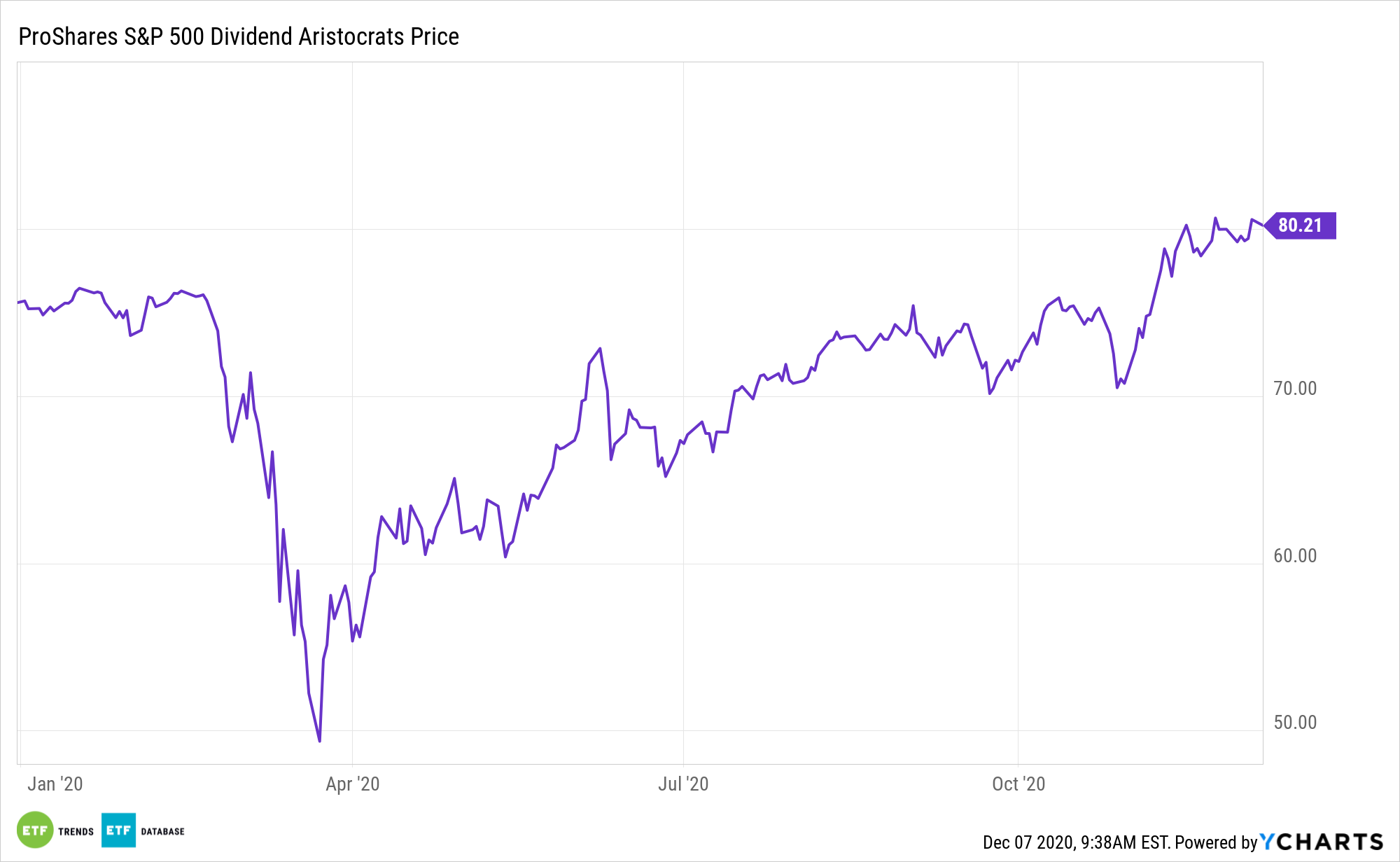

With so much talk of a value rebound, investors shouldn’t overlook the potency of dividends and related exchange traded funds, including the ProShares S&P 500 Aristocrats ETF (CBOE: NOBL).

NOBL tracks the S&P 500 Dividend Aristocrats Index, targets the cream of the crop, only selecting components that have increased their dividends for at least 25 consecutive years. Consequently, investors are left with a portfolio of high-quality, sustainable dividend payers.

With rampant dividend cutting in the S&P 500 in the first half of 2020, NOBL’s high bar for entry is serving investors well.

“Until value stocks perked up in recent weeks on the positive news about Covid vaccines, many dividend stocks had languished this year,” reports Lawrence Strauss for Barron’s. “Some dividend strategies worked better than others, however, before the rotation into value. Consistent dividend growth over at least 25 years was the best-performing basket of dividend stocks tracked by Wolfe Research.”

NOBL Ups Income, Reduces Volatility

When bonds can’t cut it with today’s low yields, investors can look to exchange-traded funds (ETFs) for additional fixed income options.

NOBL is not a high dividend strategy. When sorting by dividend yield: companies in the highest quintile of dividend yield – those whose ability to pay may become stretched in challenging markets – account for more than double the number of dividend cuts and eliminations versus those in the bottom quintile with more modest dividend yields.

“As one might expect given the inverse relationship between price performance and yield, the highest-yielding Aristocrats have been among the worst performers in 2020,” according to Barron’s.

For example, Exxon Mobil has been a drag on NOBL and the Dividend Aristocrats index this year, but if the oil giant didn’t raise its dividend, it would soon be banished from the fund.

Despite some bumps in the dividend road, many of which were skirted by NOBL, the ProShares ETF and investing for payouts remain relevant. Bottom line: NOBL offers quality and is a legitimate alternative to lagging value funds.

“But as a group, the Aristocrats have been a solid option for defensive investors during the pandemic. One way to play that is with NOBL,” concludes Barron’s.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.