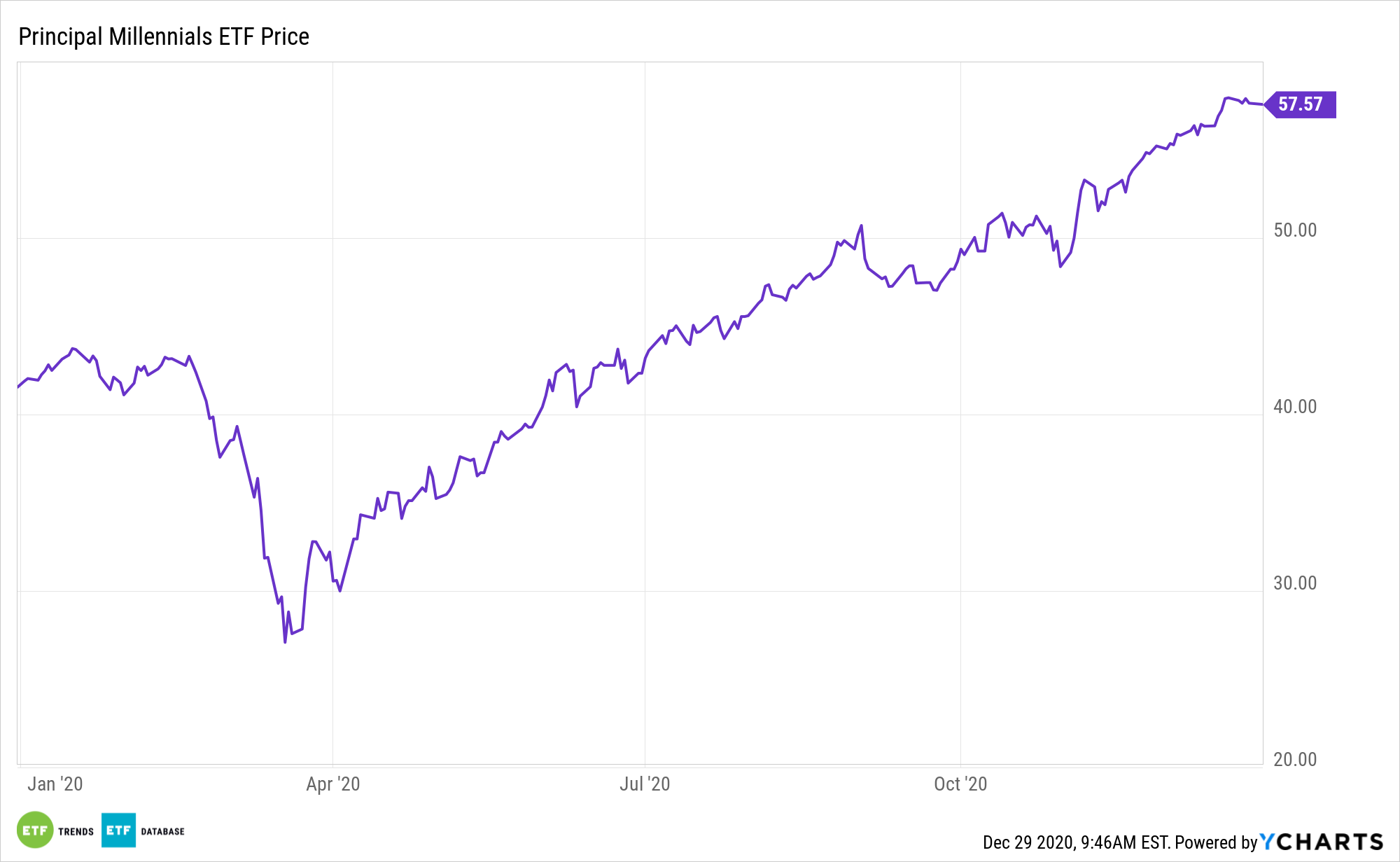

As was widely expected, the bulk of holiday shopping took place online this year, and when e-commerce companies start delivering fourth-quarter earnings in the first quarter of 2021, the Principal Millennials Index ETF (Nasdaq: GENY) could reward investors in turn.

GENY tracks the Nasdaq Global Millennial Opportunity Index. This index seeks to capture the global spending and lifestyle activities of the largest generation ever, offering exposure to brand name companies specializing in social media, digital media, technology, healthy lifestyles, travel, and leisure. The companies will evolve over time as the spending patterns of millennials change as they age.

“U.S. retail sales rose 2.4% between Nov. 1 and Christmas Eve compared with the same period last year, according to Mastercard SpendingPulse, which tracks online and in-store spending with all forms of payment. Online sales grew 47.2% during that time, said the firm,” reports Sarah Nassauer for Dow Jones.

Recent data points indicate that there are opportunities in the consumer discretionary and housing sectors. Those high performers are often those those that were previously hardest hit by the coronavirus-driven fallout in the markets.

Why the GENY ETF?

2020 may go down as many things, particularly the year that online retail asserted itself as the future of shopping. While the move was already underway, the coronavirus pandemic sped those seismic shifts along, helping to explain why GENY is one of the best bets among consumer cyclical-heavy ETFs this year.

E-commerce is a growing trend that investors shouldn’t ignore. Covid-19 isn’t going away any time soon, and consumer habits are likely to reflect this new reality anyway.

“Many shoppers avoided stores, even in the final weeks of the season when it became harder to order products online in time for Christmas. Between Nov. 1 and Dec. 22 online sales hit $171.6 billion, up 32.4% compared with the same period last year, according to Adobe Analytics,” reports Dow Jones.

Integral parts of the Gen Z-related investment thesis are shopping and entertainment consumption trends. Shopping and consumer trends are changing as more buyers rely on the convenience of online retailers to quickly and easily meet their discretionary needs. As the retail landscape changes, investors can capitalize on the trend through ETFs like GENY that target the e-commerce segment.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.