By Ryan Gilmer, CFA – VP Investment Management – TOPS ETF Portfolios

Index based ETFs have significant advantages over many actively managed mutual funds, including lower costs, less tracking error, and more transparent trading. This time of year, when many mutual funds are making year end capital gain distributions, it’s good to be reminded about another benefit of ETFs – their tax efficiency.

![]() Consider the capital gain estimates listed below, by some of the largest (by assets under management) actively managed equity mutual funds:

Consider the capital gain estimates listed below, by some of the largest (by assets under management) actively managed equity mutual funds:

Source: American Funds, Fidelity, T. Rowe Price, MFS, Oakmark, and Morningstar. If distribution given as a range, midpoint is used. Distributions are estimates based on NAV at 10/31/17 of A shares. MFS estimated capital gains as a percentage rather than per share amount.

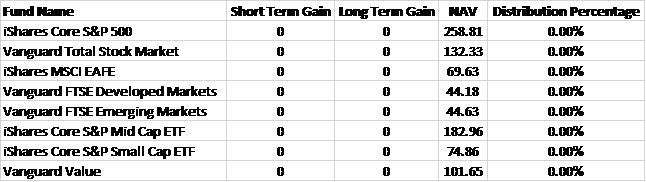

In contrast, the following chart shows distribution estimates for some of the largest equity ETF products:

Source: iShares, Vanguard, Morningstar.

Investors report capital gain distributions on their tax returns in the year they are paid out by the fund company. Consider a hypothetical investor with a taxable account subject to a 20% tax on his capital gains. While capital gains rates vary based on individual circumstances, high income or high net worth investors may have an even higher rate. Let’s say that investor receives 5% of his investment as a capital gain distribution from his mutual fund. After paying a 20% capital gains tax, he has lost 1% of his investment to taxes, which decreases his after-tax performance. If this process repeats in subsequent years, compounding the impact, it’s not hard to see how this can negatively affect his investment results.

In this example, both funds earn an 8% pre-tax rate of return. The mutual fund investor, however, because of the 5% distribution and his 20% assumed capital gains rate, only makes 7% after taxes. Assuming this continues for ten years, the difference between the ETF and mutual fund portfolio is over $191,000. For higher net worth investors in higher brackets, the difference could become even more pronounced.