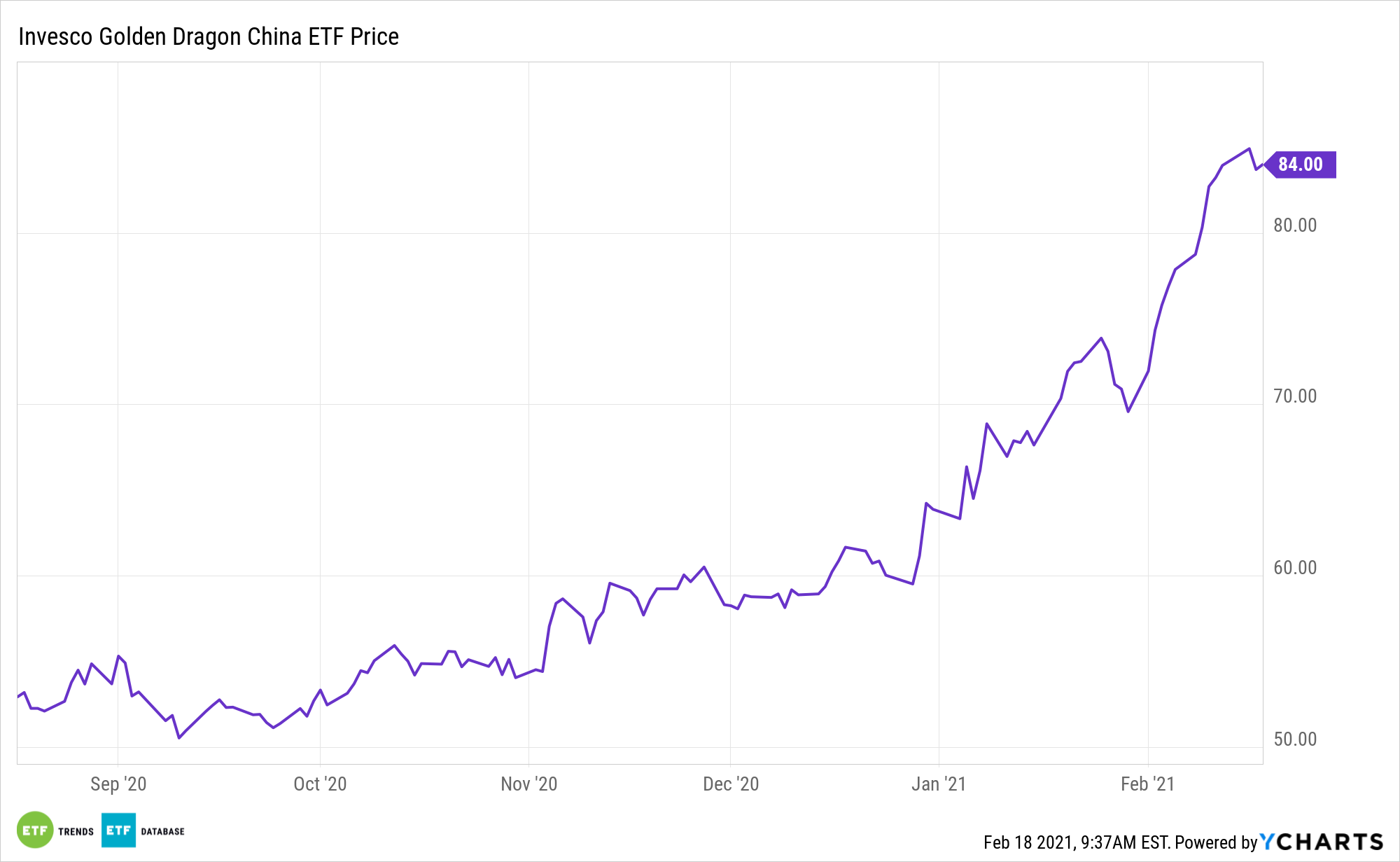

Market participants have recently expressed concern about the regulatory environment around major Chinese internet stocks, including Alibaba. Those concerns may be overblown. Investors will still want to consider the Invesco Golden Dragon China ETF (PGJ).

PGJ seeks to track the investment results of the NASDAQ Golden Dragon China Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is composed of securities of U.S. exchange-listed companies that are headquartered or incorporated in the People’s Republic of China. Unlike some China ETFs, PGJ does a decent job of spreading exposure throughout the economy; weightings to banks and energy aren’t overwhelming, and the often-overlooked tech sector receives significant attention too.

“Strong business profiles, robust cash generation and solid balance sheets should help Chinese internet majors – Alibaba Group Holding Limited (A+/Stable), Baidu, Inc. (A/Stable) and Tencent Holdings Limited (A+/Stable) – to weather heightened macroeconomic, competitive and regulatory risks,” Fitch Ratings reports. “Their credit profiles remain solid with moderate-to-high rating headrooms.”

PGJ Not Flaming Out

Like any strong-performing fund, PGJ’s fiery gains are a product of its top holdings. Currently, the top three holdings, which comprise about 30% of the fund, call the tech industry in their home. As China looks to become more technologically-independent, look for PGJ to keep gaining strength.

“We expect China’s stronger anti-trust push to be aimed at stopping anti-competitive practices in the internet sector, which should promote the development of the country’s internet sector over the longer term,” notes Fitch. “We do not expect the government to break up the Chinese internet majors or force them to undergo significant restructuring of their core operations that would impede their market positions, as they have been playing important roles in China’s economic development. They are also committed to working actively to comply with relevant policies and regulations.”

Integral to the PGJ thesis is that many of the fund’s holdings are prolific generators of free cash flow. They’re also on sturdy financial footing.

“We expect the Chinese internet majors’ profitability and cash generation to remain robust, although their overall profitability is increasingly distorted by expansion into new businesses and the diversification of their revenue sources. Their financial profiles have demonstrated strong resilience to the coronavirus pandemic during 2020. Continued service innovation, improving monetisation, accelerated digitalisation in the economy and a fuller economic recovery from the negative impact of the pandemic should drive their stronger financial profiles in 2021,” concludes Fitch.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.