Seema Shah, Chief Strategist, Principal Global Investors

The tremendous performance of the U.S. equity market over the past six months has confounded many investors. Yet, look under the surface and it might make more sense. While cyclical segments of the market have floundered under the lingering weight of lockdown effects and pandemic fear, companies which can complement and improve life with COVID-19—the likes of Facebook, Amazon, Apple, Netflix and Google—have thrived, rolling out stellar results and powering overall market performance. With populations largely confined to their homes and having to socialize, work, shop and find entertainment online, households have prioritised their spending to bread, water, and FAANGs.

Source: Bloomberg, Principal Global Investors. Data as of September 30, 2020.

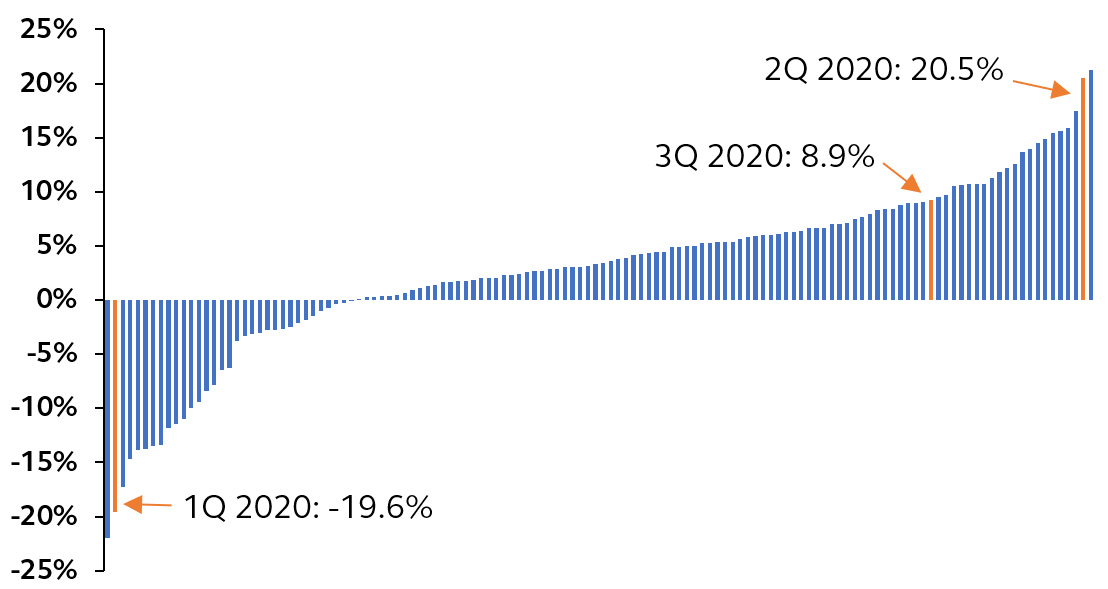

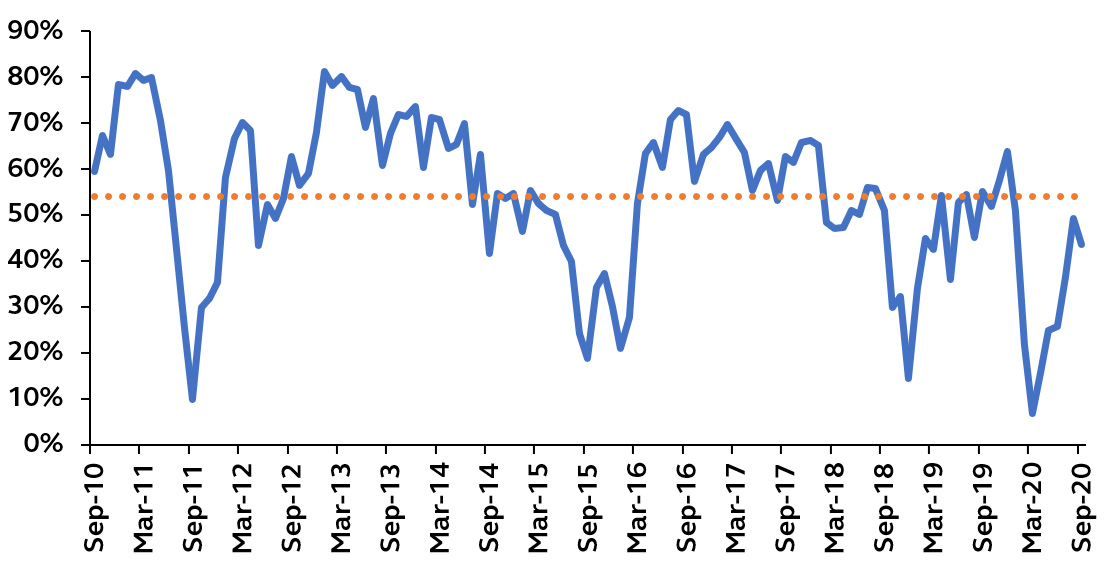

The top five companies in the S&P 500, Facebook, Apple, Microsoft, Amazon and Google (inconveniently creating the less enticing acronym FAMAG), make up over a fifth of the entire market capitalisation of the S&P 500 index and around half of the NASDAQ 100. These tech-ish darlings—Amazon is considered a consumer discretionary company, not tech—have done some serious heavy lifting. At the end of September, even as less than half the stocks on the New York Stock Exchange closed above their 200-day moving average, the S&P 500 index capped its best two-quarter performance since 2009, rising some 30% while, even more astoundingly, the tech-heavy NASDAQ Composite index has recorded a 45% increase in the past 6 months alone.

Source: Bloomberg, Principal Global Investors. Data as of September 30, 2020.

These frenzied moves higher have inevitably stretched investors’ belief in the sustainability of Big Tech’s outperformance. Price to earnings ratios have been propelled to levels associated with the dot-com boom, and our own PGAA Equity Valuation Composite suggests that the MSCI USA Growth index (which has significant tech exposure) has almost never been more expensive. At these elevated levels, investors increasingly require vindication in the form of robust earnings growth in order to maintain their tech exposure, multiplying concerns about the overall market’s heavy reliance on the technology sector to generate earnings in a post-COVID world.

A September swoon

Admittedly, although the Q3 market performance was decidedly solid, this was despite a more difficult September. Market sentiment was tainted by growing concerns around several issues, including fears around the U.S. Presidential Election, rising COVID cases, and disappointment over U.S. fiscal stimulus. By themselves, none of these events were sufficiently important to drive a market pullback. Yet, they coincided with stretched valuations, heavily overbought conditions and investor complacency, bringing a temporary end to the post-COVID rebound in financial markets.

Big Tech was not immune, and the best performing sector converted into an underperformer. The Nasdaq Composite fell into correction territory—defined as at least a 10% drop from the recent high—just three sessions after hitting a record, the speediest-ever such fall.

While Big Tech has since regained some ground, investors have expressed concern about their continued rattled performance. Yet, we consider the September swoon as a natural speed bump for the sector.

Conditions remain broadly supportive of Big Tech

While other sectors have struggled to survive, the COVID crisis created the perfect trio of conditions for Big Tech firms to thrive: limited physical social interaction, an uncertain economic backdrop, and depressed bond yields. These conditions remain firmly in place.

- COVID-19: The pandemic is by no means over and cases are once again rising in the U.S. and even spiking above the April peaks in Europe. While deaths have generally remained low, permitting governments to prioritize economic reopening, several European cities have clamped down once again on social gatherings, while New York City is considering reintroducing new public health restrictions. As such, the acceleration of digital trends for business, education and households in the wake of the pandemic is unlikely to fade anytime soon. The stay-at-home trade is still in vogue.

- Economic backdrop: The global economic recovery has progressed faster than many had envisaged, yet there is still some way to go before the global economy returns to pre-pandemic levels. Generous government stimulus and insurance programs that have buffeted the recovery are beginning to wind down and economic scarring is likely to become more apparent as companies increasingly report closures and job cuts in Q4. What’s more, with the pandemic still at large, consumers and businesses will remain restrained by virus fear, thereby sustaining the uncertain backdrop. Big Tech companies—with their strong balance sheets, positive cash flow and resilient earnings—will continue to be considered as a relative safe haven.

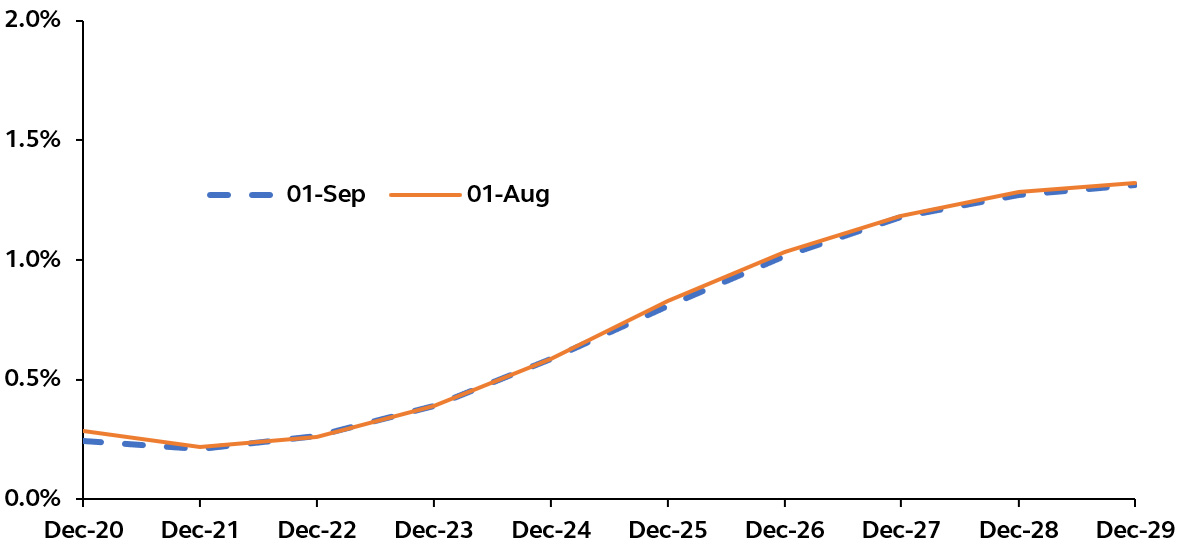

- Bond yields: As so much of Big Tech profits lie far in the future, their valuations benefit tremendously from low rates. The Federal Reserve’s recent adoption of a new average inflation targeting framework explicitly permits inflation to tick above 2% for some time before the central bank looks to tighten monetary policy. The implication is that asset purchases will continue, policy rates are essentially locked near zero, and investors can expect short-term bond yields to be pinned down for the foreseeable future. What’s more, while the economy is healing, inflationary pressures will be contained, putting little upward pressure on long-end bond yields over the next year or so.

Source: Bloomberg, Principal Global Investors. Data as of September 30, 2020.

Without evidence of a broader economic recovery and rekindling of inflation pressure, there is little in the fundamental market dynamics to suggest tech disappointment in the near-term.

Of course, technology stocks are by no means bullet proof. Each passing day seems to bring positive announcements regarding a viable and effective vaccine. While a breakthrough would clearly be great news, it would be less positive for the tech sector. The pandemic has triggered many behavioral changes and, just as definitive progress on COVID-19 and a pick-up in global growth momentum would likely result in a reflation rotation, a vaccine would trigger a re-allocation into less-loved cyclical sectors.

At the same time, while tech sector valuations are elevated, the earnings and revenue potential in the coming years from areas such as cloud computing, artificial intelligence, and cyber security will remain sturdy, regardless of a vaccine. Investors should be reassured that, while dependence on technology will likely fade somewhat as households and companies look to return to a more normal way of life, technology will inevitably continue play a greater role than it did pre-COVID.

Originally published by Principal Global Investors, 10/7/20

Unless otherwise noted, the information in this document has been derived from sources believed to be accurate as of October 2020. Information derived from sources other than Principal Global Investors or its affiliates is believed to be reliable; however, we do not independently verify or guarantee its accuracy or validity. This material contains general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, recommendation or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that Principal Global Investors or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, Principal Global Investors and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in this document or in the information or data provided in this document.

Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Investing involves risk, including possible loss of principal.

Links contained in some blog posts may take you to third-party sites and Principal Global Investors makes no guarantees to the accuracy of the information provided. Principal Global Investors does not endorse, authorize, or sponsor any third-party content.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts or returns. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc. and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

1356299