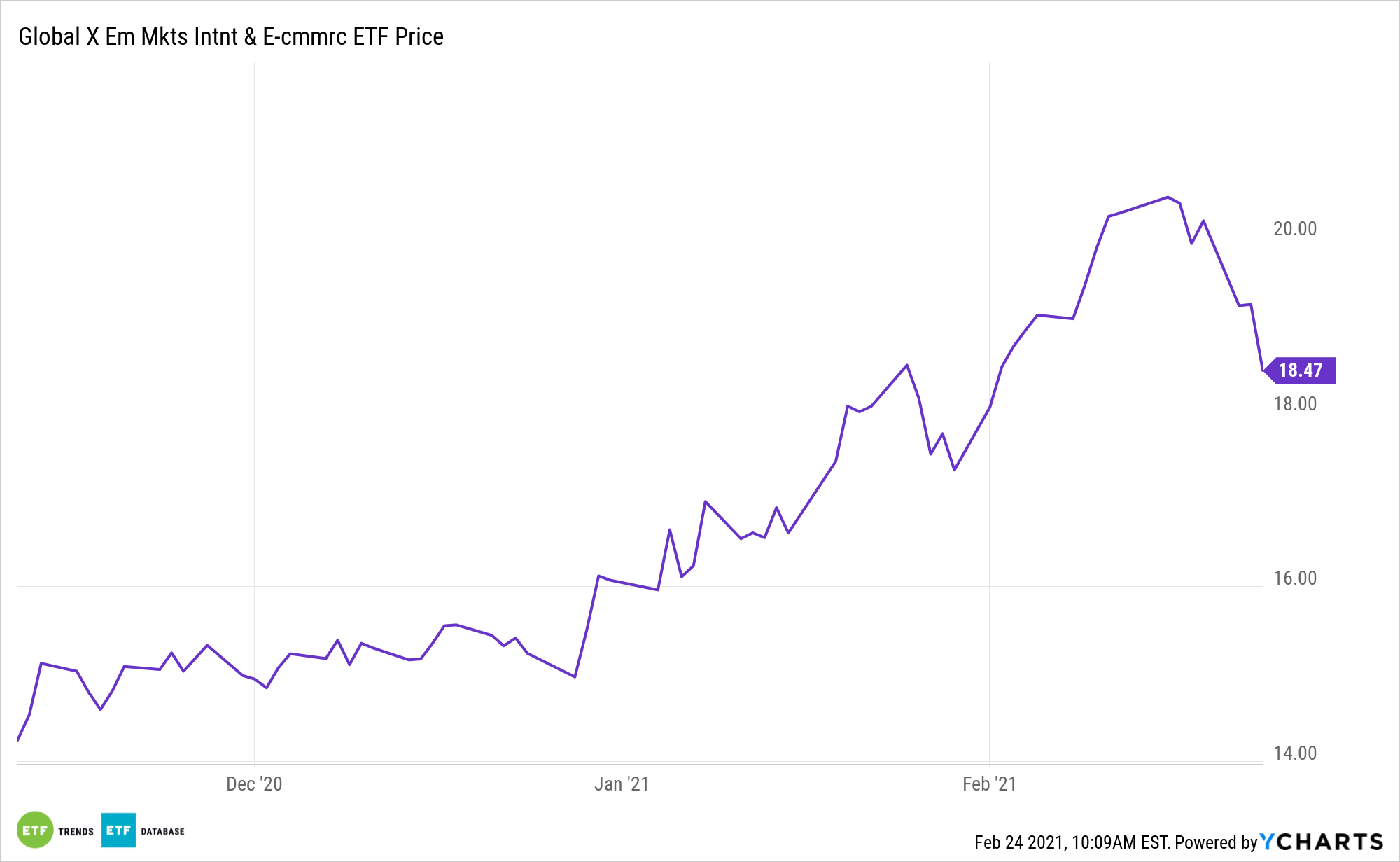

Online retail is an increasingly relevant investment thesis, but investors shouldn’t confine their search to domestic fare. The Global X Emerging Markets Internet & E-Commerce ETF (NASDAQ: EWEB) proves investors can go shopping in emerging markets.

EWEB, which debuted last November, holds 49 stocks and tracks the Nasdaq CTA Emerging Markets Internet & E-commerce Net Total Return Index.

As many U.S. investors well know, a big part of the case for investing in online retail is favorable demographics, a promise emerging markets still hold.

“EMs represent great potential for internet & e-commerce companies as they sit at the intersection of a few key growth trends: rising smartphone penetration rates, improving internet infrastructure and large youthful populations,” said Brian Comiskey, Manager of Industry Intelligence at the Consumer Technology Association (CTA), in an interview with Global X analyst Chelsea Rodstrom. “In fact, nine in 10 members of Gen Z live in EMs per the latest research from Bank of America. Internet & e-commerce is a compelling theme as it stands at the nexus of these growth trends.”

Extending the E-Commerce Thesis Abroad

Internet and e-commerce based business models are receiving a slight boost, notably from an increase in demand for widely adapted e-commerce businesses. The shift in day-to-day habits from lockdown measures to contain the pandemic has accelerated the adaption of certain platforms, such as distance learning, telemedicine, and food delivery, among others.

Looking ahead, middle-income consumers will likely take on a greater role in the emerging economies. According to McKinsey & Co. projections, there will be an expected 4.2 billion people among the consuming class by 2025, with emerging markets making up $30 trillion in consumption to developed markets’ $34 trillion.

As has been widely noted, the coronavirus pandemic is speeding adoption of online retail around the world.

“Further, COVID-19 has only hastened the shift toward more digital, automated, and remote capabilities across global economies; an evolution that could ultimately define the next 20 years,” says Comiskey. “The need for socially-distanced and remote solutions has altered consumer behaviors and pulled forward the digital and ‘on-demand’ lifestyle of the future in both developed and developing markets.”

Predictably, China looms large in the emerging markets online retail equation, but there’s more to the EWEB story.

“Southeast Asia in particular has seen a significant surge with 40 million people coming online this year for the first time across Singapore, Indonesia, Malaysia, the Philippines, Thailand and Vietnam per a report by Google, Temasek Holdings and Bain & Company,” adds Comiskey. “Bringing their regional total to approximately 400 million people online, these countries also saw a 63% growth rate in their e-commerce sector in 2020.”

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.