To say 2020 has been eventful would be the understatement of the year. But in the world of the investing, one positive theme is the growth of sustainable investments, including environmental, social, and governance (ESG) exchange traded funds.

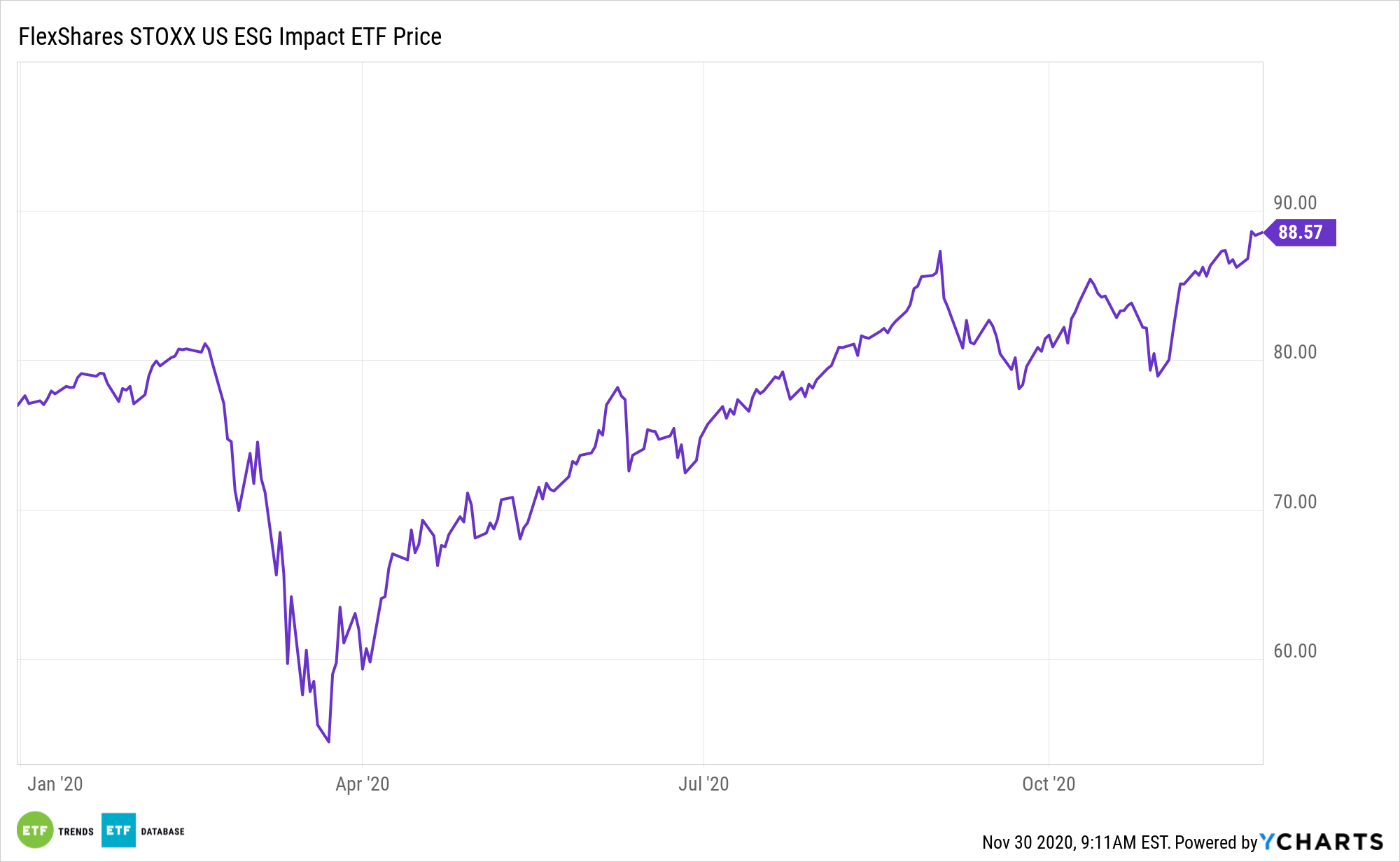

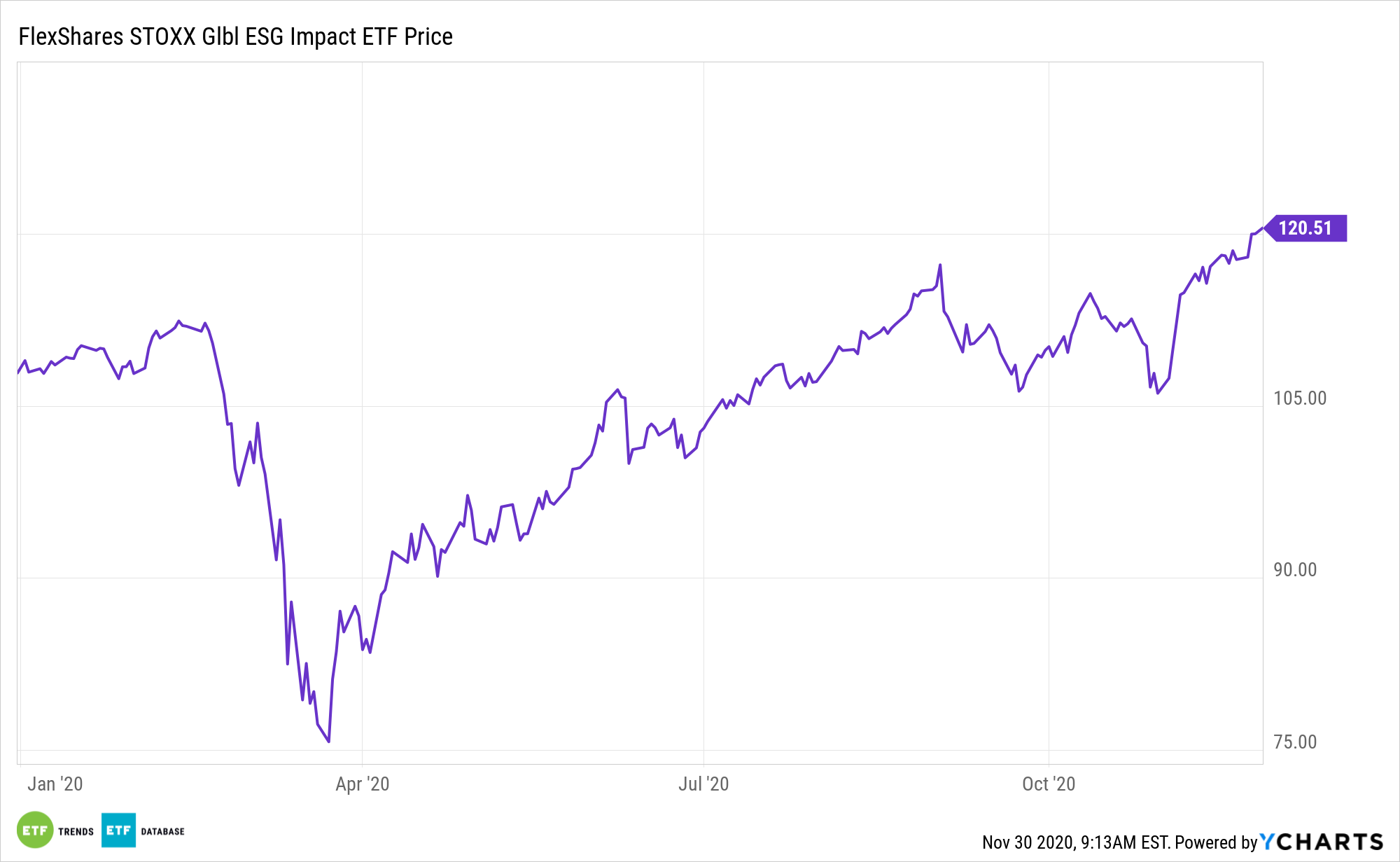

That theme will continue into 2021 and beyond, supporting ETFs such as the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.- incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

Data confirm the move to ESG has ample momentum and is a sustainable long-term trend.

“The OECD reports that one fifth of professionally managed U.S. assets now invests at least partially on environmental, social, and governance principles,” reports John Rekenthaler for Morningstar. “Other sources cite higher figures. Whatever the true amount, ESG’s emergence trails only the growth of indexing as the largest investment trend of the past decade.”

ESG Investing: A Long-Lasting Trend

The widespread proliferation of environmental, social, and governance investments will require global data standards and regulations to further progress.

Give the breadth of various ESG indices, regulators and policy makers are concerned that companies will embark on “rating shopping” tours to pick the ESG index provider for an index that best suits their ESG narrative.

Even if investors are not ESG devotees, that doesn’t mean they should ignore ETFs such as ESG and ESGG. In fact, folks in the less devoted camp can still benefit from sustainable investing if they’re able to put personal feelings aside.

“But if the rest of the world thinks otherwise, then who is the investor to argue? Astute shareholders put aside their personal beliefs, recognize what the marketplace rewards, and then hop along for the ride,” notes Rekenthaler.

For its part, ESG is delivering the goods. The FlexShares ETF is beating the S&P 500 by 211 basis points year-to-date.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.