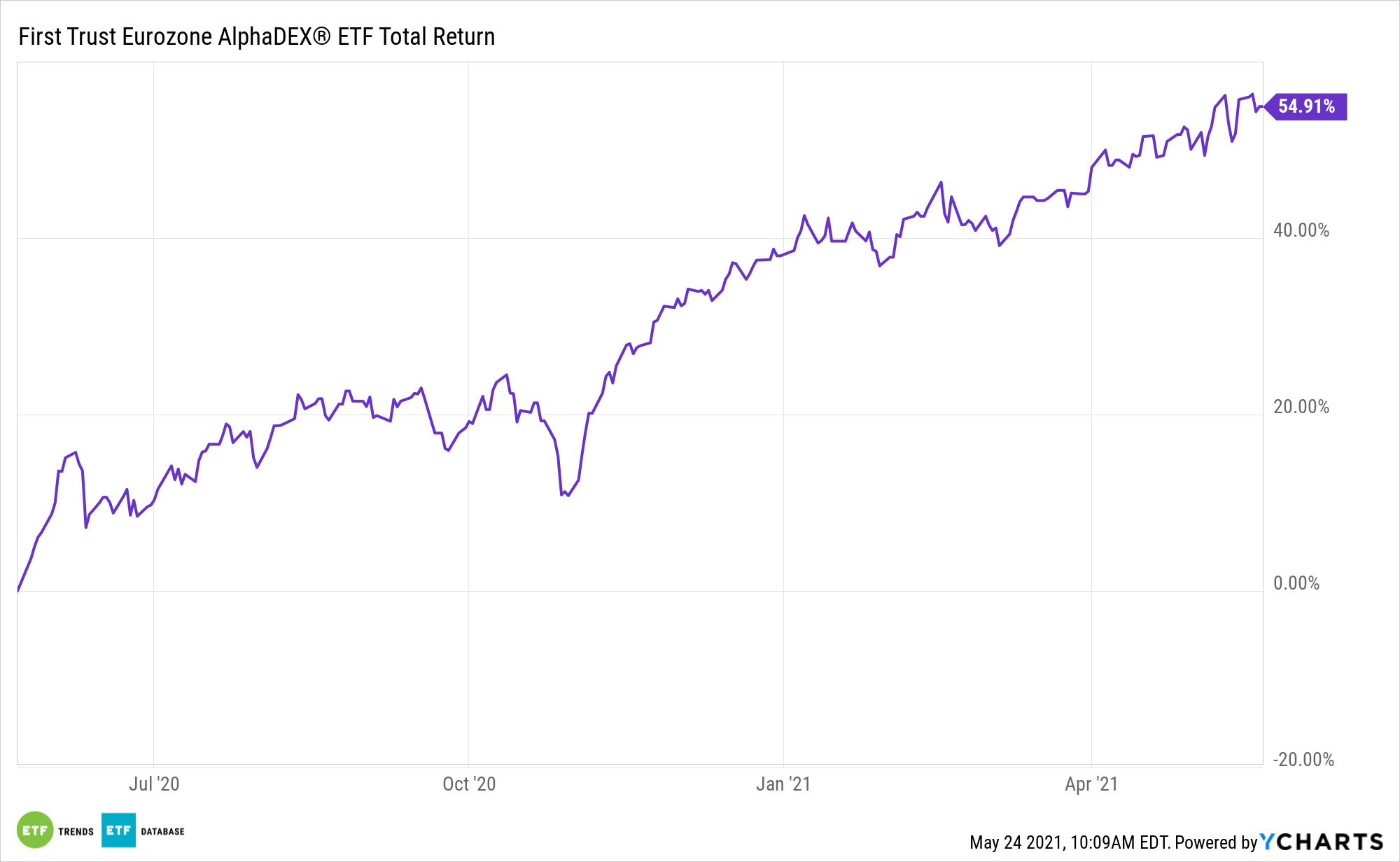

Eurozone economic activity is rebounding in strong fashion, which is bolstering many of the region’s equity markets. For example, the First Trust Eurozone AlphaDEX ETF (NasdaqGM: FEUZ) is up a stout 12.26% year-to-date.

FEUZ, which tracks the Nasdaq AlphaDEX® Eurozone Index, turns seven years old in October. In the Europe exchange traded fund conversation, FEUZ is often overlooked, but its age indicates it’s been through some patches for Eurozone equites. Now, things are looking up for the region, with some data pointing to imminent GDP increases.

“The headline IHS Markit Eurozone Composite PMI® rose from 53.8 in April to 56.9 in May, according to the preliminary ‘flash’ reading, the survey’s new orders index rose even more sharply to 58.4,” notes the research firm. “You have to go back to June 2006 until you find faster growth of new orders. The data therefore point to a sharp acceleration of GDP growth in the eurozone during the second quarter.”

What Makes ‘FEUZ’ Tick?

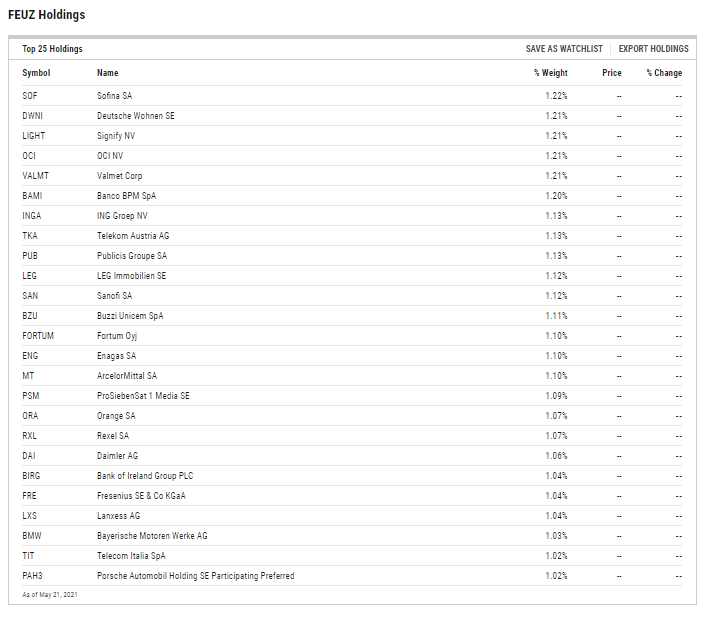

The Eurozone is comprised of 19 European Union (EU) member countries, 10 of which are featured in FEUZ. The First Trust fund allocates nearly 46% of its weight to Germany and France – the Eurozone’s two largest economies.

That heft to those two countries is benefiting FEUZ investors this year. The MSCI Germany and MSCI France indices are up an average of 13.75% year-to-date.

With a 23.34% weight to financial services stocks, FEUZ offers a value tilt. While there’s still value to be had with once-depressed European bank stocks, the sector is offering big-time appreciation this year as highlighted by a 19% gain for the MSCI Europe Financials Index.

Another point in favor of FEUZ is its exposure to sectors with inflation-fighting potential. Like the United States, many areas in Europe are experiencing inflationary pressures.

“Average prices charged for goods and services meanwhile rose at the fastest pace since comparable data were first available in 2002, fueled by a survey-record increase in factory gate prices. Prices charged for services rose modestly by comparison, through showed the biggest increase for just over two years,” according to IHS Markit. “How long these inflationary pressures persist will depend on how quickly supply comes back into line with demand, but for now the imbalance is deteriorating, hinting strongly that consumer price inflation has further to rise.”

FEUZ allocates almost 23% of its weight to the materials and industrial sectors – two groups that historically perform well as consumer prices increase.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.