The outlook for dividend growth continues to improve, but investors looking to play that trend with more conviction should focus on funds with the best potential of delivering credible payout growth.

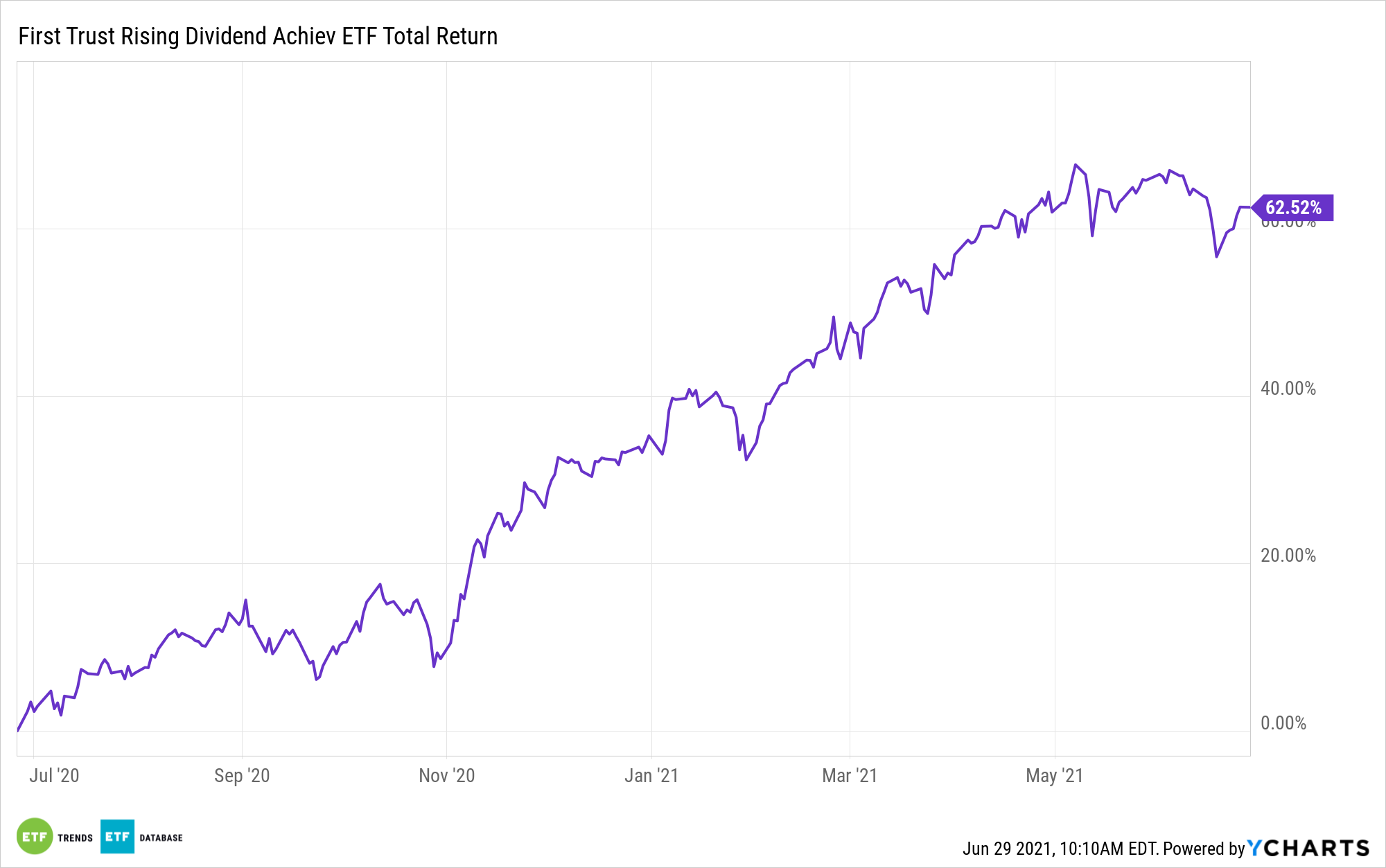

The First Trust Rising Dividend Achievers ETF (NasdaqGS: RDVY) fits that bill. RDVY, which tracks the NASDAQ US Rising Dividend Achievers Index, deploys a unique methodology relative to some competing ETFs, but its stated investment objective is straightforward.

Rather than emphasizing pure yield or a company’s history of raising payouts, the ETF focuses on metrics like earnings, debt-to-equity, and payout ratios to assess not only a company’s ability to sustain its current dividend, but grow it over time. That positions the First Trust fund to capitalize on what is an increasingly positive payout environment.

A recent Goldman Sachs note analyzed by Lawrence Strauss of Barron’s indicates that strong earnings will support payout growth this year, but that the dividend futures markets may be understating how much S&P 500 payouts will rise.

“Goldman points out that ‘the market-implied’ compound annual growth rate for S&P 500 dividends is a little under 1% through 2030—including up 1% this year, and up 3% in 2022. That’s based on the futures market,” reports Barron’s.

Why Are Investors Flocking to RDVY?

Amid 2020’s dividend strife, income investors were reminded of an important factor: sectors are a significant source of strength or weakness in dividend ETFs. Last year, consumer discretionary, energy, and real estate were among the biggest payout offenders while healthcare and technology, broadly speaking, continued boosting dividends.

“Goldman expects dividend growth through 2022 to be driven by health care, information technology, consumer discretionary, and financials. The firm expects those four sectors to contribute 71% of S&P 500 dividend growth through 2022,” added Barron’s.

That’s great news for RDVY investors because those four sectors combine for 72 percent of the fund’s weight, according to First Trust data. Alone, financial services stocks represent 30.27 percent of the fund, which is meaningful because the Federal Reserve recently approved dividend increases and buyback plans for big domestic banks. Seven of RDVY’s top 10 holdings hail from the financial services sector.

Data suggest investors are warming to the RDVY story in a big way. As of June 24, the fund has $4.63 billion in assets under management, of which $2.33 billion flowed in just this year. In other words, RDVY has roughly doubled in size in about six months.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.