With the 2000 technology bubble still remembered by many of today’s market participants, it may be surprising to some to learn that the Nasdaq-100 Index (NDX) and the Invesco QQQ Trust (QQQ) actually prove somewhat resilient in trying markets.

Obviously, given the index’s large technology exposure, it’s not a low volatility fund. Nor does it weather storms entirely, but looking at NDX’s historical performances in crises can prove instructive.

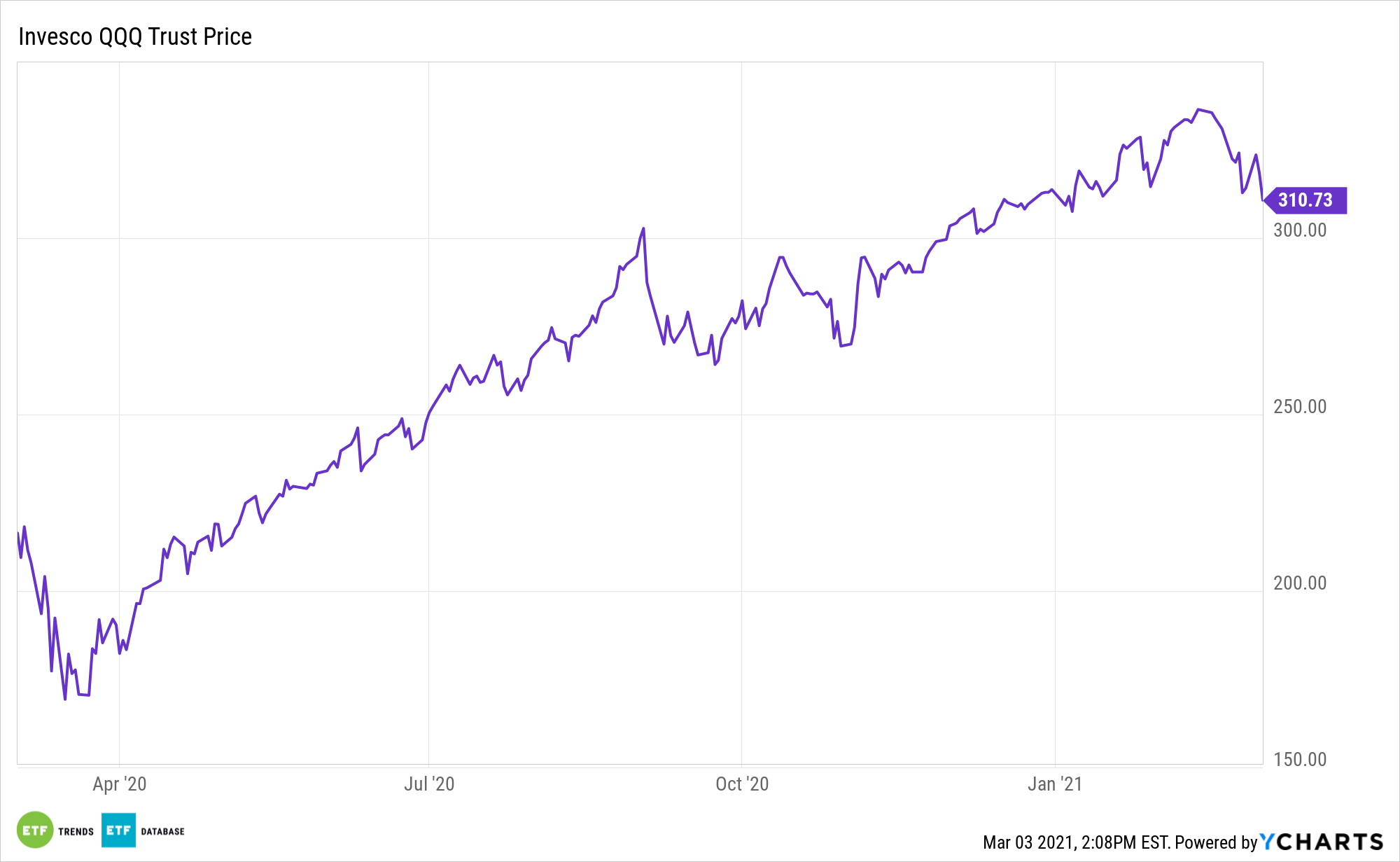

“It may seem counterintuitive that the U.S. stock market has continued to set record highs through the uncertainty and unpredictability of the global pandemic. Yet the records keep breaking. This is particularly true of the Nasdaq-100 Index® (NDX®), which was up a staggering 47.6% in 2020, and 48.9% on a total return basis,” according to Nasdaq Global Indexes.

Not Crisis-Proof, But Still Some Strong Positives

Many QQQ components are using technology to disrupt the industries they are in. These companies use innovation techniques to create competitive advantages across multiple sectors and industries beyond tech. The coronavirus pandemic has also highlighted opportunities with tech stocks and QQQ.

Additionally, the tech bubble notwithstanding, QQQ and NDX has some favorable history on its side.

“Throughout this time, the index compares favorably with other broad-based indexes. However, that was not the case during the prior two periods of severe market disruption in the past two decades: the Tech Bubble/Bust at the turn of the century and the Financial Crisis of 2008/2009,” according to Nasdaq.

Crises or not, NDX volatility also compares favorably with that of the S&P 500.

“The Nasdaq-100 and S&P 500 are two of the most popular equity indexes in the US. We provided performance and volatility analysis for almost 12 years. The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care. The growth of companies in these industries has continued to be strong. Given the way technology is influencing the world and making companies more efficient, this trend is more than likely to continue going forward,” concludes Nasdaq.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.