President Biden has bold clean energy ambitions with big implications for assets like the First Trust Global Wind Energy ETF (FAN).

FAN seeks investment results that correspond generally to the price and yield of an equity index called the ISE Clean Edge Global Wind EnergyTM Index.

FAN components “are identified as providing goods and services exclusively to the wind energy industry are given an aggregate weight of 66.67% of the index. Those companies determined to be significant participants in the wind energy industry despite not being exclusive to such industry are given an aggregate weight of 33.33% of the index. This weighting is done to ensure that companies that are exclusive to the wind energy industry, which generally have smaller market capitalizations relative to their multi-industry counterparts, are adequately represented in the index,” according to First Trust.

Good news for FAN investors and those considering the fund: Biden is a fan of wind energy.

“The Biden administration is outlining ambitions to dramatically boost offshore wind power in the U.S. by 2030, pushing to drive construction of projects at sea capable of generating enough electricity for more than 10 million American homes,” reports Bloomberg.

The Future of Wind

The ETF’s index provides a benchmark for investors interested in tracking public companies throughout the world that are active in the wind energy industry. In order to be eligible for inclusion in the index, a security must be issued by a company that is actively engaged in some aspect of the wind energy industry.

“Top administration officials unveiled the new goal in a Monday meeting with state officials, executives and labor leaders, as part of President Joe Biden’s push to counter climate change, promote renewable energy and strip the electric grid of greenhouse gas emissions by 2035,” adds Bloomberg. “As part of the push, federal regulators took steps to advance the sale of offshore wind farm rights in Atlantic waters south of New York’s Long Island.”

Covid-19 certainly did a number on business sectors across the spectrum, but one area that didn’t suffer was electricity generation via wind and solar power. In fact, the use of wind and solar for electric power has doubled in the last five years, which underscores the ability for renewable energy sources to thrive.

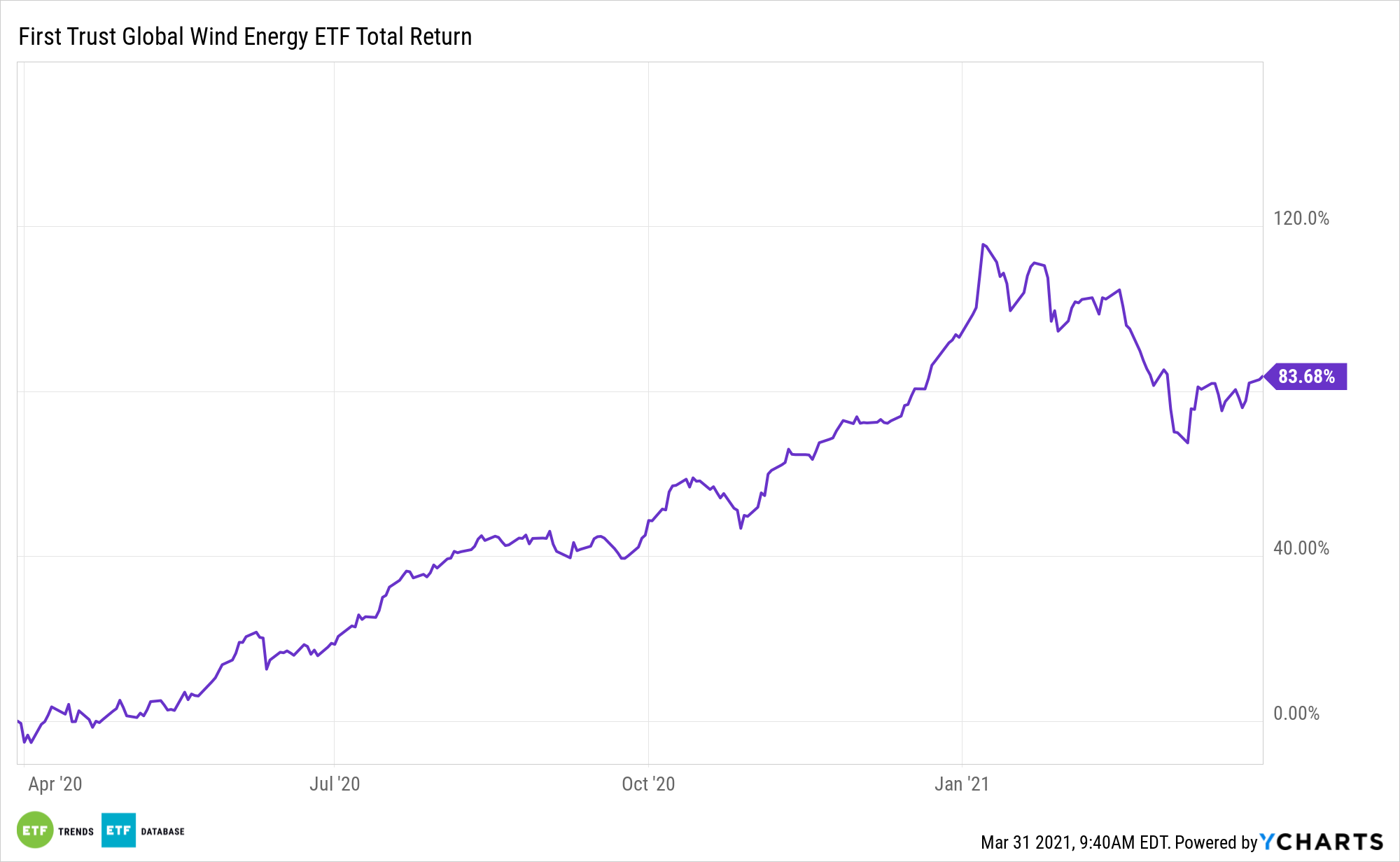

Data confirm that wind exposure is paying off for FAN. Adding to the case for the fund is the fact that wind power installations are increasing around the world, not just in a single market.

Biden’s “wind energy initiative dovetails with the administration’s work on a new U.S. carbon-cutting pledge aligned with efforts to keep average global temperatures from rising more than 1.5 degrees Celsius from pre-industrial levels,” concludes Bloomberg.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.