The 2020 income situation – it’s trying to say the least – is shining a light on preferred stocks and exchange traded funds, including the Principal Spectrum Preferred Securities Active ETF (CBOE: PREF).

PREF is increasingly relevant today because conservative fixed income investments, including Treasuries and municipal bonds, sport yields at or near historic lows.

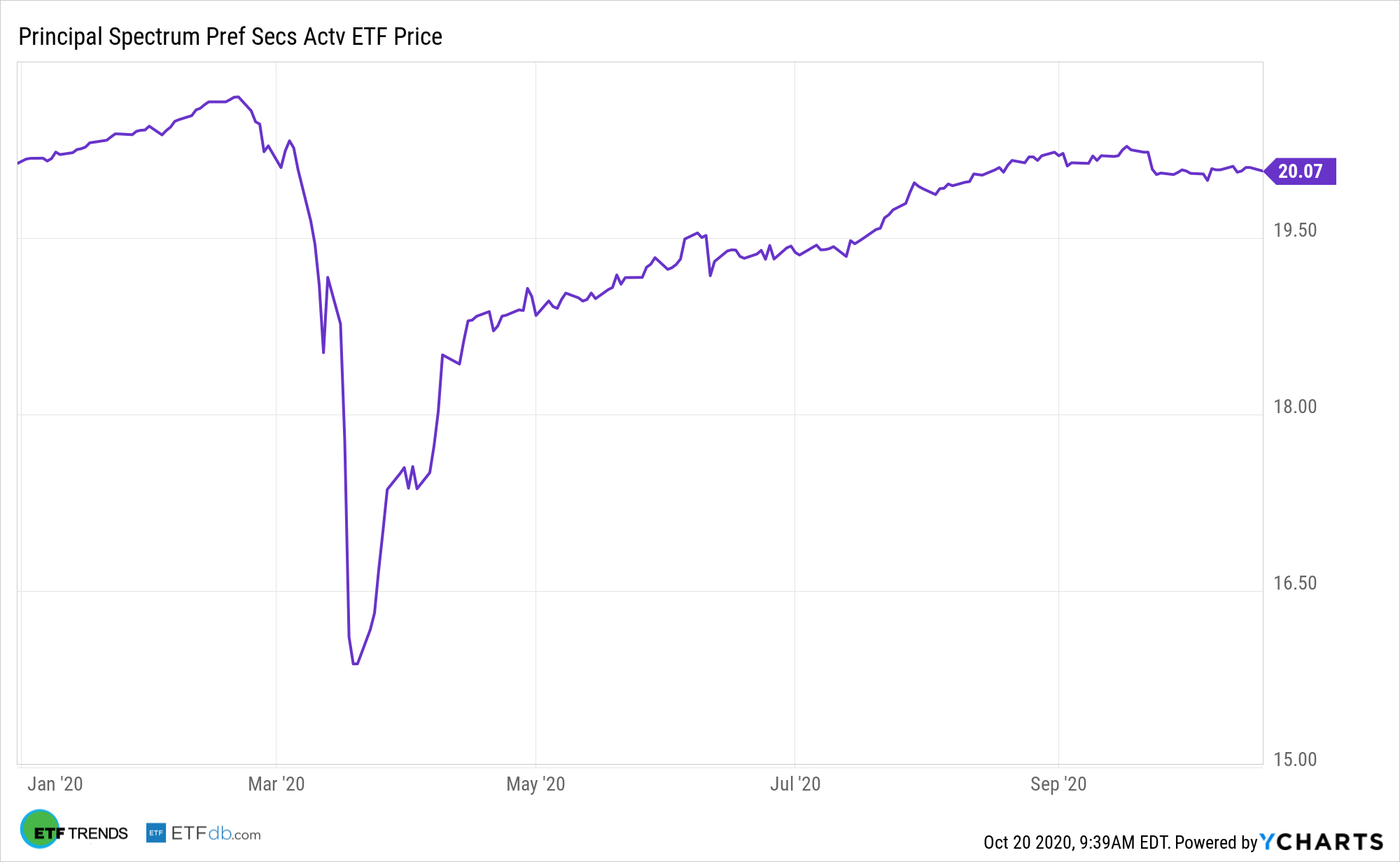

“Preferred stocks have enjoyed a strong rally since the market lows in March, reducing opportunities in the $350 billion sector,” reports Andrew Bary for Barron’s.

Preferred stocks are a type of hybrid security that shows bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

PREF: Your 2021 Preference?

“Most preferreds from the leading issuers—the major banks—now trade at premiums to their face value, often resulting in yields of 3% or less until the securities are likely to be called for redemption in the coming years,” according to Barron’s.

PREF is actively managed, meaning it can offer investors a potentially more diverse lineup than passive, bank-heavy preferred ETFs. Additionally, PREF’s active style can steer investors away from preferreds issued by companies with low credit ratings, which can signal trouble for preferred dividends.

“Preferreds have long been popular with retail investors because of their relatively high yields, security (preferred is senior to common stock), and liquidity,” reports Barron’s. “Many issues, especially those with $25 face value, trade like common stocks on the New York Stock Exchange and the Nasdaq market. Preferred dividends, like those on common shares, usually benefit from preferential dividend tax treatment.”

Income investors have looked to preferred stock ETFs in their portfolios for a number of reasons. For instance, the asset class offers stable dividends, does not come with taxes on qualified dividends for those that fall into the 15% tax bracket or lower, is senior to common stocks in the event liquidation occurs, is less volatile than bonds and provides dividend payments before common shareholders.

PREF is up more than six percent over the past six months and yields an impressive 4.63%, far more than what investors earn with Treasuries or municipal bonds.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.