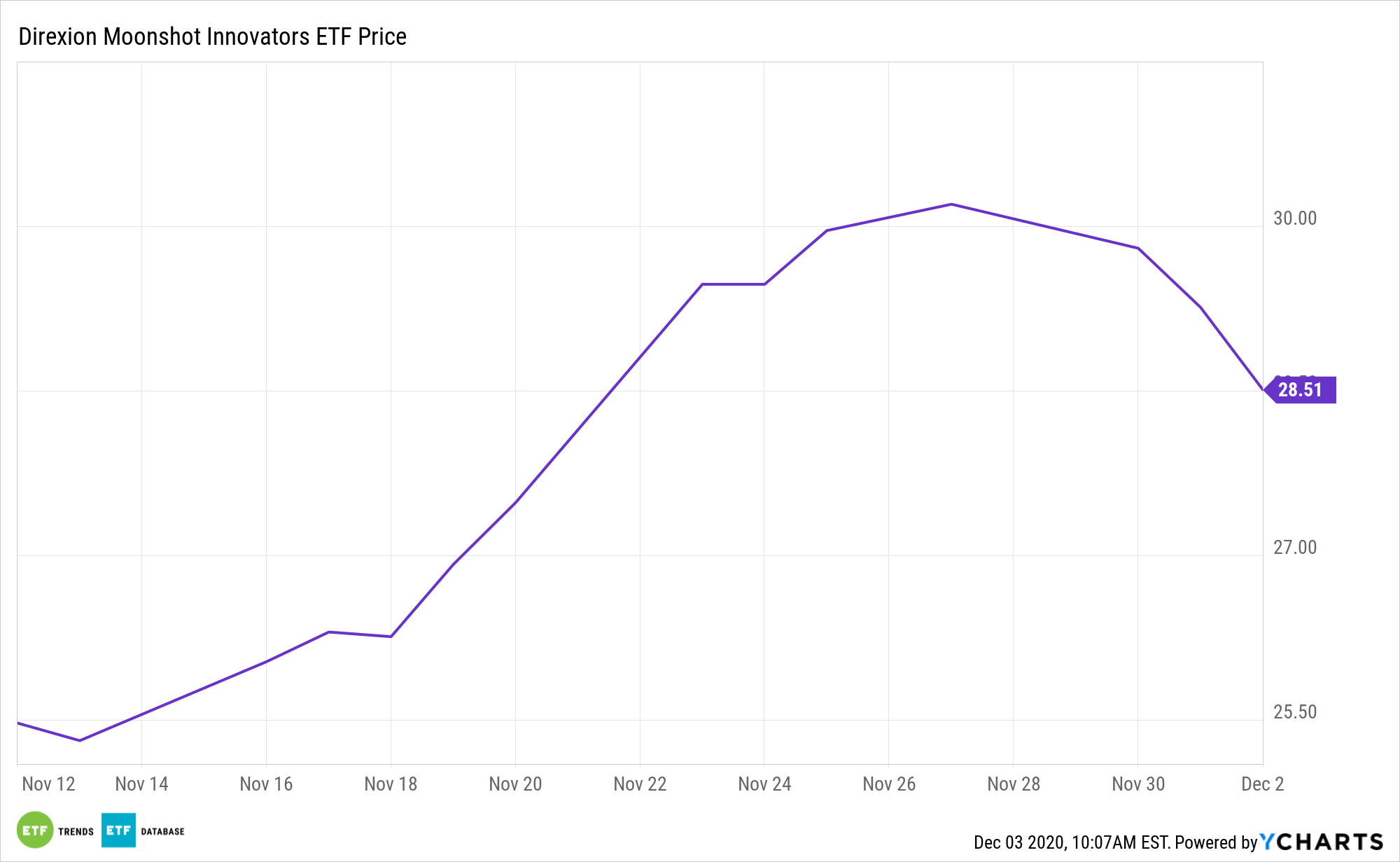

Disruption and innovation are increasingly prominent themes in the world of exchange traded funds, and issuers are taking fresh approaches to delivering those themes to advisors and investors. The newly minted Direxion Moonshot Innovators ETF (MOON) is a prime example of that trend.

MOON, which debuted last month, invests in 50 early-stage companies, with the highest allocation of resources to research and development, along with the degree to which firms stress an innovative culture and mission.

MOON seeks investment results, before fees and expenses, that track the S&P Kensho Moonshots Index. The S&P Kensho Moonshots Index measures the performance of 50 U.S.-listed companies with the highest Early-Stage Composite Innovation Score, subject to market capitalization and liquidity criteria. Index constituents are first equal-weighted but are adjusted to account for the liquidity, industry group, and diversification constraints.

Integral to the MOON thesis is the methodology of its underlying index, one that indicates how the benchmark can deliver out-performance of baskets of larger, older innovators.

“The market consistently rewarded the Moonshots index over the Established Innovators on an annualized return basis over one-, three-, and five-year periods,” according to S&P Dow Jones Indices. “These findings suggest that the market attaches a premium to the early-stage innovators identified by the Moonshots strategy.”

The MOON ETF: A New Approach to Innovation

The MOON thesis is aided by the fund’s exposure to mid- and small-cap stocks. Many established, competing funds are heavily allocated to large- and mega-cap names.

The top holdings in The S&P Kensho Moonshots Index represent a mix of mid-cap and small-cap companies across various moonshot objectives and progressive themes. Each holding falls into one of 17 thematic subsectors, with autonomous vehicles, clean technology, and genetic engineering being just three examples.

In fact, historical data indicate MOON can be a compelling alternative to traditional beta mid-cap products for growth-oriented investors.

“It is also worth noting that, despite its focus on relatively smaller companies, the Moonshots index and the Established Innovators exhibited similar levels of volatility. The outperformance of the Moonshots index relative to the Established Innovators is therefore not a function of higher risk,” notes S&P.

“The magnitude of the Moonshots index’s historical outperformance relative to small- and mid-cap benchmarks on an annualized basis emphasizes how differentiated the index is from its similarly sized peers. In fact, during a time when small- and mid-cap companies generally underperformed their larger brethren, it is of particular interest that the Moonshots strategy is able to outpace both constituencies.”

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.