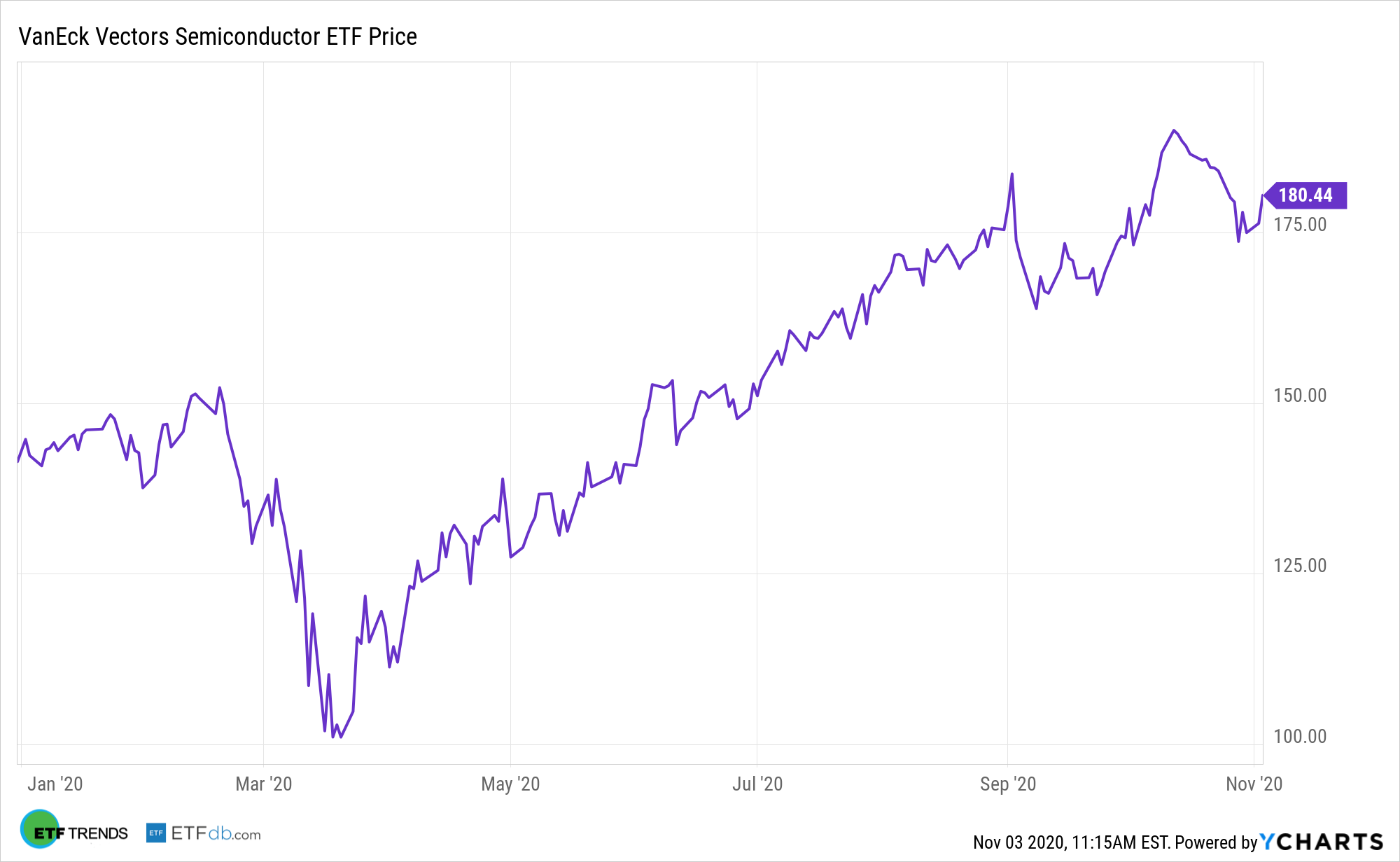

The VanEck Vectors Semiconductor ETF (NASDAQ: SMH) is one of this year’s stars among industry exchange traded funds, confirming semiconductor industry consolidation and buoyant chip demand are credible reasons to embrace this fund.

SMH, one of the bellwether semiconductor ETFs, seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Semiconductor 25 Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index. The index includes common stocks and depositary receipts of U.S. exchange-listed companies in the semiconductor industry. Such companies may include medium-capitalization companies and foreign companies that are listed on a U.S. exchange.

Acknowledging the positives that sent SMH higher earlier this year, chip stocks weren’t immune to the recent tech sell-off, but that could open the door to opportunity with the VanEck fund as the sector rebounds.

“In a risk-off market, indiscriminate selling often fuels share price volatility. Semis were among the stocks hit hardest during the COVID-19 selloff this past March; however, most chip stocks have made a resilient comeback,” said Michael Cohick, VanEck Senior ETF Product Manager, in a recent note. “This is potentially good news for semiconductor stocks and investors seeking outsized returns in what many anticipate to be a challenging and unpredictable market over the near-term.”

SMH: A Catalyst-Rich Story

China’s ambitious goal towards self-sufficiency is flowing over into the semiconductor sector. The second largest economy is looking to divest itself from reliance in technology, heating up competition from the U.S., all to the benefit of semiconductor ETFs. Some SMH components are actually benefiting from the coronavirus pandemic in similar fashion.

“The global pandemic and ensuing stay-at-home trends are boosting the demand and adoption of products that use chips,” notes Cohick. “For example, certain semiconductor companies, such as Advanced Micro Devices, Inc. (AMD) and Nvidia Corp. (NVDA), are significant players in the booming global video gaming and eSports industry, too. These chip makers develop and manufacture semiconductor chips that define the graphic experience of the player and are crucial to the gameplay experience.”

As an industry, semiconductor makers are highly tied to global growth, estimates for which are being ratcheted lower due to the coronavirus. However, many of those trimmed estimates pertain to the first half of this year. Pent-up demand could seep into the third and fourth quarters.

“During periods of high demand, upturns occur and tight supply, or even shortages, lead to higher prices and revenue growth. According to the World Semiconductor Trade Statistics, it is expected that worldwide semiconductor sales will grow by 3.3% this year, totaling $426 billion dollars, and by 6.2% in 2021,” according to Cohick.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.