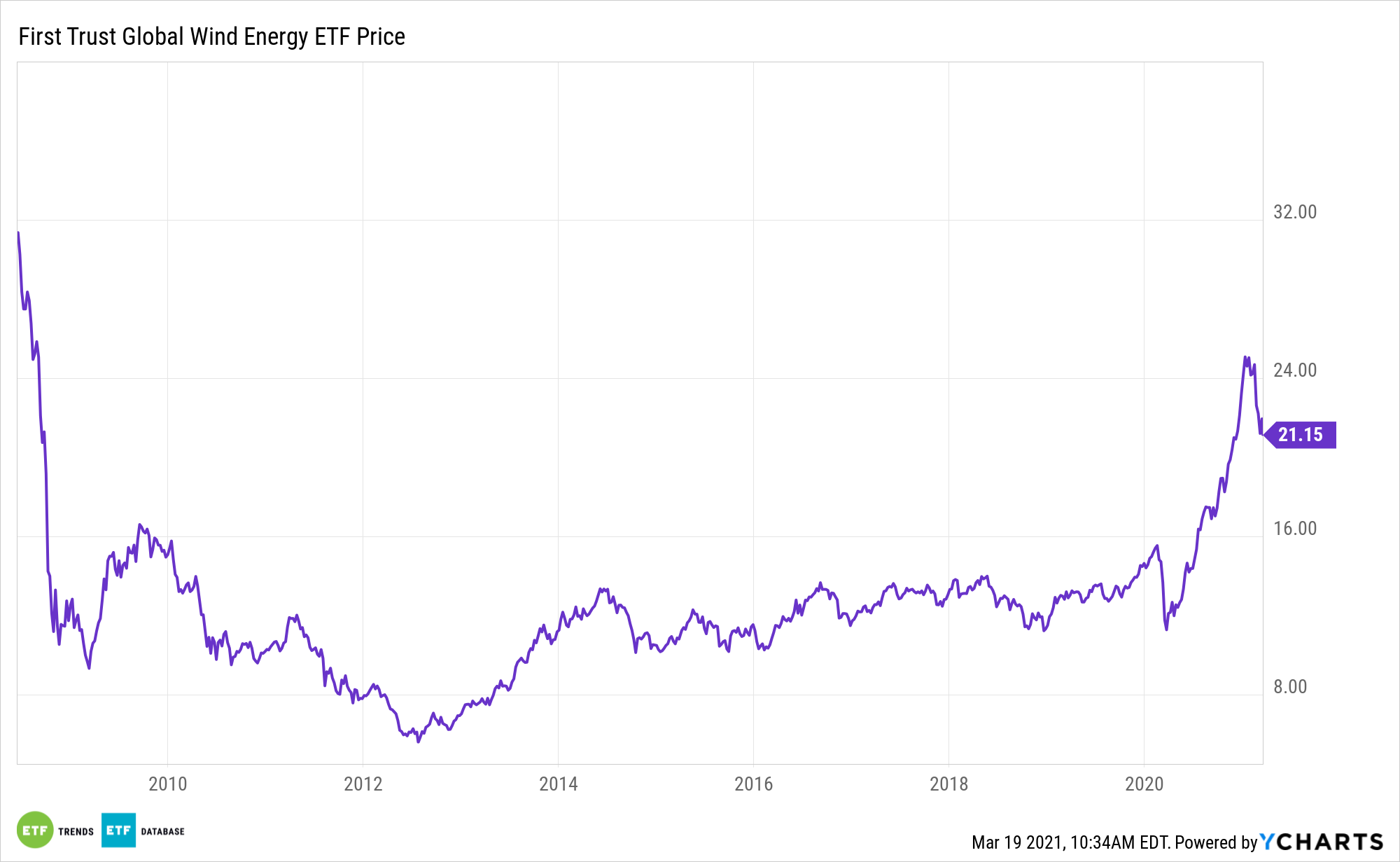

Some market observers say wind investments are entering a golden age. Investors can tap into that theme with the First Trust Global Wind Energy ETF (FAN).

FAN seeks investment results that correspond generally to the price and yield of an equity index called the ISE Clean Edge Global Wind EnergyTM Index.

FAN components “are identified as providing goods and services exclusively to the wind energy industry are given an aggregate weight of 66.67% of the index. Those companies determined to be significant participants in the wind energy industry despite not being exclusive to such industry are given an aggregate weight of 33.33% of the index. This weighting is done to ensure that companies that are exclusive to the wind energy industry, which generally have smaller market capitalizations relative to their multi-industry counterparts, are adequately represented in the index,” according to First Trust.

One of the big benefits with FAN is its underlying index.

“Clean Edge – a leader in clean-energy indexing and research – determines the universe of constituents, using primary and secondary sources to select only companies that are ‘engaged and involved in some aspect of the wind energy industry such as the development or management of a wind farm; the production or distribution of electricity generated by wind power; or involvement in the design, manufacture or distribution of machinery or materials designed specifically for the industry,’” according to Nasdaq research.

FAN’s Fabulous Approach

Another benefit of FAN is that its index has various requirements that ensure investors get a pure play wind strategy.

“FAN’s benchmark goes further, applying qualifiers to member firms. For example, FAN holdings be “actively engaged” in some element of the wind industry, be wind farm operation, power distribution or manufacture of parts and supplies. That keeps a small number of companies from dominating the fund,” according to Nasdaq.

The ETF’s index provides a benchmark for investors interested in tracking public companies throughout the world that are active in the wind energy industry. In order to be eligible for inclusion in the index, a security must be issued by a company that is actively engaged in some aspect of the wind energy industry.

“As part of its research, Clean Edge further segments the index’s constituents into Pure Play and Diversified categories, with a more stringent set of conditions for the former including at least ‘50% or more of revenues and/or generating assets (energy capacity and/or production) coming from wind-related activities,’” finishes Nasdaq.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.