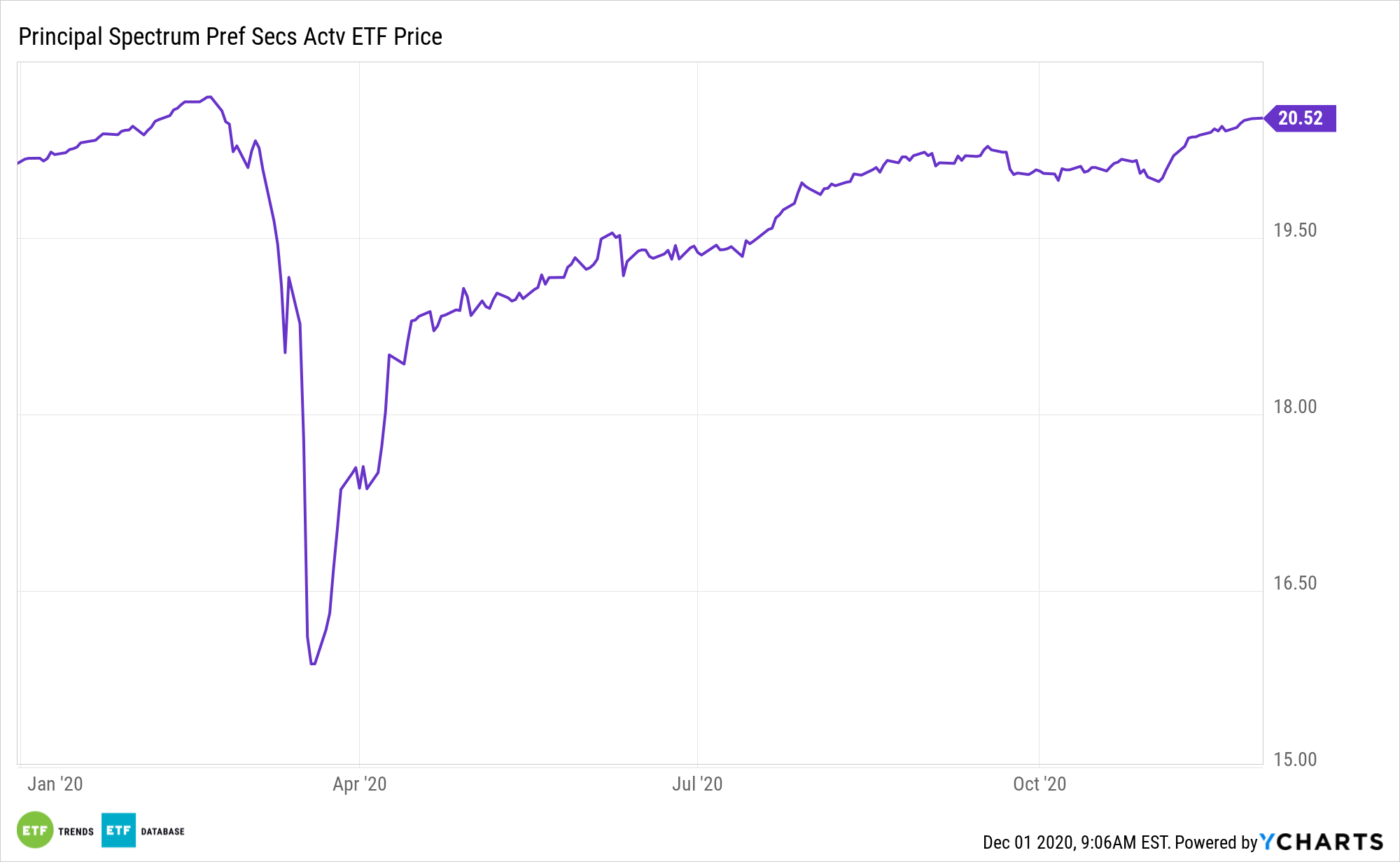

With a new year right around the corner, advisors and investors should continue to prepare for an extended low-yield environment. One way of combating low returns is with the Principal Spectrum Preferred Securities Active ETF (NYSEArca: PREF).

In the current market environment, investors will have to balance their outcome investing with the amount of risk they are comfortable with.

“Because preferreds don’t come with those voting rights, companies sometimes issue them instead of common stock to avoid diluting ownership,” reports Business Insider. “Preferred shares can be sold to qualified investors and employees by privately held companies as well as public ones; if the company goes public, any preferreds can then be bought and sold on a stock exchange.”

Preferred stocks, including those residing in PREF, are hybrid securities due to their combined debt and equity attributes. The securities are senior to common equity and junior to senior debt in the capital structure. They are issued by financial institutions, energy companies, utilities, and telecom companies, among others. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

Integrating the PREF ETF into Your Portfolio

It’s advisable for income-seeking investors to fit preferreds in between investment grade corporates and high yield because of their risk to reward characteristics. Additionally, preferred securities offer exposure to qualified dividend income to help boost after-tax income.

“Because the dividends are taxed as capital gains if they are held longer, they may also make sense for income-oriented individual investors who’d otherwise buy bonds. That’s because bond payments are interest, which is always taxed as normal income. In contrast, stock dividends qualify for a lower tax rate if you own them as a longer-term investment (longer than a year, usually),” according to Business Insider.

PREF’s active management is another benefit for investors to consider.

Spectrum targets credit quality through a top-down and bottom-up process that scores relative credit quality to reduce credit risk. Spectrum actively manages towards lower aggregate call risk on preferred securities by reducing exposure to overpriced call options that can lead to negative yield horizons. Lastly, they focus on securities with adjustable-rate coupons and high forward reset spreads, where negative convexity is a significantly lesser risk, to help better manage interest rate risk.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.