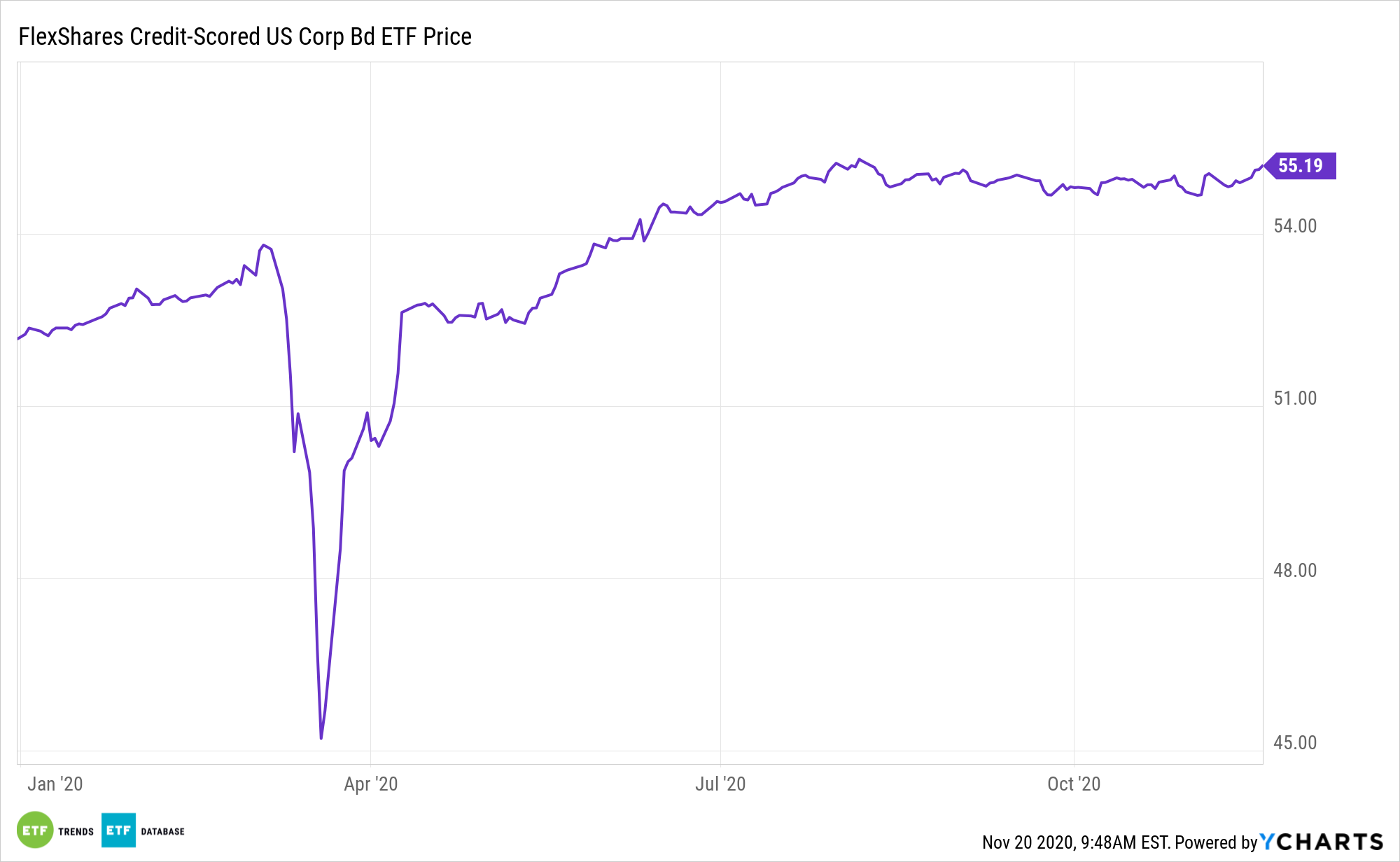

The FlexShares Credit‐Scored US Corporate Bond Index Fund (NasdaqGM: SKOR) is an investment-grade corporate bond exchange traded fund worth considering in 2021 as the potential for narrower yield spread lingers.

SKOR tracks the Northern Trust Credit-Scored US Corporate Bond Index, which focuses on companies with quality characteristics such as strength in management efficiency, profitability, and solvency, according to FlexShares.

Bond funds hold a collection of debt with varying maturities, buying and selling debt securities to maintain their short-, intermediate- or long-term strategies. When it comes to bond ETFs, investors should look at the duration, or a bond fund’s measure of sensitivity, to gauge their investment exposure to changes in interest rates, A higher duration means higher sensitivity to shifts in rates.

“Corporate credit has largely recovered from the terrible slump prompted by COVID-19. In general, corporate bond yield spreads are now the narrowest since February 2020,” according to Moody’s Investor’s Service. “Corporate bond yields also now reside near historical lows. For example, November 18’s 3.37% long-term Baa industrial company bond yield was barely above August 6’s 65-year low of 3.33%, while the accompanying 177 basis-point spread over the 30-year Treasury yield was the thinnest since mid-February 2020.”

Keeping SKOR in 2021

SKOR’s quality purview is particularly relevant in the coronavirus climate.

“Prior to COVID-19 and since 2016, the lowest moving 12-month averages for the yield and spread of Moody’s Analytics long-term Baa industrials were the 4.46% and 157 bp, respectively, of the span-ended March 2018. If, as expected, profits growth becomes well established in 2021, a 20 bp narrowing by the long-term Baa industrials spread seems likely,” notes Moody’s.

SKOR can ameliorate volatility because in building the roster, “multiple factors are taken into account including the characteristics of issuers’ total debt structure, minimum exposure percentages, and odd-lot trade restrictions, to aid in developing our corporate bond indexes,” as FlexShares notes.

“However, such spread narrowing may be more than offset by higher benchmark Treasury bond yields later in 2021. In turn, after soaring higher by a prospective 52% annually in 2020 to a record high $1.996 trillion, 2021’s issuance of US$-denominated investment-grade corporate bonds may shrink by 20% to $1.600 trillion. However, the latter would still top 2017’s erstwhile record-high of $1.509 trillion,” concludes Moody’s.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.