Brent crude prices are in the midst of a three-week slide and West Texas Intermediate is stumbling amidst concerns that the Delta variant of the coronavirus will stymie the reopening trade and as members of the Organization of Petroleum Exporting Countries (OPEC) and the so-called “plus” nations agreed to ramp up output.

Predictably, that volatility and subsequent price retrenchment has weighed on previously hot oil equities. The S&P 500 Energy Index tumbled nearly 8% last week.

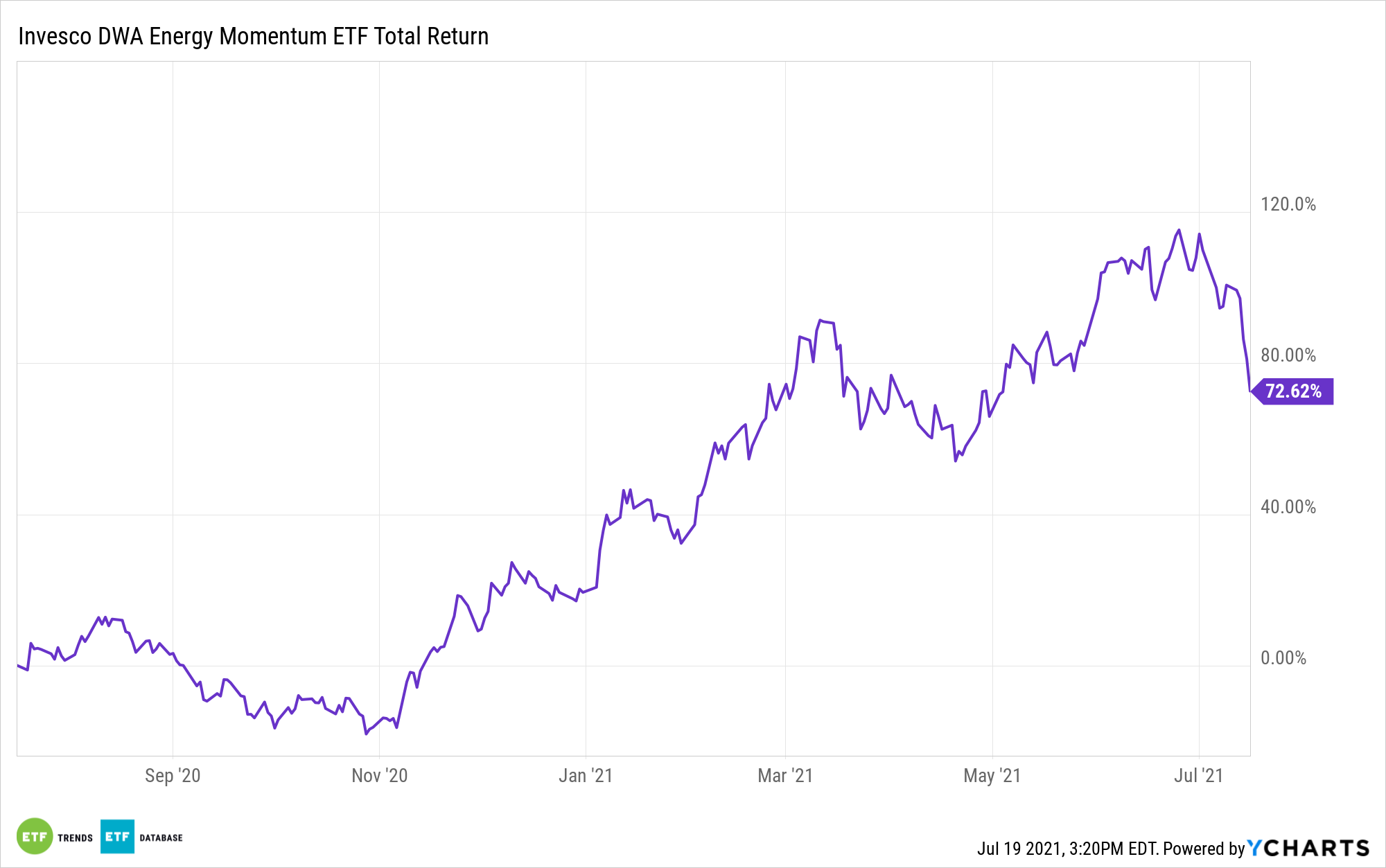

Those are the breaks with energy stocks, but in a case of a negative potentially turning into a positive down the road, the recent weakness in the energy sector is making multiples on some members of the Invesco DWA Energy Momentum ETF (PXI).

Prior to the recent pullback a slew of energy stocks “were fairly valued but only because the market was simultaneously 1) overweighting high near-term prices and 2) unfairly discounting the long-term value generation. The OPEC deal has eliminated the first of these issues but not the latter, hence certain stocks are now looking cheap,” said David Meats, Morningstar energy equity research director.

PXI’s Rebound Potential

The $183.5 million PXI follows the Dorsey Wright Energy Technical Leaders Index. That benchmark is rooted in Dorsey Wright’s famed, proprietary relative strength methodology, potentially making the fund an ideal way to participate in an energy rebound.

As Morningstar notes, there’s at least one benefit of the aforementioned energy stumble.

“But with the pullback in the sector, the roster of 4-star energy stocks has grown slightly. As of the close of trading on July 14, 18 of the 58 energy stocks fell into that undervalued category,” according to the research firm.

Among the quartet of new entrants to that undervalued list is PXI component Pioneer Natural Resources (NYSE: PXD), which slid almost 11% last week. The company produces oil and natural gas in the Permian Basin in West Texas, one of the largest domestic shale plays, meaning the stock is levered to a possible rebound in West Texas Intermediate prices. If prices remain high, domestic exploration and production firms will likely boost output.

The stock accounts for 2.54% of PXI’s roster.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.