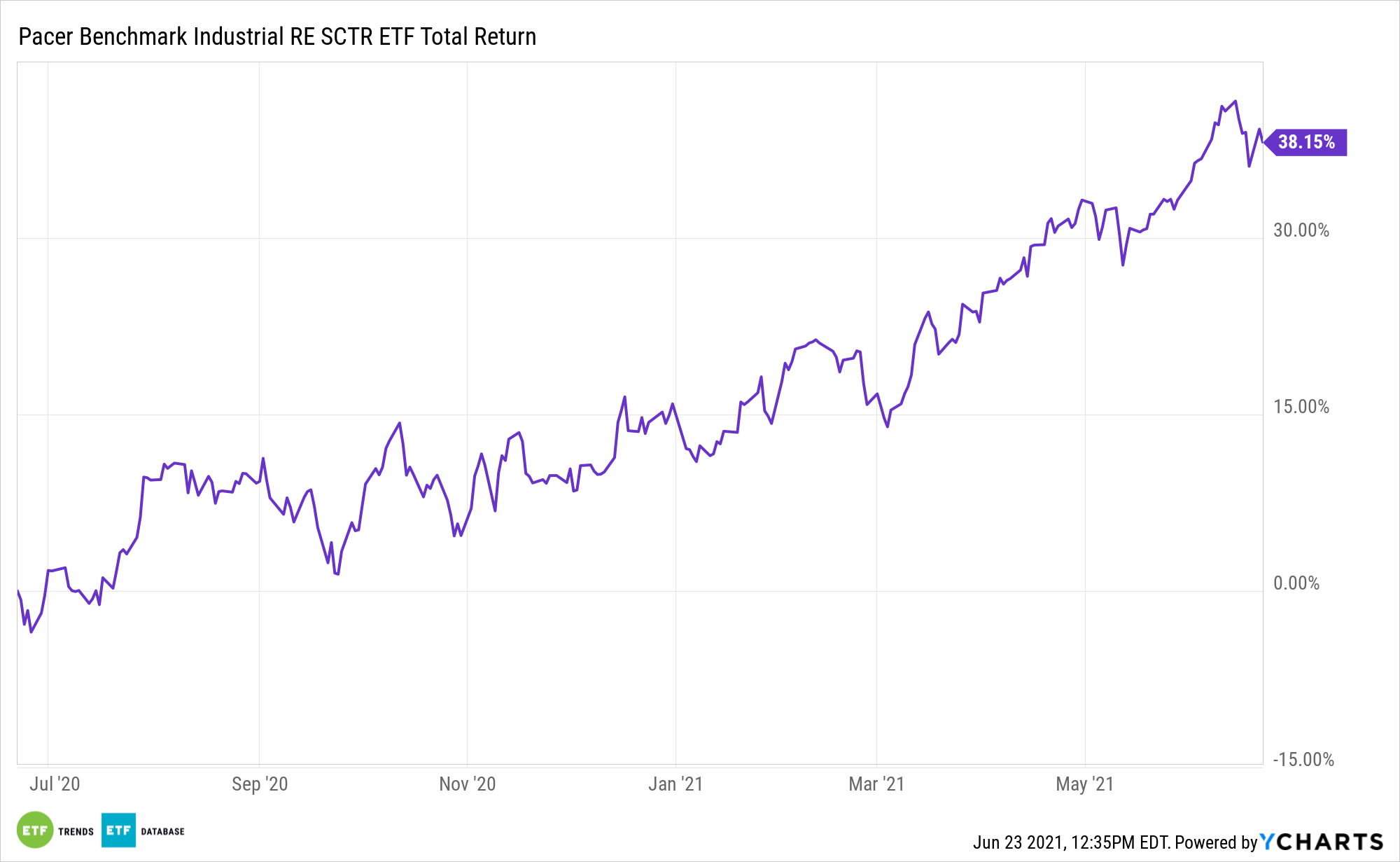

Pure performance confirms the validity of zeroing in on a specific REIT segment. Over the past year, INDS is higher by 35.60%, an advantage of more than 640 basis points over the diversified MSCI US Investable Market Real Estate 25/50 Index.

INDS, which turned three years old last month and tracks the Benchmark Industrial Real Estate SCTR Index, is also a relevant consideration in today’s inflationary environment. As has been widely noted, REITs have a long history of being a solid inflation-fighting asset class. Much of that status is derived from pricing power – a concept industrial REITs are currently taking to the next level.

“Industrial taking rents were up 9.7% in the first five months of 2021 compared with the same period last year, while industrial asking rents rose 7.1%, according to CBRE, which tracks 58 U.S. markets,” according to the Journal.

Adding to the long-term case for INDS are the supply and demand dynamics at play in the industrial REIT universe. Online retail sales are soaring, meaning the Amazons and Walmarts of the world need more hubs from which to ship goods to consumers.

Yet, in today’s context, the amount of viable land available for warehouse construction is declining, meaning INDS could further enhance pricing power by way of scarcity.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.