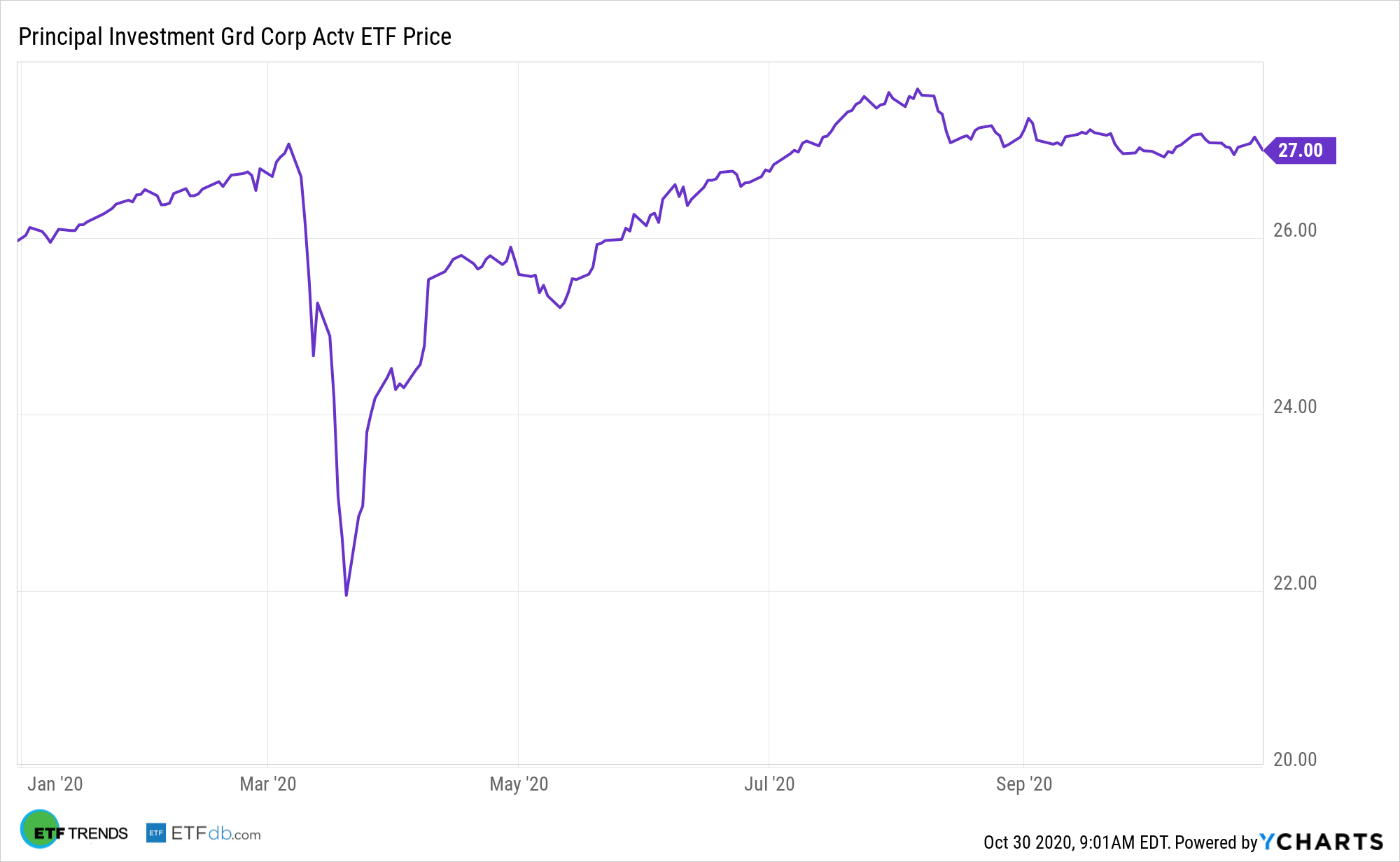

Equities are contending with a bout of pre-election volatility, but that turbulence isn’t weighing on investment-grade corporate bonds, highlighting advantages of the Principal Investment Grade Corporate Active ETF (NYSEArca: IG).

IG is an actively managed fund, a potentially beneficial trait at a time when demographic shifts could disrupt traditional corporate bond investing. IG tries to provide current income and capital appreciation by investing in investment-grade corporate bonds rated BBB- or higher by S&P Global Ratings or Baa3 or higher by Moody’s Investors Service.

“Since the end of 2009, there have been six distinctive jumps by the VIX which were not accompanied by a commensurate widening of the high-yield bond spread,” notes Moody’s Investors Service. “Following each of the six episodes, the VIX receded and the high-yield bond spread either stabilized or narrowed. The muted response by the high-yield bond spread to the latest upswing by the VIX implies the corporate credit market is less than convinced that the recent surge in equity market volatility is the harbinger of a darker outlook for corporate earnings.”

IG Skirting Electoral Volatility

IG combines bottom-up independent credit research with top-down strategy, seeking alpha through credit selection, industry rotation, curve positioning, and a forward-looking, iterative process. This mechanism seeks credits exhibiting stable-to-improving credit rating trajectory that may benefit from spread compression and income premiums, an approach that’s relevant in today’s corporate credit climate.

The combination of yield, investment-grade exposure, and potential for reduced volatility make IG an alluring idea for income investors in the current market environment. With Election Day looming, IG is all the more relevant.

“On balance, investment-grade corporate bonds performed well amid the latest equity-price plunge,” according to Moody’s. “From October 23 to October 28, Bloomberg/Barclays investment-grade bond yield dipped from 2.03% to 1.98%. Even medium-grade corporates managed to avoid a jarring climb by yields. For example, Barclays Baa corporate bond yield fell from October 23’s 2.36% to October 28’s 2.34%.”

Principal’s IG includes global exposures as its pool of fixed income securities covers foreign securities, corporate securities, securities issued or guaranteed by the U.S. government or its agencies and instrumentalities, and securities issued or guaranteed by foreign governments payable in U.S. dollars. Additionally, it may invest in other investment companies, including exchange-traded funds that invest in fixed income securities.

“It’s time to worry more about prospects for corporate earnings when the business-cycle-sensitive Baa industrial company bond yield increases significantly amid a plunging U.S. equity market,” says Moody’s.

For more on multi-factor strategies, visit our Multi-Factor Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.