The course of the Invesco Buyback Achievers ETF (NASDAQ: PKW) is charted by its underlying holdings, but buyback strategies seem to come back into style when repurchases tick higher. Some market observers expect that’s about to happen in significant fashion.

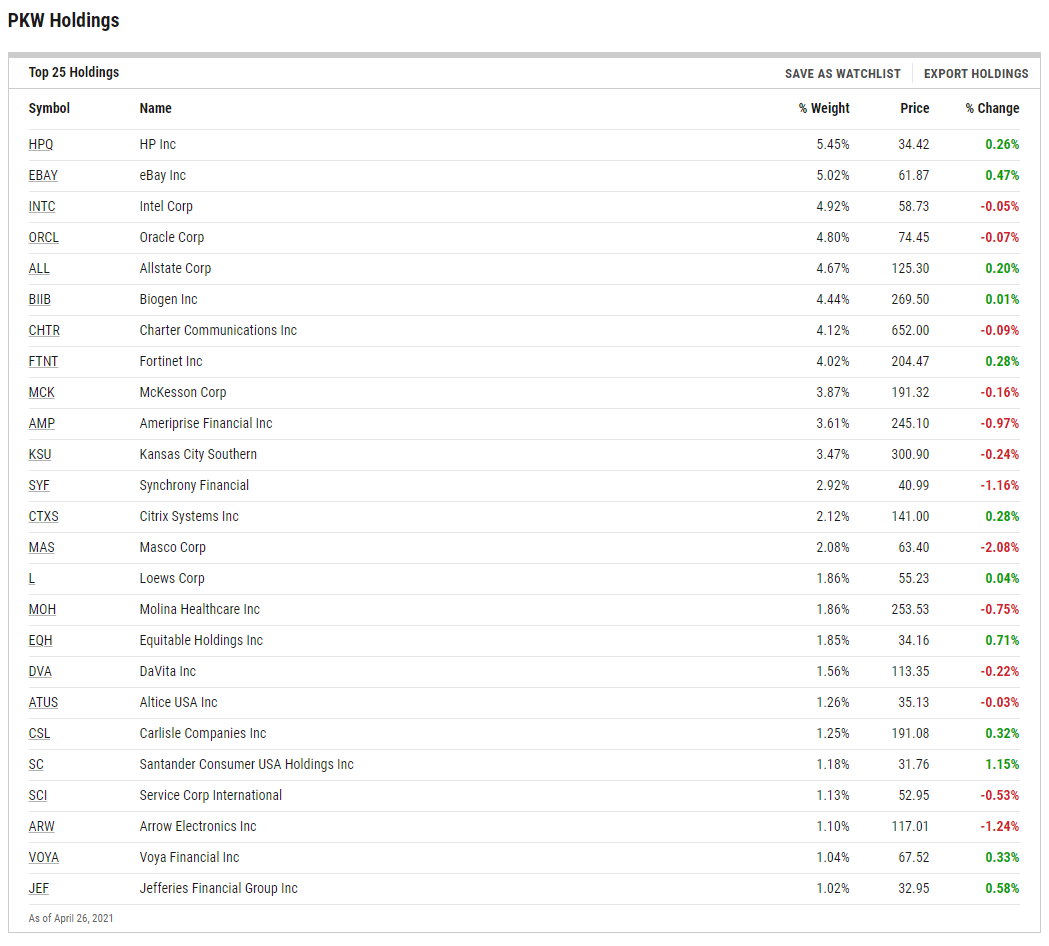

PKW follows the NASDAQ US BuyBack Achievers Index, which “is comprised of US securities issued by corporations that have effected a net reduction in shares outstanding of 5% or more in the trailing 12 months. The Fund and the Index are reconstituted annually in January and rebalanced quarterly in January, April, July and October,” according to Invesco.

A buyback “blackout” period ended last week, and that could open the floodgates of share repurchases over the near-term, potentially lifting broader markets and some PKW components in the process.

“To wit, 2021 YTD authorizations are +75% vs 2020 YTD auths, +24% vs 2019 auths, and +26% vs 2018 auths (reminder, 2018 was a record buyback year),” ZeroHedge reports, citing Goldman Sachs Strategist John Flood.

The Perks of ‘PKW’

As noted in this space last week: “Tech is PKW’s second-largest sector allocation at 25.35% – trailing only the 27.40% weight assigned to financial services stocks. Healthcare and industrial stocks combine for over 24% of the Invesco ETF’s roster.”

The nearly 53% combined weight to financial services and tech stocks is relevant over the near-term because those two sectors can aggressively repurchase shares. Many tech companies have big cash stockpiles and frequently use that capital to buy back equity.

In the case of financials, the Federal Reserve is taking the coronavirus handcuffs off, allowing big banks to repurchase stock and boost dividends following lulls on those fronts last year.

Data confirm a wave buybacks is coming, if it’s not already here.

“We are currently running 1.6x vs 2020 FY ADTV, 1.0x vs 2019 FY ADTV, and 0.9x vs 2018 FY ADTV and we expect this to continue to pick up as we move into open window starting next week. So in other words, 2021 has more authorizations than 2018 (record buyback year), but is only pacing .9x the ADTV (actual purchases) of 2018 so far,” according to Goldman’s Flood.

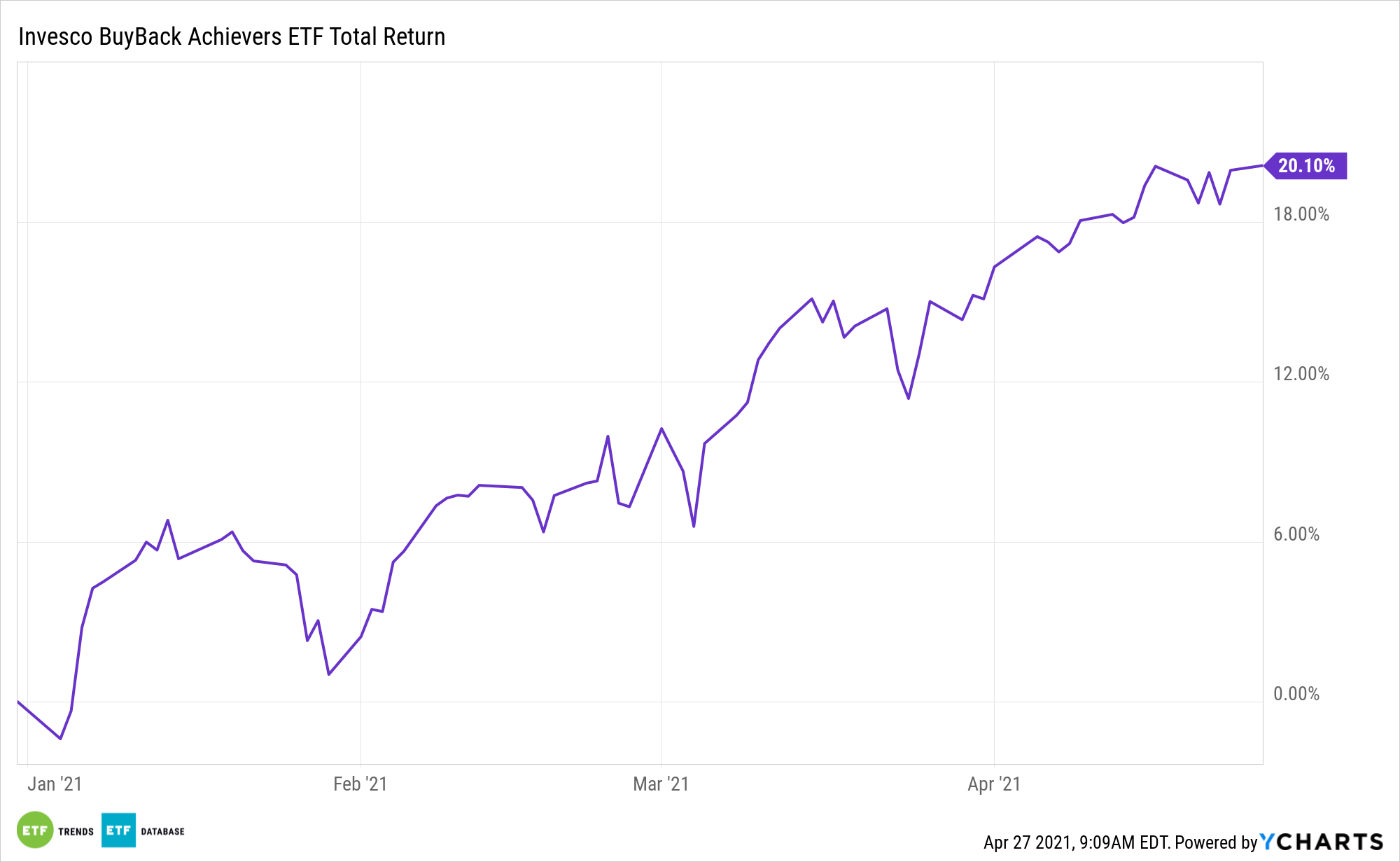

As it pertains to PKW, the fund is slightly lower over the past week, but it’s up over 20% to start 2021 and is flirting with all-time highs.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.