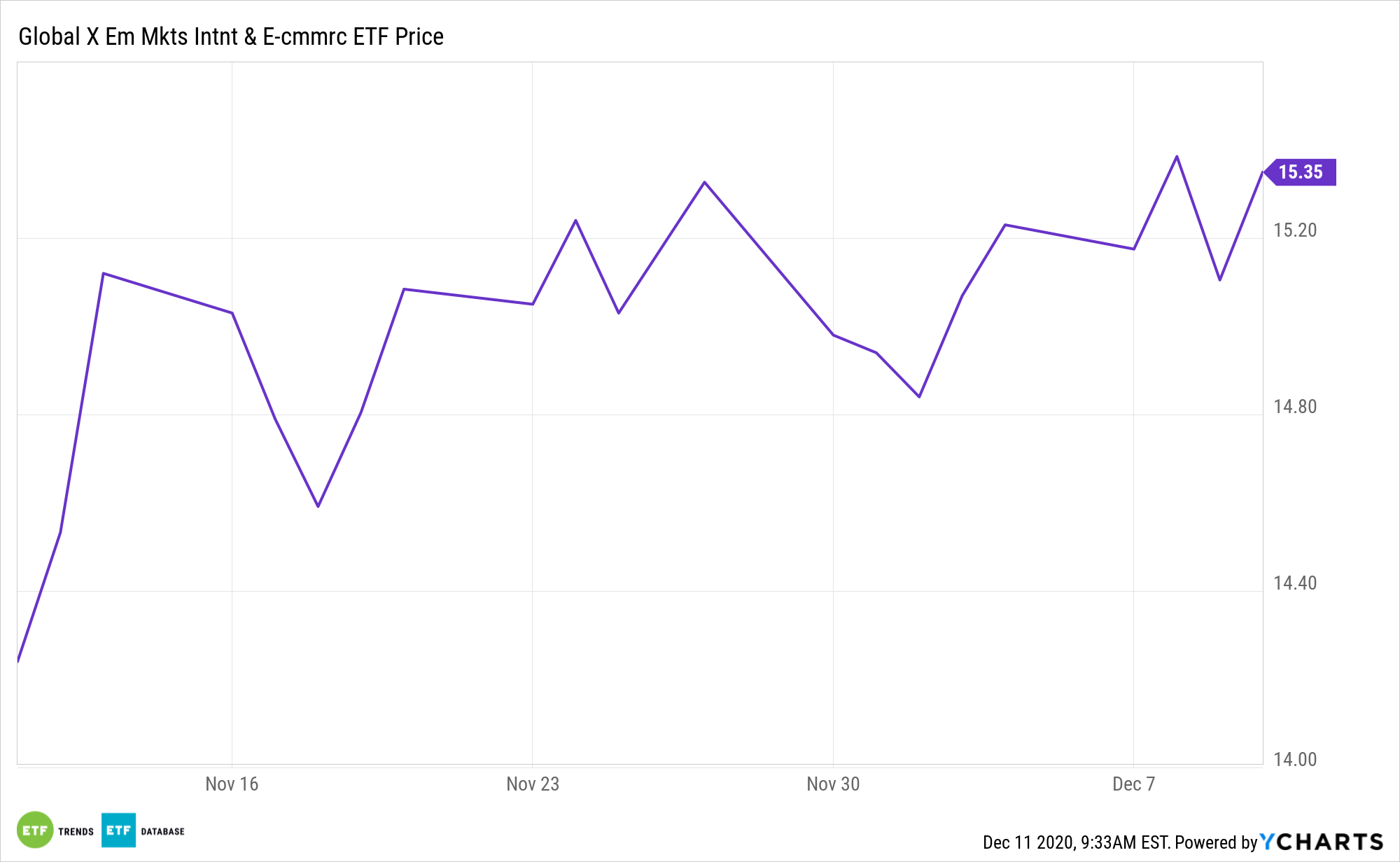

Some new ETFs benefit from impeccable market timing. Count the Global X Emerging Markets Internet & E-Commerce ETF (NASDAQ: EWEB) among them. EWEB debuted last month amid of a spate of encouraging data regarding the growth of online retail in developing economies.

EWEB tracks the Nasdaq CTA Emerging Markets Internet & E-commerce Net Total Return Index and holds nearly 50 stocks. EWEB is less than a month old, but it’s clear there are positive tailwinds in place for this rookie fund.

“Today, the confluence of rising smartphone penetration rates, improving internet infrastructure and large youthful populations is powering the growth of emerging markets. Industry analysts have effectively identified how these elements are paving the way for the success of internet and e-commerce companies in these markets,” according to the Consumer Technology Association (CTA).

The Internet and E-Commerce Themes Moving Forward

As a split internet/retail ETF, EWEB devotes over 93% of its weight to the consumer cyclical and communication services sectors. EWEB has eight geographic exposures with China looming large at an allocation of 74%. There are strong fundamentals backstopping this new ETF.

Looking ahead, middle-income consumers will likely take on a greater role in the emerging economies. According to McKinsey & Co. projections, there will be an expected 4.2 billion people among the consuming class by 2025, with emerging markets making up $30 trillion in consumption to developed markets’ $34 trillion.

“The promise of emerging markets often traces back to the meteoric rise of Chinese e-commerce giants Alibaba and JD.com,” notes CTA. “Although e-commerce operations remain a significant component of their businesses, as seen by Alibaba’s record Singles’ Day sales this year, the greater impact is how the rise of e-commerce has paved the way for other innovative internet-based technologies in these companies’ regions.”

Internet and e-commerce based business models are receiving a slight boost, notably from an increase in demand for widely adapted e-commerce businesses. The shift in day-to-day habits from lockdown measures to contain the pandemic has accelerated the adaption of certain platforms, such as distance learning, telemedicine, and food delivery, among others.

“The pandemic has increased e-commerce engagement considerably. CTA’s COVID-19 Impact: Retail Innovations study reports 60% of consumers have increased their amount of online shopping since the pandemic began. And the pandemic has also spurred upticks in more nascent industries such as telehealth and remote learning,” according to CTA.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.