Broadly speaking, the healthcare sector is generally viewed as defensive, but there growing pockets of disruption and innovation in the space, including health technology equities.

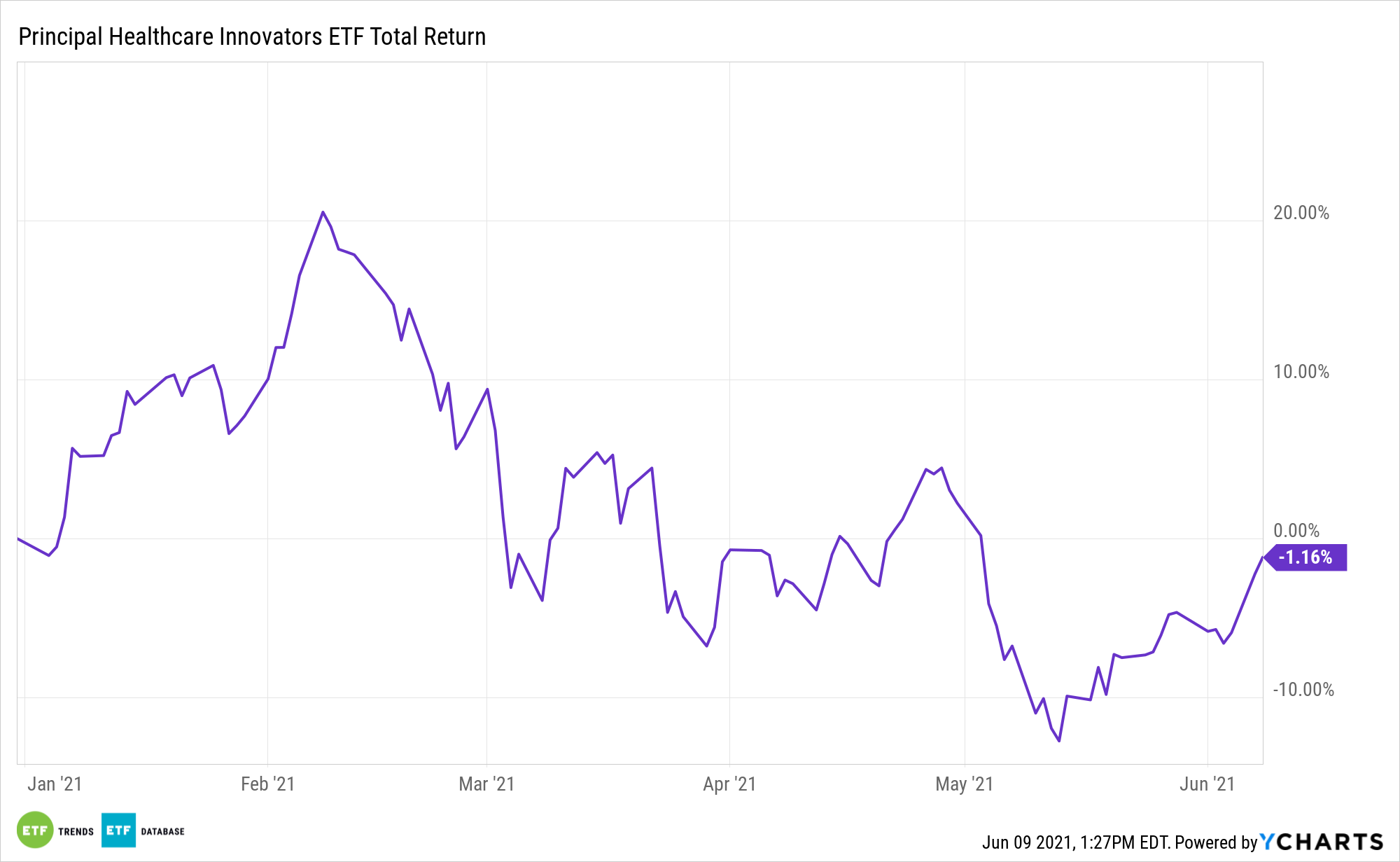

For investors looking for healthcare with a growth feel, the Principal Healthcare Innovators Index ETF (BTEC) is one exchange traded fund to consider. The $158 million BTEC, which tracks the Nasdaq Healthcare Innovators Index, was a favorite for some investors at the height of the race to develop a coronavirus vaccine because the fund previously featured a large weight to Moderna (NASDAQ: MRNA).

That stock is no longer among BTEC’s 303 holdings, but there’s still a compelling case for the Principal ETF, one cemented by Goldman Sachs recently waxing bullish on some healthcare tech equities.

“Goldman Sachs has started covering a rapidly growing, high-margin health tech sector that it says is set for a post-pandemic boost,” reports Lucy Handley for CNBC. “The Wall Street firm’s analysts have issued stock ratings in the diagnostics sector for the first time, picking four companies they say are innovative and can diversify revenues across multiple products.”

Some BTEC Holdings Make the Goldman List

Investing in companies with the disruptive or innovative labels in the healthcare sector can subject investors to lumpy earnings or even firms that aren’t yet profitable.

However, a potential benefit of the BTEC strategy is that its holdings are research- and development-intensive, both necessary prerequisites for success in in the hyper-competitive healthcare innovation arena. That dedication can pay off when it comes to bolstering margins, as is the case with Exact Sciences (EXAS), a diagnostics company and BTEC’s second-largest holding. Exact margins run at 70% and could expand to 76% over the next three years, according to Goldman Sachs.

“Its large commercial organization allows the company to commercialize new products more rapidly into the already established infrastructure,” says the investment banking company.

Goldman Sachs is also bullish on Guardant Health (GH), which produces liquid biopsy blood tests for use in the booming multi-cancer early detection (MCED) market.

“GH has shown an unmatched ability to develop innovative and highly accurate diagnostics with high clinical utility.”

Guardant resides just outside of BTEC’s top 10 holdings at a weight of 1.64%. Goldman Sachs also recently highlighted CareDx (CDNA), shares of which are up almost 21% year-to-date. The company provides testing for patients waiting on kidney, heart, and lung transplants and is a smaller member of the BTEC roster at a weight of 0.63%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.