The arrival of October doesn’t just bring the start of the fourth quarter and Halloween. The tenth month of the year is also Cybersecurity Awareness Month and, yes, there are exchange traded funds for that.

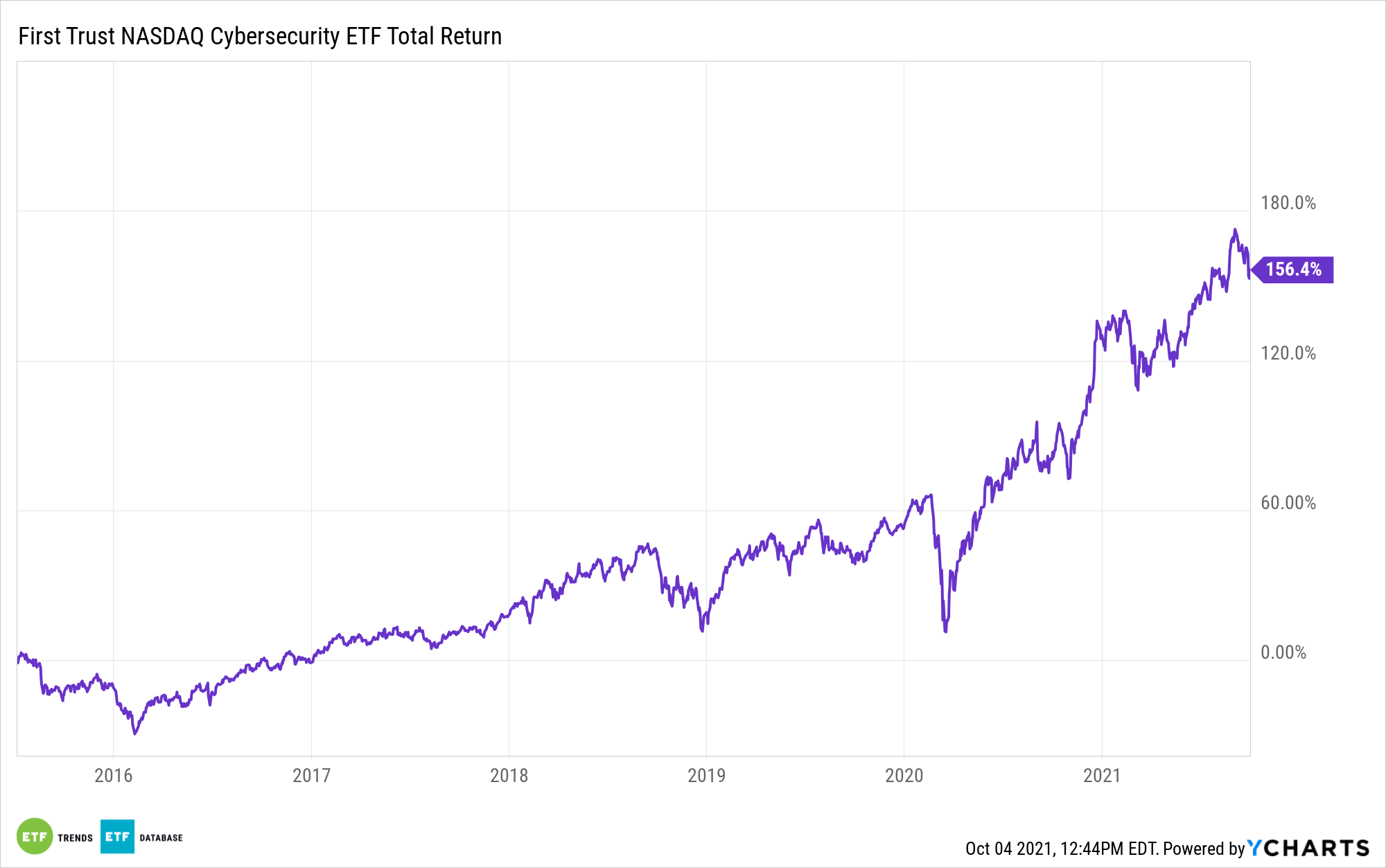

One of the titans of the group is the First Trust Nasdaq Cybersecurity ETF (CIBR). CIBR, which has $4.77 billion in assets under management and recently turned six years old, follows the Nasdaq CTA Cybersecurity Index.

That index is “designed to track the performance of companies engaged in the cybersecurity segment of the technology and industrials sectors. It includes companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations,” according to First Trust.

One trading day into October, CIBR is up 11.33% year-to-date and resides about 6% below record highs. While Cybersecurity Awareness Month may serve to ignite interest in cybersecurity stocks and ETFs, the fact of the matter is that the cybersecurity investment thesis runs much deeper than even a month-long celebration indicates.

“However, we also saw confirmation that we are in the middle of one of the most substantial firewall-related spending cycles we’ve seen in years,” said Goldman Sachs in a recent report. “Demand during the first quarter of this year was stronger than seasonally expected as the majority of vendors within our coverage group beat expectations. We saw demand continue to accelerate in the second quarter, and those vendors better positioned to benefit from these secular drives saw year-over-year growth accelerate with share gains supported by better cross-sell, up-sell, and new business.”

Among the cybersecurity names Goldman likes is Palo Alto Networks, Inc. (NASDAQ:PANW), CIBR’s largest holding at a weight of 6.56%.

“The company provides firewall appliances and software; Panorama, a security management solution for the control of appliances and software deployed on an end-customer’s network as a virtual or a physical appliance; and virtual system upgrades, which are available as extensions to the virtual system capacity that ships with physical appliances,” reports Lee Jackson for 24/7 Wall Street.

The bank is also bullish on Tenable (NASDAQ:TENB), a maker of security solutions software with more than 27,000 customers. Goldman’s price target on the name is $61, and it closed at $46.63 last Friday. Tenable is CIBR’s sixth-largest component at a weight of 3.28%.

For more news, information, and strategy, visit the Innovative ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.